How Far Can This Market Go? 30th Record Close for S&P 500.

S&P 500 & NASDAQ 100 Zoom to Record Highs.

Breakdown

The S&P 500 hit a new all time record high for the 30th time this year as price action broke over $5,400.

The NASDAQ 100 is just a stones throw away from 20,000 with gains propelled by big tech and semiconductors.

Now begs the question: Is the market getting extended?

Let’s take a look.

We have often said that there is no bull market without participation from semiconductors; and participation we’ve had!

BlackRock iShares Semiconductor ETF SOXX 0.00%↑ is up 65 points or 35% from its January 2024 breakout from a cup with handle base.

Individual components such as NVDA 0.00%↑, AVGO 0.00%↑, QCOM 0.00%↑, and MU 0.00%↑ have been screaming into 52 week and record highs.

The rally in semiconductors has been broad based.

Many individual names are grossly extended over major moving averages - a pull back is likely.

NVDA 0.00%↑ is now 30% extended from its 50 day moving average and 90% extended above its 200 day moving average.

Similar action can be seen with AVGO 0.00%↑, now extended over 35% above its 50 day moving average.

It would be wise to hedge or trim stock into this aggressive extension, use the 50 day moving average as your guard rail.

We are heading into the summer months and volume is expected dry up across the board as we head into the doldrums of summer.

Raise capital to redeploy once stocks set up again post presidential election - we remain extremely bullish on this cycle, we just see aggressive extension in the short term.

NASDAQ Market Indicators

We are starting to see the ratio of new highs to new lows diverge in a way that usually coincides with a pull back in the general market.

New lows are now out pacing new highs on the NASDAQ - 152 / 104.

This signals a deterioration in overall breadth and a “thinning” of the market.

Whats happening is quite interesting because you have the indexes screaming into new highs while at the same time being technically oversold.

We see two possible resolutions here.

With the individual components of NASDAQ being oversold and new lows expanding - we may see the market rotate out of mega caps and rotate into the depressed names, masking a serious correction.

Mega caps and leading sectors specifically semiconductors roll over, causing a deeper correction in the general market.

Debt Market Flashing Green Light

Despite 500 basis points worth of hikes by the Federal Reserve, the junk bond market is not flashing any warning signs.

In the last issue of Behind The Street we talked about the FDIC Quarterly Banking Profile First Quarter 2024 report.

Unrealized losses on available-for-sale and held-to-maturity securities increased by $39 billion to $517 billion in the first quarter. Higher unrealized losses on residential mortgage-backed securities, resulting from higher mortgage rates in the first quarter, drove the overall increase. This is the ninth straight quarter of unusually high unrealized losses since the Federal Reserve began to raise interest rates in first quarter 2022. - FDIC

Many economists and analysts were raising red flags at the amount of unrealized losses as shown above.

However, we are not seeing any distress in the junk / high yield bond indexes, if anything both HYG 0.00%↑ & JNK 0.00%↑ are acting well.

We can use junk bonds to determine credit stress in the market, also as a gauge for risk appetite from investors.

SPDR® Bloomberg High Yield Bond ETF JNK 0.00%↑ looks to be building a base, breaking back above its 50 day moving average - acting well despite calls for stress in the bond market.

The healthy action in the junk bond market leads us to believe that a pull back in the general market should’t be overly concerning - but a normal run of the mill correction in a larger bull trend.

