Happy Independence Day

July 4, 1776 - the day the Declaration of Independence was adopted, setting the framework for the most prosperous and powerful nation the world has ever seen.

All through the beauty of Free Market Capitalism - with Liberty & Justice for all.

The main growth driver for America, in our view, comes from robust individual freedoms including property rights, freedom of movement, freedom of expression and capital creation.

In other words, when government sets a framework, provides individual freedoms and allows the free market to work - great things happen!

You get the most powerful economy to the tune of $28.78 trillion ( Nominal GDP ) and growing.

People vote with their feet - the above graphic from Visual Capitalist shows China having the world’s biggest outflow of high-net-worth individuals.

It shows the United States taking in 3,800.

More important than money is Intellectual Capital, for which the United States has no shortage.

The number of H-1B visa applications hit a new record with 780,884 applications, a 61% increase from the previous year and nearly 700,000 above the 85,000-annual cap.

These are highly educated individuals - many with advanced degrees that are eager to come to America to work and grow our economy in cutting edge industries.

Retaining employees is a key factor to a thriving company, high employee turnover can be a death blow to any organization.

The United States of America with a total population of 333 million saw just 5,315 people renounce their citizenship last year - 0.0015% of the population.

Not only does no one want to leave America, we have a record number of highly educated, qualified and motivated individuals eager to come here in search for the American dream and INDIVIDUAL FREEDOMS.

So long as the core founding values of America persist, we will continue to be a brain drain on the rest of the world and be the leader in innovation and technology.

Bet on America - Lean Bullish - Enjoy Capitalism - Happy 4th!

Fireworks In The Sky - S&P Record High

The S&P 500 closed at another record high, crossing $5,567 for the first time ever.

Prior out of favor tech stocks making a resurgence are powering this market higher.

Amazon AMZN 0.00%↑ making up nearly 4% of the S&P 500 recently broke out into new high territory after two years of lack luster performance.

We believe the move is just getting started - with earnings estimates up 58% for 2024 and another 28% in 2025.

Amazon recorded a 10% operating margin in Q1 — its first quarter with double-digit margins in company history.

As margins continue to expand and as the e-commerce business turns into a profit center, we expect earnings estimates to be revised even higher.

Free cash flow is expected to reach a record $62 billion in 2024 after being negative in 2021 and 2022.

Amazon is also the industry leader in cloud computing with its AWS division; and after a rough two years - cloud spending is expected to ramp with the tail winds of AI.

Here is a crazy fact for you:

In 2023, AWS was responsible for two-thirds of Amazon's $37 billion in operating income, while contributing 16% of the company's total revenue. - Investors Business Daily

Now you can understand why we are so excited about the e-commerce business turning into a profit center!

Tesla

Another Mega Cap giant that lost its luster on Wall Street and now making a come back is TSLA 0.00%↑

In a prior issue of Behind The Street we wrote a section titled - TESLA - Back From The Dead? calling for a bottom in the stock.

Since then, TSLA 0.00%↑ is up almost 40%.

We believe that Tesla is a big data play in addition to FSD and that margin compression of 2022 - 2023 has now been fully priced into the stock.

The market tends to be forward looking by roughly six months - the future outlook in our view is that margins will improve as price cuts to EVs conclude.

Many short sellers are caught off sides on this one.

Getting a little granular on volume and price action - this is exactly what you want to see when a stock bottoms.

A violent explosion of price off the bottom supported by thunderous volume exceeding the average daily stock turnover.

Pictured above is the top components by weight in the S&P 500.

With Tesla and Amazon now in gear this should allow other larger components in the S&P 500 to take a breather as this market rotates into the “less loved”

