Update From Korea 🇰🇷

Before we dive right into the markets - a quick update from Korea.

I have been traveling (Business & Pleasure) through Korea for the past two weeks and I am blown away and ever so bullish on the country.

The business friendly environment, relentless focus on education, safety, cleanliness and technology - particularly Bitcoin and cryptocurrency - will most certainly solidify Korea as a leader in the region.

Capital will flow through the path of least resistance - Korea, particularly Seoul, checks most if not all the boxes for quality of life and ease of doing business.

Korea should continue to benefit significantly from the boom in semiconductor use in AI and other technologies.

This will lead to an acceleration in wealth creation for Koreans and drive economic growth.

Taiwan is the largest producer of semiconductors in the world, followed by South Korea, China, and the United States.

Korea accounted for 60.5% of the global memory semiconductor market, with DRAM market share of 70.5% and NAND market share of 52.6%.

Korean-made memory semiconductors possess the world’s best technology.

Wake Me Up When September Ends.

Historically, September is the worst month of the year for U.S. Stocks with a -13.5% annualized return.

It is important to understand the seasonality of the market especially this year with the looming U.S. Presidential Election.

The general market is acting well after significant bottoming signals as discussed in our last report titled Phoenix (Stocks) Rising From The Ashes!

We have been bullish!

The S&P 500 is trading just shy of new record highs after a global market sell off sparked by the unwind of the yen carry trade.

If historical seasonality proves correct - the market may start to form a handle going into the election, in which case - we need to identify the sectors and stocks setting up and emerging out of bases.

Leaders

In our May 10 issue of Behind The Street titled: The Time To Prepare Is Now! STOCK MARKET UPDATE we initiated bullish coverage on a new IPO - CAVA 0.00%↑.

The stock is up over 65% since initiating coverage.

After a beat and raise earning report on August 22nd, the stock gapped up into new record territory - trading over $120 in after hours trading.

Q2 Earnings Highlights

EPS: $0.17 (+183% y/y)

Revenue: $233.5 Million (+35% y/y)

Restaurant Profit Margin: 26.5%

What we like to look for when identifying a new stock to cover is the following.

Earnings Growth 25%+ q/q

Revenue Growth 25%+ q/q

Growing Institutional Sponsorship

Return on Equity 20%+

Consecutive Beat and Raise earnings reports.

After over a decade of analyzing winning stocks there are a few characteristics that stand out and they are almost always involving earnings and sales growth.

Remember:

Stocks are expensive for a reason and stocks are “cheap” for a reason.

Companies turning out consistent earnings growth and revenue growth will tend to perform well over time and their valuations will seldom be “cheap”.

The market will assign a premium for predictable and consistent earnings and sales growth.

Look To Quality

As we enter September - the worst performing month for stocks, look to quality and pay attention to stocks trading near highs and getting sold down the least during a market correction.

In addition - look to outperforming sectors.

