The Time To Prepare Is Now! STOCK MARKET UPDATE

An URGENT report to help you crush it in markets and in life.

Walks & Wall Street Reading Room

Let’s kick this newsletter off with an unexpected twist.

Summer is fast approaching, meaning you’ll need a few good reads to dive into while on your weekend excursions to The Hamptons.

For Traders

Reminiscences of a Stock Operator - by Edwin Lefèvre

Based on the life of American Stock Trader Jesse Livermore - Reminiscences is a classic recommended by the worlds greatest traders including Paul Tudor Jones and Stanley Druckenmiller.

How To Make Money In Stocks - by William J. O’Neil

William J. O’Neil founder of O’Neil Securities and Investors Business Daily created the CAN SLIM methodology for investing in stocks.

C - Current quarterly earnings per share should increase year-over-year by at least 18-20%

A - Annual earnings per share should show consistent growth over the last five to ten years

N - New products, services, or management

S - Supply and demand should be scarce but strong

L - Leaders or laggards ( Leading Stock in Leading Sector )

M - Market direction ( 7 our of 10 stocks follow the general market trend )

Piece of advice from William J. O’Neil

The Battle For Investment Survival - by Gerald M. Loeb

Gerald Loeb was a founding partner of E.F. Hutton & Co. - known to be the most quoted man on Wall Street, famous for his contrarian investing style with prudent risk management.