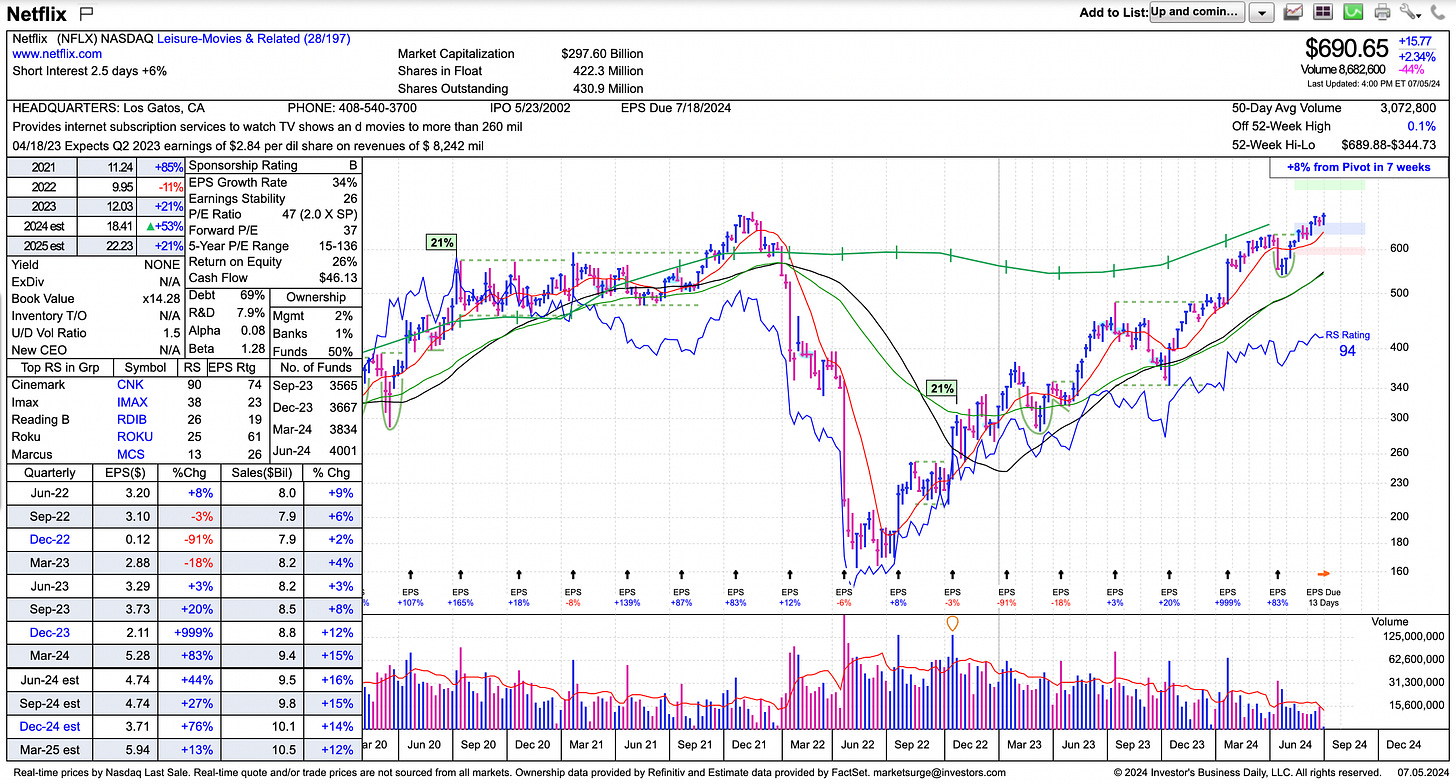

We Are Watching Netflix - Update

On April 11, 2024 we published a bull thesis on NFLX 0.00%↑ called We Are Watching Netflix

Netflix has a 0.65% weighting in the S&P 500 and we think it just may grow to a full percentage point as the stock approaches a new record high.

We’d like to bring attention back to the earnings recovery.

2021 - $11.24

2022 - $9.95

2023 - $12.03

2024 est - $18.41

2025 est - $22.23

Netflix is scheduled to report earnings on July 18, a beat and raise quarter should gap the stock into new record territory.

It’s safe to say we will be on that earnings call and you should be too.

