Tis The Season - Earnings Season

Wall Street earnings kicked off on Friday October, 11 when JPMorgan Chase & Co JPM 0.00%↑ posted Q3 earnings that beat expectations on both the top and bottom line.

If you’ve been keeping up with us here on Behind The Street, you’d know one of our main themes for 2024 has been forecasting a roaring recovering in deal making on Wall Street after an earnings slump 2022 - 2023.

In our February 9, 2024 report titled “Extreme FEAR Drives Price. Higher?” we outlined our bull thesis on financials, particularly boutique investment banks.

Read: The Great Dealmaking Comeback

Since then the XLF 0.00%↑ has broken out of a flat base to new record highs with many of the individual bank stocks up 65%+.

The backbone of a healthy economy is a thriving financial sector and things are looking rosy on Wall Street.

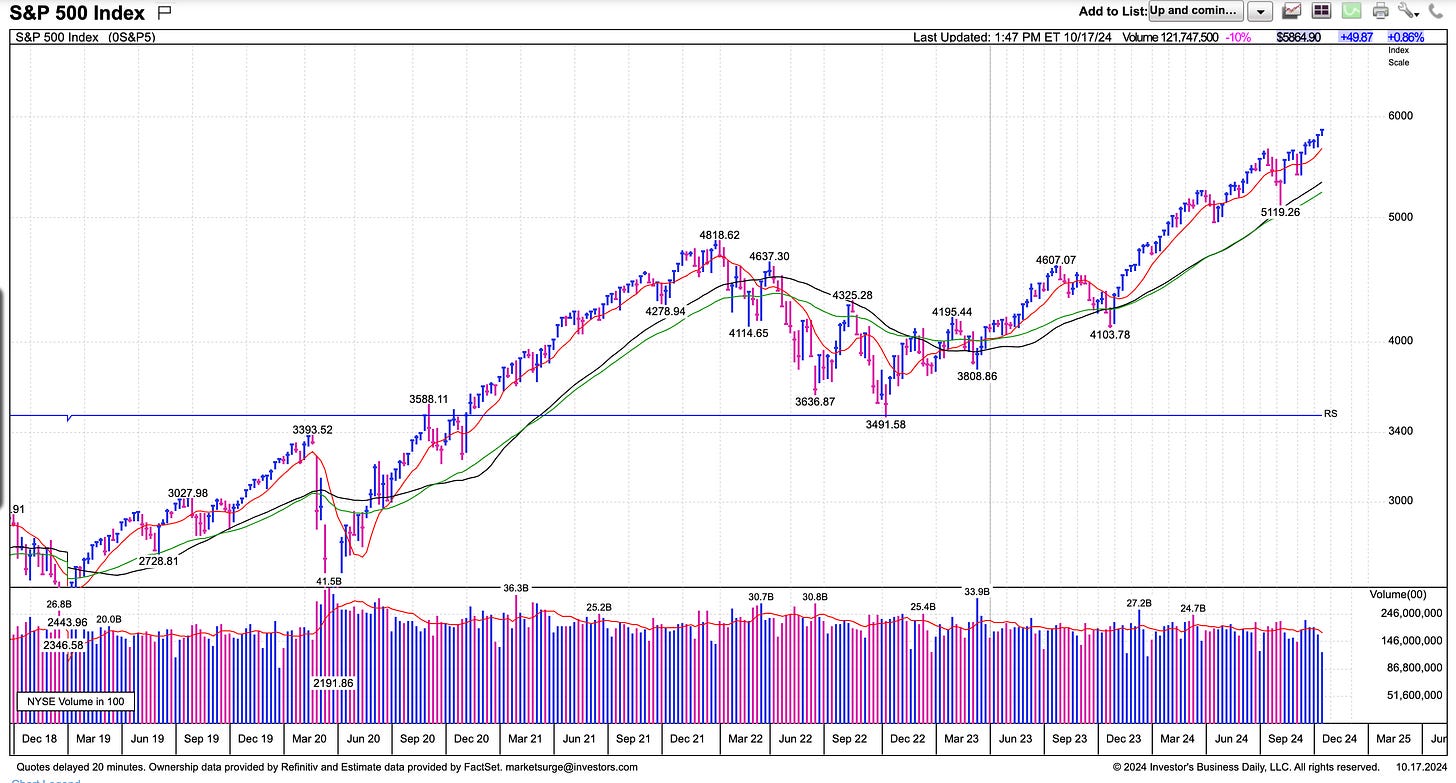

Chances are, if the banks are doing well - so is the economy and if the economy is doing well (positive GDP growth) the S&P 500 should be higher roughly 70% of the time six months after a positive GDP print.

This formula was proven true in 2024 as we saw a turn around in bank earnings, higher than expected GDP growth and new record highs for the S&P 500.

At JPM 0.00%↑ Investment banking fees climbed 31% to $2.27 billion in Q3, exceeding the $2.02 billion estimate.

Goldman Sachs GS 0.00%↑ Investment banking revenue jumped 20% to $1.87 billion, on strength in debt and equity underwriting. Total profit surged 45% from a year earlier to $2.99 billion.

CEO David Solomon noted Goldman’s backlog for pending deals increased from both a year earlier and the second quarter.