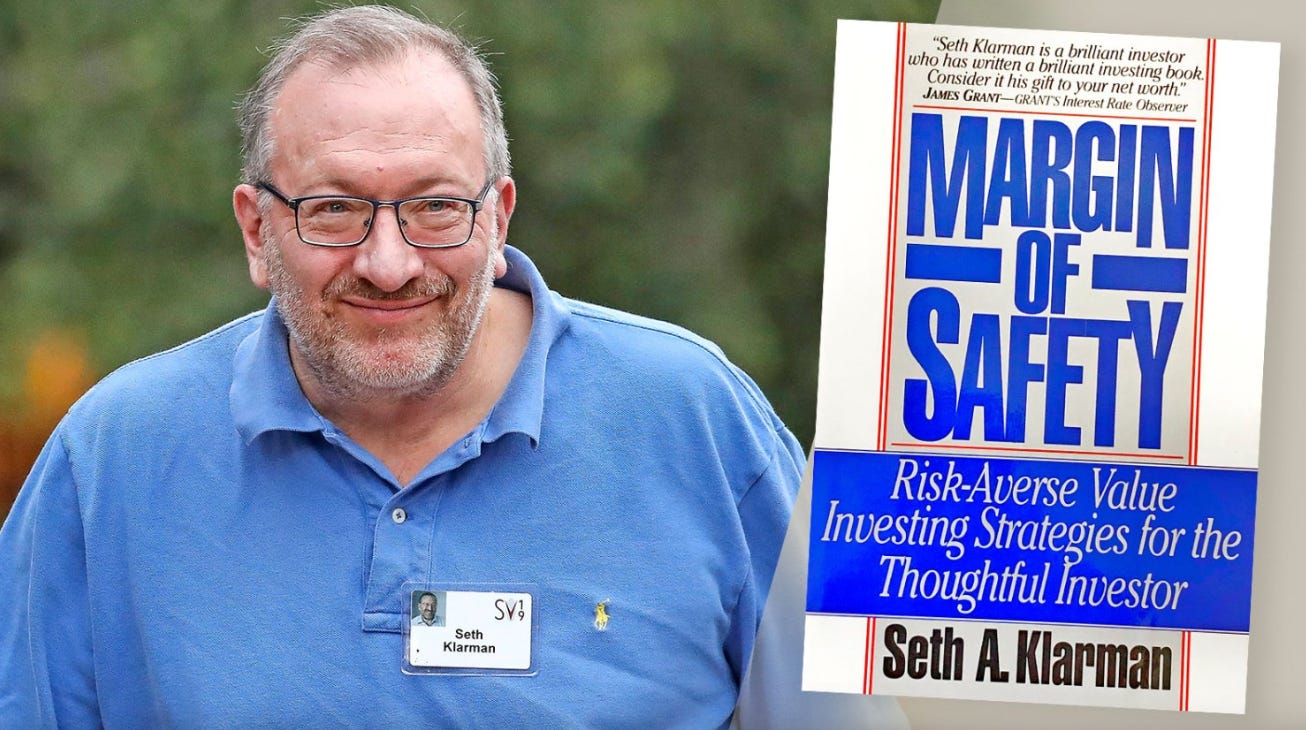

For Value Investors

Margin Of Safety - by Seth Klarman

Seth Klarman is an American Billionaire investor know for his value investing strategy similar to Benjamin Graham - “The Father Of Value Investing”.

Klarman is one of the founders of The Baupost Group - a Hedge Fund with roughly $25B AUM.

Learn More: HERE

Piece of advice from Stephen Seth Klarman

Business & Private Equity

What It Takes, Lessons In The Pursuit Of Excellence - by Stephen A. Schwarzman

Stephen Schwarzman founded private equity giant Blackstone with Pete Peterson in 1985 with just $400,000.

Since then Mr. Schwarzman has grown Blackstone’s assets under management to over $1 Trillion.

Piece of advice from Stephen Schwarzman.

How To Make A Few Billion Dollars - by Brad Jacobs

Brad Jacobs has created seven corporations, five of which are publicly traded XPO Logistics, GXO Logistics, RXO, United Rentals; and United Waste Systems.

Piece of advice from Brad Jacobs

What’s Next?

The opportunity is now - when markets fall into corrections during cyclical bull markets, unprecedented opportunities present themselves.

Corrections allow us to identify new leading stocks and affords us the opportunity to get back into previous leaders that we missed.

Above is a chart of the S&P 500 - there is nothing bearish about this chart.

The S&P 500 appears to be testing its breakout level into new record highs.

When the S&P 500 broke out into new high territory, many of the market leaders became extremely extended above their 50 day and 200 day moving averages.

We have covered this in previous issues of Behind The Street - it is completely normal for true market leaders to correct back to their 50 day moving averages before establishing a new base and resuming the uptrend higher.

As discussed in STOCK MARKET CORRECTION! Biden Taxing Unrealized Gains? the first major swing low at the start of a market correction can be used as your ‘line in the sand”.

Above is a chart of the S&P 500 with our “line in the sand” drawn at 4,953.

4,953 can be used as a place to risk manage our positions - to cut our losses and scale back exposure should the market fall back below this level.

Exposure should be added on each follow through day to leading stocks or the general market.

During a market correction, the investor first looks for an attempted rally. Day 1 of an attempted rally begins when a major index closes up from the previous session. Neither volume nor the size of the gain matters. The only thing that matters is that the attempted rally stays alive.

For the attempted rally to stay alive, the index cannot undercut the low of Day 1.

On Day 4 or later of the attempted rally, the Nasdaq or S&P 500 must deliver a strong gain in volume up from the previous day. That big gain in rising volume is the follow-through day, which confirms that a new uptrend is underway.

A follow-through day can't pick the exact day that a market bottoms, but it can get you in close to the bottom.

Investors Business Daily

The VIX is collapsing - providing us with additional evidence that this recent pull back was a normal and much needed event in a much larger bull cycle.

Historically it is wise to short volatility after these big blow offs in the VIX.

This does not mean we are out of the woods - this is just a green light to be pulled back into the market and to cut or trim your positions should the market reverse below your “line in the sand”.