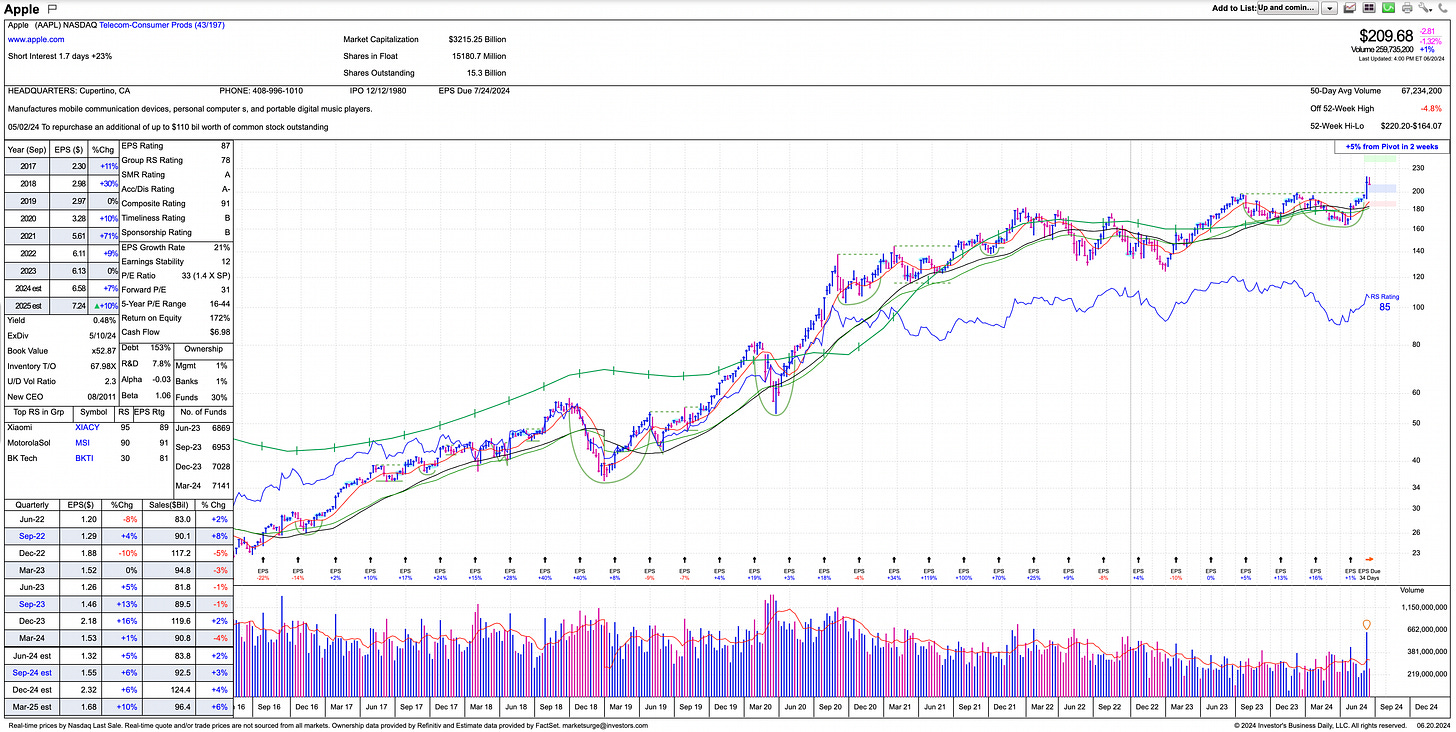

The Great Refresh! AAPL 0.00%↑

Perhaps the most under reported bull thesis for Apple and AI came at the WWDC24 on June 10, 2024.

The news propelled AAPL 0.00%↑ to a brand new record high over $200.

Apple has inked a partnership with OpenAI to roll out some pretty amazing features!

But theres a catch!

All the new and improved AI features will require new hardware starting with the newest iPhone 15 Pro line up as well as iPads and Macs running the M-chip or later.

This could quite possibly bring about a major pull forward in the upgrade cycle if consumers want to take advantage of the most cutting edge innovation in AI.

Looking ahead, think about how this applies to other industries?

It is quite possible that the world is about to enter the largest hardware refresh cycle since the pandemic!

This is bullish for both hardware manufacturers and semiconductors, long term.

The fact that ARM 0.00%↑ was up massively on news that consumers will need to buy new devices to take advantage of AI features, confirms our thesis that Apple will have massive pull forward in device upgrades.

Arm components are in almost every Apple product.

TESLA - Back From The Dead?

TSLA 0.00%↑ stock is down 56% from its November 4, 2021 high.

Tesla has been getting punished by the street after a string of price cuts on its EVs have made shareholders and customers very unhappy.

Many Tesla owners have seen the value of their vehicles decline by over 60% due to these aggressive cuts.

Shown above, you can see TSLA 0.00%↑ has a pattern on long, drawn out corrections in both price and duration lasting roughly 950 - 1,000 days.

We would never condone bottom fishing, but if the stock can reagin $260, a starter position may be warranted.

There are just too many bullish factors going for Tesla from full self driving, big data and AI.

Additionally, the price cuts are in the rear view mirror and margins should recover going into 2025.

Earnings are seen up 37% for 2025 with full year EPS at $3.29.

Keep this one on the watch list and monitor to see if the stock can make its way thought most of its over head supply.

Financials

The SPDR Select Sector Fund XLF 0.00%↑ seems to be digesting nicely and should make a run into new high territory sometime early next week.

Bank earnings have been showing strong signs of deal making on Wall Street making a major come back - M&A activity is heating up on the street.

Goldman Sachs GS 0.00%↑ is trading into new record highs after an earnings report that beat expectations.

Full year 2024 EPS is seen up 59% to $36.48

Full year 2025 EPS is seen up 11% to $40.36

Smaller Boutique banks are doing exceptionally well with Piper Sandler PIPR 0.00%↑hitting a new record high just today.

It is very important to monitor the health of the financial sector as you cannot have a strong economy without a robust financial sector.

Activity in both M&A and IPO are heating up on Wall Street, a bullish sign.

Gold

Gold looks to be gearing up for another leg up after breaking out of a decade long cup with handle base.

We are but 89 points away from another record high for the shiny metal, perhaps a sign that investors believe 3% is the new 2% regarding inflation.

As the United States inches closer to what looks to be a messy election, we see gold out performing well into November as investors looks for a safety trade.

Video Coming Soon

Coming soon! Behind The Street will be publishing market update videos every other day and a market outlook video on Sundays.

Stay tuned for an official launch date, we will upload on YouTube.

Thank You

A big THANK YOU to all of our clients! Without your support we wouldn’t have been able to secure #1 Medium Team - Transactions.

Updates

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.

Tom,The AI renaissance will surely require hardware updates. Congrats on #! team on Transactions!!!

Look forward to watch your market update videos. Peace out!