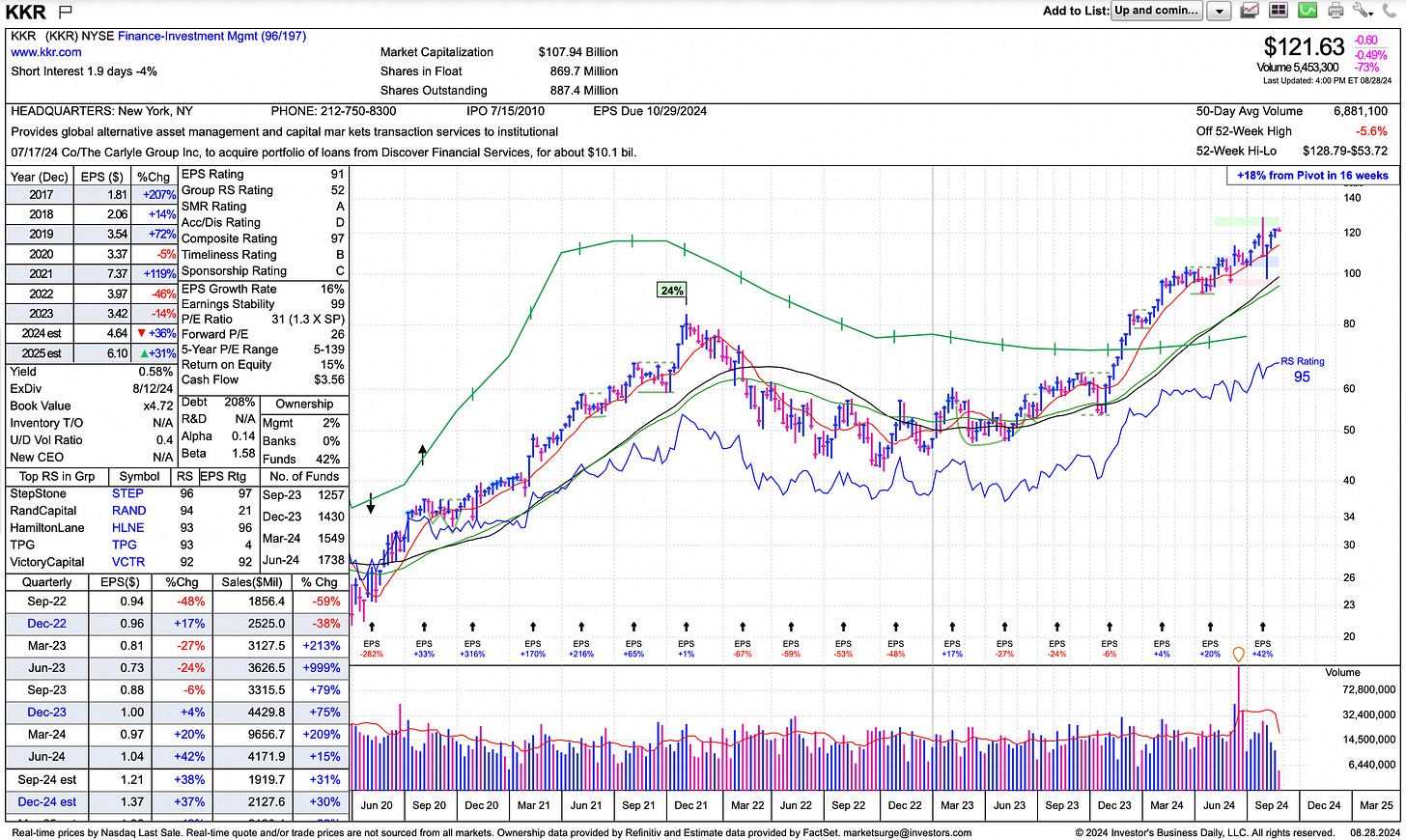

The financial sector XLF 0.00%↑ in the U.S. is performing well, breaking out to new record highs after building a year long flat base.

We expect financials to continue to outperform - a good sign for the health of the general U.S. economy.

For the economy to grow the financial sector needs to be doing well.

JPMorgan Chase JPM 0.00%↑ hit another record high this week and is the leading stock in the financial sector.

Private Equity giant KKR 0.00%↑ has erased almost all of its losses from last weeks market correction.

The PE market is currently rebounding from the bear market of 2022 - 2023.

What To Avoid?

On July 20 we posted a sell on X as SMCI 0.00%↑ put in a blow off top and was carving out a large distribution pattern.

SMCI 0.00%↑ went on to collapse over 65%

When stocks go through a “blow off top” price action will consistently gap up on heavy volume, followed by sideways price action on historically elevated volume from the initial run up.

This is what is called distribution.

Avoid prior leading stocks that have topped as it is possible they will never reach another record high.

Wait for a new base to build and for the stock to take out much of its overhead supply.