Earnings Recap

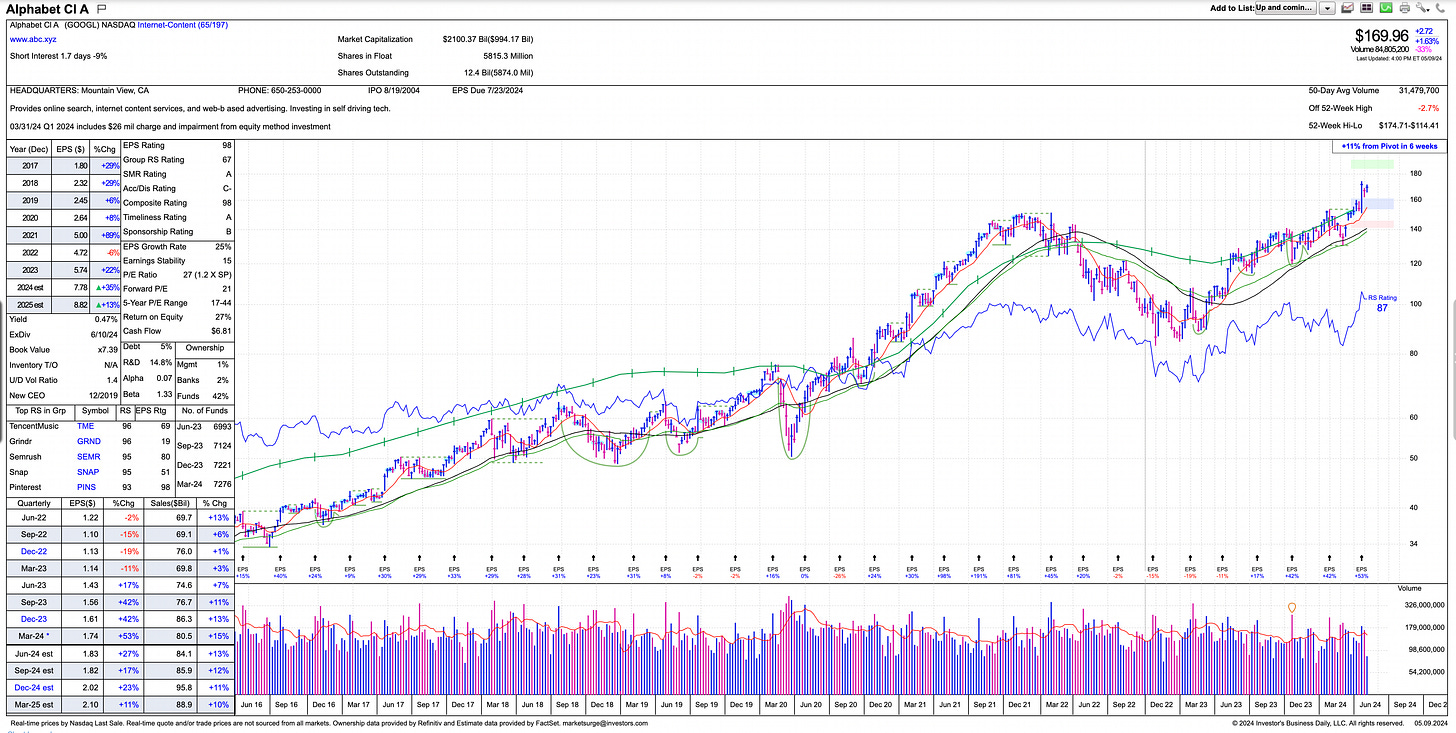

As earnings seasons works its way through - big tech giants are putting up impressive numbers.

Net Income:

AAPL 0.00%↑ $23.64 billion

GOOGL 0.00%↑ $23.66 billion

MSFT 0.00%↑ $21.94 billion

AMZN 0.00%↑ $10.4 billion

META 0.00%↑ $12.37 billion

Combined these five companies made over $92 Billion last quarter.

Alphabet announced it will be issuing a dividend for the first time in history while Apple makes headlines with a monster $110 Billion share buyback program.