Netflix Second Quarter 2024 Earnings Interview

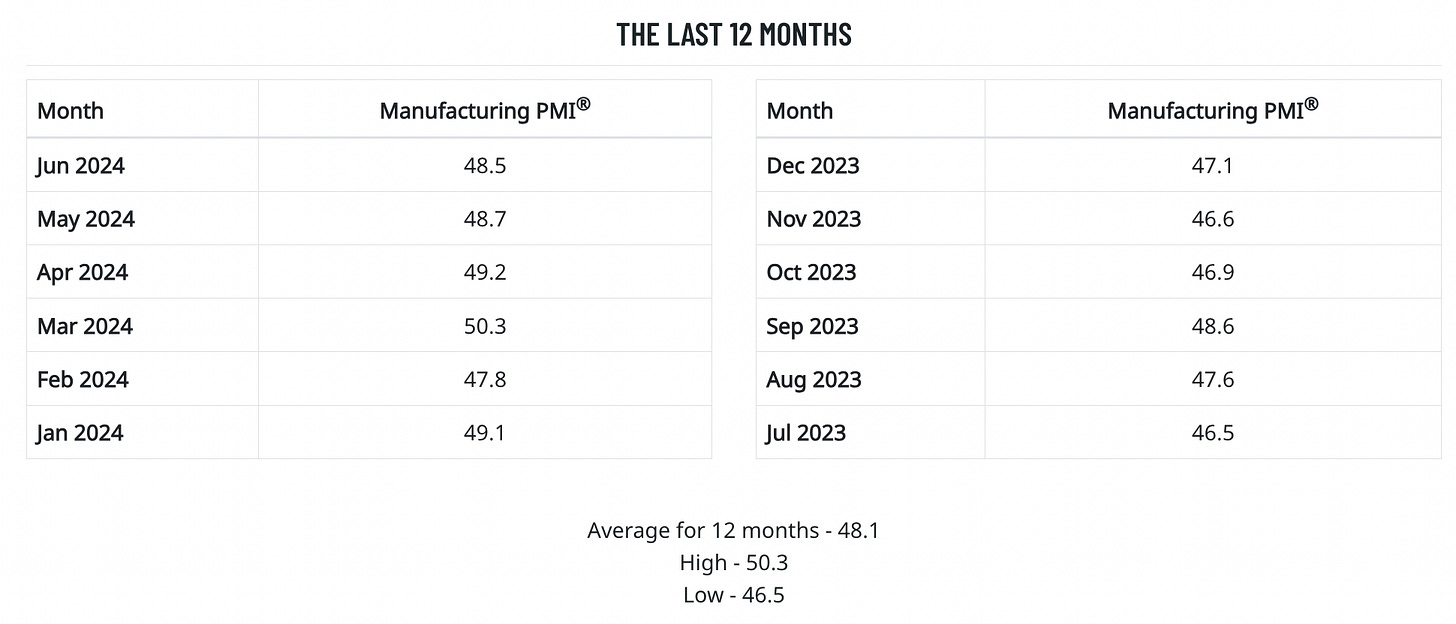

U.S. Manufacturing Snap Shot

The manufacturing sector accounts for 20% of the U.S. Economy, making the ISM Manufacturing Report on Business an important leading economic indicator.

Both professional traders and portfolio managers as well as the Federal Reserve use the ISM PMI report to help make trading decisions and set monetary policy.

A few concerns need to be addressed in the most recent Manufacturing Report On business.

Particularly relating to comments from survey respondents as shown below.

We are starting to see respondents getting negative across a wide variety of industries, claiming consumer demand and inventories becoming less stable as well as reports of customers cutting orders.

However, we do still see positive responses and we view this as an overall positive for the manufacturing sector.

It is possible the uncertainty with the election year is causing both respondents and customers to be more conservative than normal.

After what we saw (or didn’t see) during the recent debates - we can’t blame them.

Be sure to put more focus on the trajectory of PMI numbers, not the reading itself.

Are PMIs rolling over and decelerating?

Are the PMIs starting to turn up and head positive?

Successfully identifying a trend is far more important than looking at the number.

Below is the last 12 months of PMI readings:

Since July 2023 - PMIs have been accelerating, there is a high correlation between growth in the manufacturing sector and overall GDP Growth.

If there is growth in the manufacturing sector, there is high probability U.S. GDP growth will be positive - 70% of the time when U.S. GDP growth is positive, the S&P 500 is positive six months later.

Understanding the above - we can begin to structure asymmetric bets on the market.

Example: If GPD growth is positive, probably don’t want to have a bunch of short positions in the portfolio - as a pair trade yes, but directional - probably not.

Knock On Wood - Lumber Is Talking!

Lumber prices dropped to $450 per thousand board feet in July - a fourteen month low. We can use commodities prices as a leading economic indicator.

It is no surprise that building permits in May were at a seasonally adjusted annual rate of 1,386,000 - 3.8 percent below the revised April rate of 1,440,000 and is 9.5 percent below the May 2023 rate of 1,532,000.

Perhaps now is not a bad time to build your dream home or put that new extension on your house - lumber prices are down.

The SPDR S&P Homebuilder ETF XHB 0.00%↑ is starting to break down after being a top performing group.

Home builders have been out, particularly PHM 0.00%↑ and TMHC 0.00%↑ - both have now broken their 50 day moving averages.

We think this is the start of a correction in this sector - wait for new bases to form before buying, these stocks are bing sold for now.

Video Coming Soon

Coming soon! Behind The Street will be publishing market update videos every other day and a market outlook video on Sundays.

Stay tuned for an official launch date, we will upload on YouTube.

Thank You

A big THANK YOU to all of our clients! Without your support we wouldn’t have been able to secure #1 Medium Team - Transactions.

Updates

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.

Love walks on Wall Street

NVDA 2000 😎✌🏽