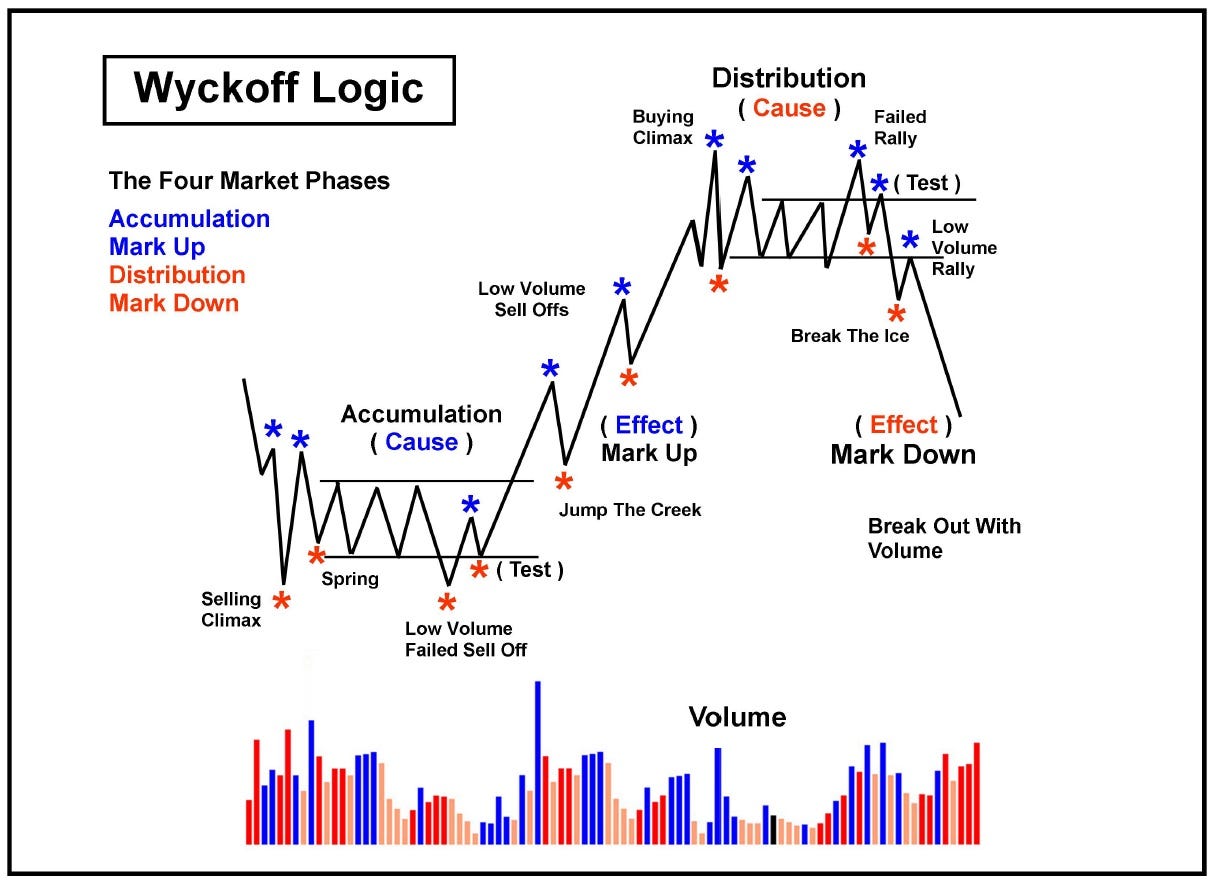

Recent price action in SMCI 0.00%↑ can be identified by studying Wyckoff Theory.

Wyckoff Theory - A Quick Review

There are four market phases every trader and investor must know.

Accumulation

Mark up

Distribution

Mark Down

Richard Wyckoff was one of the most successful stock market operators of all time and the founder of Wyckoff Theory.

Wyckoff Theory states that there is a “composite operator” that dictates trends and direction in the market.

The composite operators are the large institutional investors on Wall Street - Hedge Funds, Family Offices, Prop Traders, Banks and Mutual Funds.

Institutional traders are managing the big money on the street and can take months, even years to accumulate full position sizes in the market.

By analyzing the tape and looking at volume profiles, we can identify whether the market is under accumulation or being distributed.

Pictured above you can see the clear Wyckoff distribution schematic on SMCI 0.00%↑ with a blow off top on heavy volume - followed by higher than average volume after the blow-off throughout the base.

Lastly, you have a final crescendo sell off with a large exhaustion gap down on record volume - usually sign of the final move down.

Avoid bottom fishing stocks, stock with leaders with high relative strength trading near highs.

Gold

Gold reached yet another record high with little coverage from mainstream financial media - leading us to believe we are in the early innings of this move.

It is possible we may see upwards of $5,000 gold by the end of this bull cycle, especially since the outcome of the U.S. Presidential election will result in more government spending regardless of the outcome.

Highly unlikely that we see fiscally responsible policy from the Trump or Harris administration - government spending will balloon.

Gold, Bitcoin and real assets will benefit, get exposure.

The $DXY continues to show weakness which should continue to be positive for equities and gold.

Japan

For months we have written about a bull market in Japanese equities and we still remain bullish on Japan even after the mini flash crash.

If you look at the NIKKEI 225 on a monthly time frame, you will see the formation of a multi-decade cup with handle with a shake out upon testing the 1989 highs.

Contrary to popular opinion - we see the NIKKEI 225 making brand new record highs in short order.

As the IPO market recovers we are expecting Tokyo’s biggest new issue of the year at a near $10bn valuation.

We fully expect the Tokyo Stock Price Index to test and make a new record high in 2025.

Another bullish catalyst for Japan is the recent expansion of a tax-protected investment scheme aimed at encouraging individuals to invest in stocks, a programme that is expected to raise retail investor interest in newly issued stock. - FT

After the severe bear market through the 1990’s, Japanese people have generally turned away from investing in stocks - that is changing.

5 Beekman Street Penthouse

Take a look at our newest listing at 5 Beekman Street PH 51.

Listing Information: 5 Beekman Street #PH51 3 Bed 3.5 Bath 3,554SF

Updates

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.

Thanks for reading Behind The Street ! Subscribe for free to receive new posts and support my work.

Enjoy your time in SK Tom, and thank you for sharing your impressions!

Looks good! Glad you were able to to produce a Behind the Street newsletter!