Cloud computing was a bright spot and should continue to be a bright spot in the future.

Amazon AWS - Microsoft Azure - Google’s Google Cloud business continue to boom.

Google Cloud revenue: $9.57 billion

Microsoft’s Intelligent Cloud revenue: $26.71 billion

Amazon Web Services Revenue: $25 billion

Amazon is trading at a 52 week high and points shy of a new record high.

Microsoft is looking to break back above its 50 day moving average - just 18 points away from a new record high.

Alphabet gapped up into new highs and is now digesting the earnings move 11% extended above the 50 day moving average.

Beach Ball Under Water

A tell tale sign of a strong bull market is when stocks act as beach balls underwater.

Stocks sell off for a number of reasons - often large institutions are rebalancing portfolios and taking profits.

If Fidelity lets rip of a few billion worth of stocks, thats going to impact the price - the question is will there be buyers to swoop in and buy those shares.

Pictured above is Netflix NFLX 0.00%↑ - the stock gapped down over 10% on earnings and virtually rallied right back within a matter of two weeks.

The stock has even regained its 50 day moving average.

Netflix reported first-quarter net income of $2.33 billion on revenue of $9.37 billion with total memberships beating expectations at 269.6 million.

This is a turn around story to watch as the company cracks down on account sharing.

It’s safe to say we are “watching Netflix”

A similar story can be told with META 0.00%↑ - gapping down over 15% on earnings and levitating right back - still trying to reclaim the 50 day.

The turn around story in Meta will be studies in business schools for many years to come - Mark Zuckerberg’s “year of efficiency” is really playing out.

Focusing on the core business and getting rid of corporate bloat has turned the social media giant back into a cash generating machine.

At the time, Zuckerberg said the company would be better at eliminating unnecessary projects and cracking down on bloat, which would help Meta become a “stronger and more nimble organization.” The company cut about 21,000 jobs in the first half of 2023, and Zuckerberg said in February of this year that hiring will be “relatively minimal compared to what we would have done historically.”

Headcount declined by 10% in the first quarter from a year earlier to 69,329.

CNBC

Notice the correlation between net income growth and stock price appreciation.

Pay very close attention, especially during a market correction - to stocks that are being supported and “bucking the trend” as these names should continue on to be the new leaders upon conclusion of the cycle correction.

New Issues

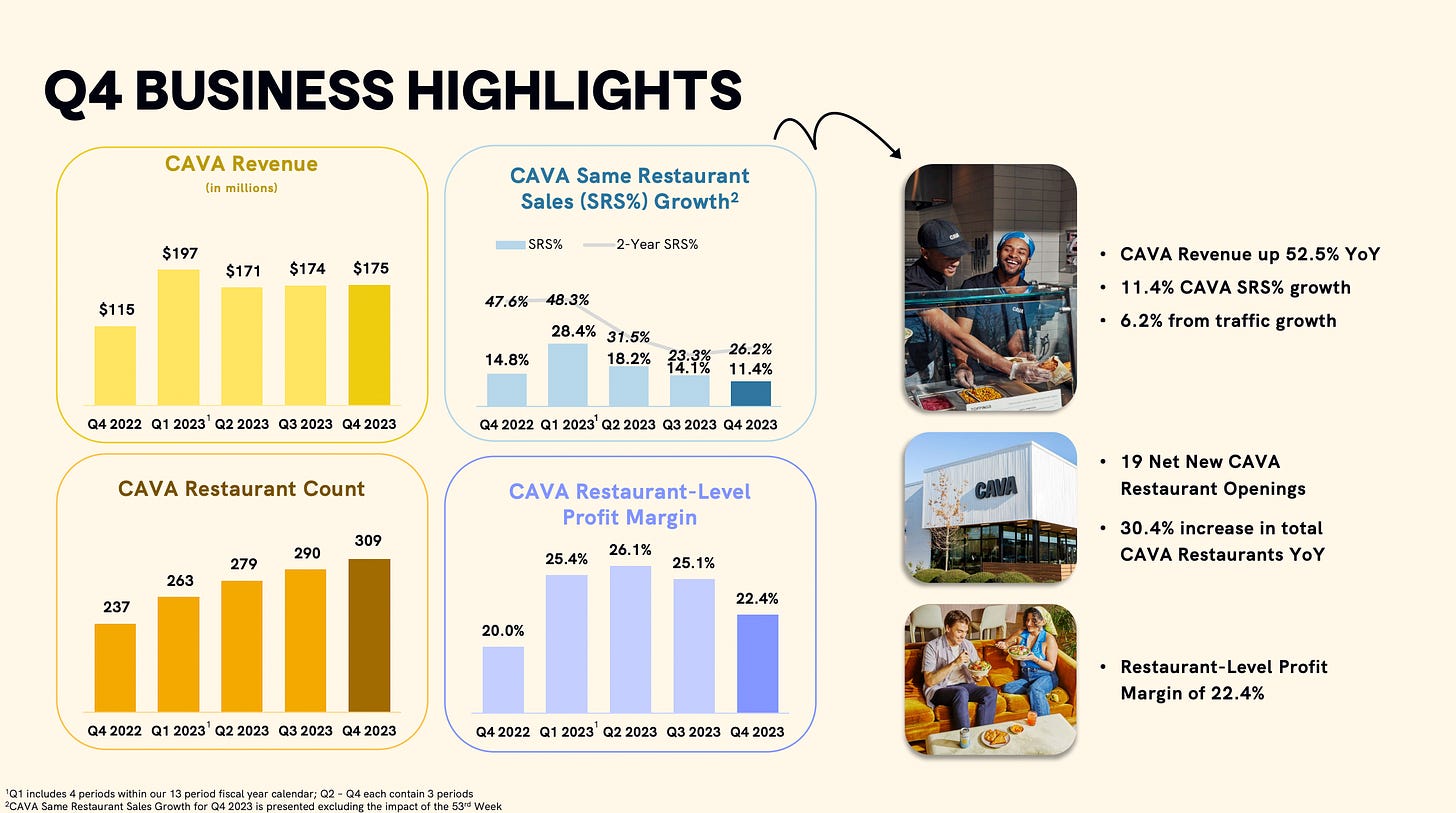

We have started to cover a new IPO building out an interesting IPO base - CAVA CAVA 0.00%↑

These QSR companies - particularly ones that can achieve scale tend to be fantastic businesses over time.

Think Chipotle CMG 0.00%↑ Wingstop WING 0.00%↑

A few characteristics that make these businesses great.

Scalability

Healthy Margins

Great Product

Repeat Customers

FY 2023: CAVA currently has 309 locations across the county - 24.8% Margins - 17.9% same restaurant sales growth - $13.3M Net income.

Assuming stable margins at scale, this is one to watch.

For context Chipotle has over 3,000 restaurants, but we believe the total addressable market for Mexican food significantly out weighs that of Mediterranean.

Can CAVA grow to 2,000 restaurants? We think so and will be paying close attention to each quarterly report to make sure trajectory is stable.

Currently, CAVA 0.00%↑ seems to be forming a text book cup with handle IPO base going into earnings on May 28, 2024.

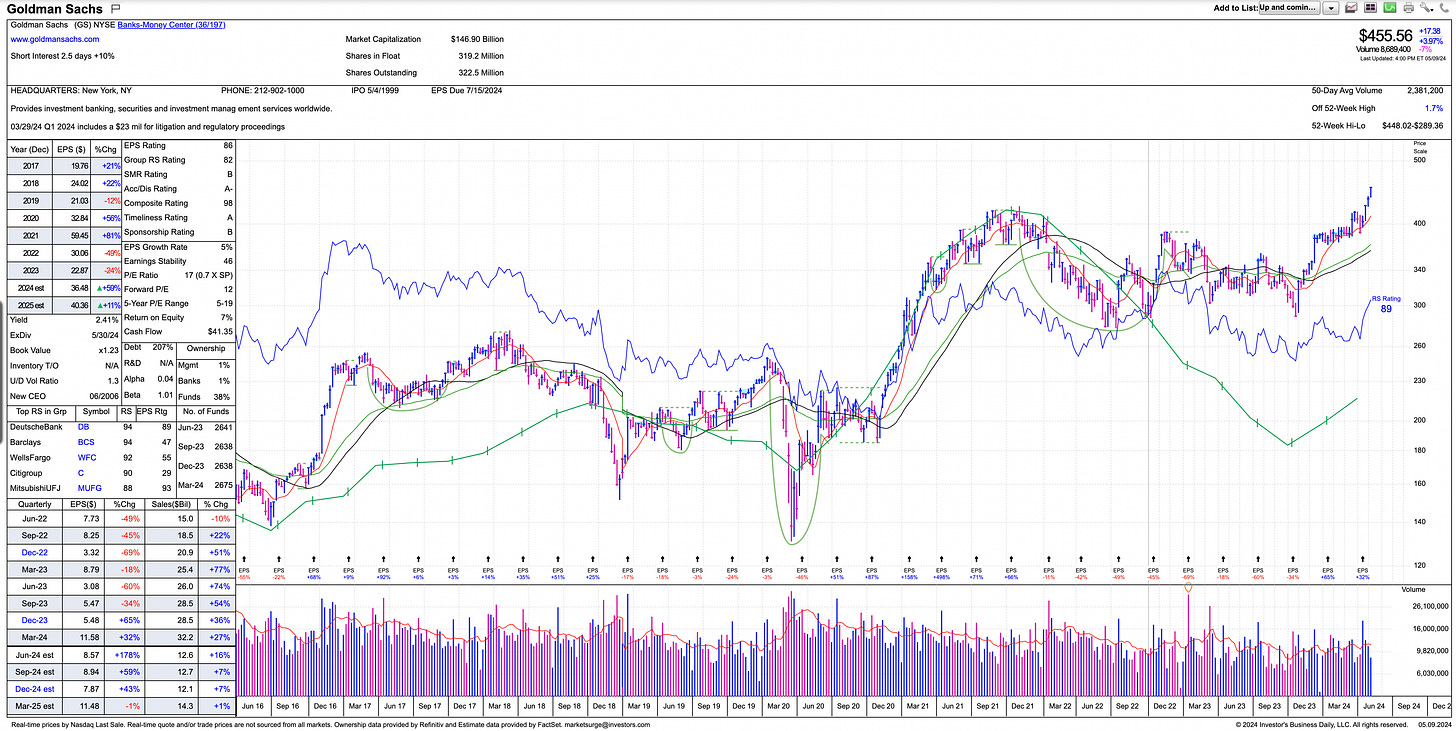

Financials XLF 0.00%↑

The financial sector continues to outperform as the XLF 0.00%↑ find support at its 50 day moving average after a slew of upbeat bank earnings.

We expect new record highs for the financial sector in the coming weeks.

Please review our previous coverage of bank earnings: HERE

Share of Goldman Sachs GS 0.00%↑ hit fresh record highs after a complete turn around in deal making on Wall Street.

Boutique Investment Banks continue to perform well, you can review our previous coverage and bull thesis on financial by clicking HERE

Video Coming Soon

Coming soon! Behind The Street will be publishing market update videos every other day and a market outlook video on Sundays.

Stay tuned for an official launch date, we will upload on YouTube.

Thank You

A big THANK YOU to all of our clients! Without your support we wouldn’t have been able to secure #1 Medium Team - Transactions.

Updates

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.

Your newsletter keeps getting better. Congratulations!