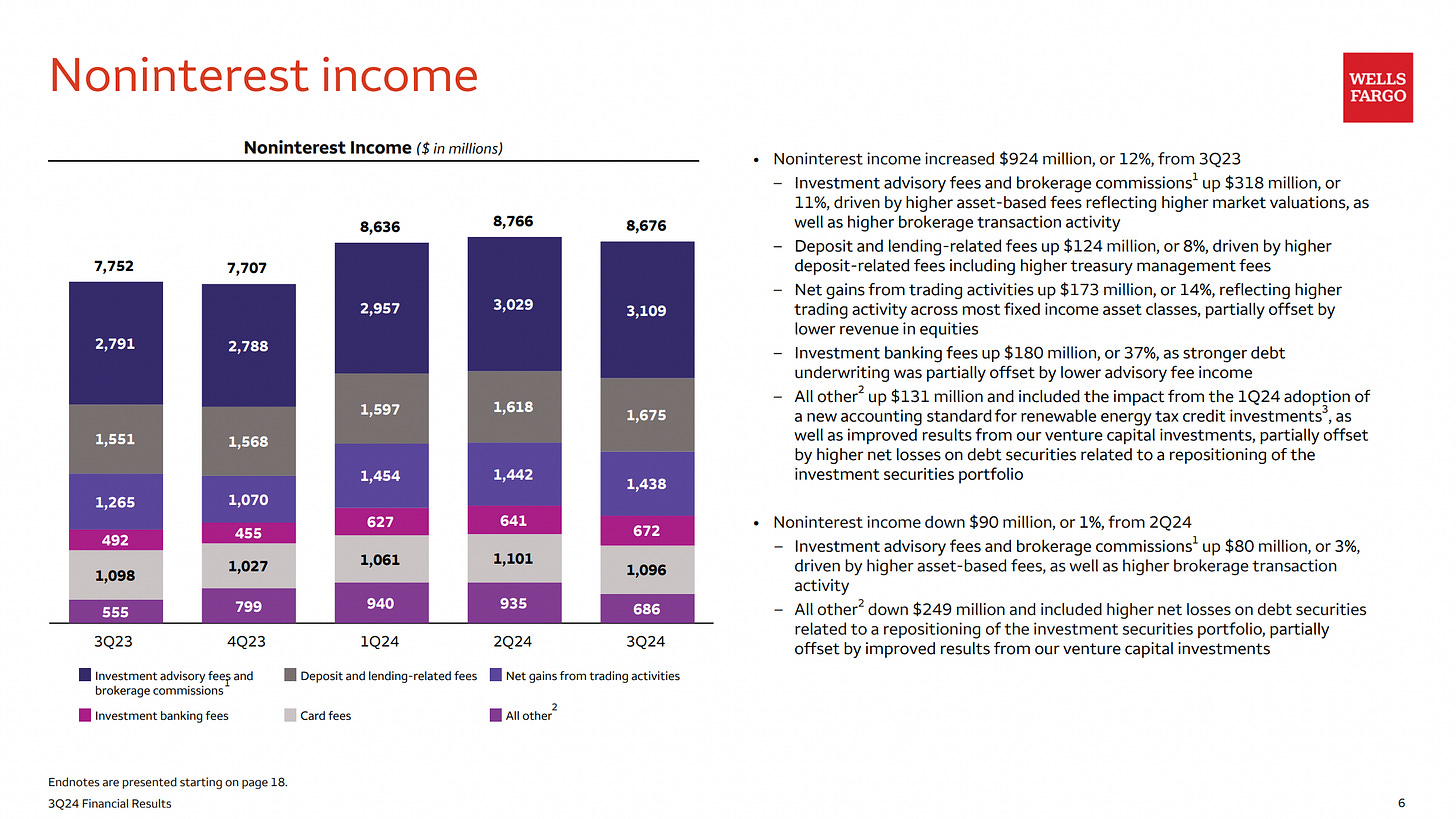

Wells Fargo WFC 0.00%↑ saw investment banking fees increase $180 million, or 37% with total non-interest income up $924 million or 12% from Q3 2023.

Wells Fargo also increased their dividend by 14% and repurchased $3.5 billion of common stock in the third quarter and $15 billion during the first nine months of the year.

WFC 0.00%↑ stock jumped to a new record high on the back of the better than expected earnings report.

As discussed, Private Equity giants KKR 0.00%↑ and Apollo Global Management APO 0.00%↑ have also been performing well on the deal making recovery.

We can use stocks as a leading economic indicator and price action in PE giants have been forecasting an upcoming boom.

Pictured above is a weekly chart of APO 0.00%↑ - trading into new record high territory and up almost 50% since out February 2024 newsletter.

Notice the Earnings block below.

We can see the stock price leading and anticipating a steep earnings rebound into 2025.

A similar pattern follows with KKR 0.00%↑ - earnings slumped in 2022 and 2023 with a string rebound in 2024 and continued expected strength in 2025.

The continued strength in financials, major banks and private equity giants is a positive sign for whats to come in markets, especially in the U.S. in 2025.

Emerging Trends - Nuclear Power

Data Centers, Cloud Computing and AI will consume an unfathomable amount of energy over the coming decade.

Experts and industry leaders agree the only solution to meet growing energy demands in a green and clean manner is to go nuclear.

According to Goldman Sachs research a ChatGPT query needs nearly 10 times as much electricity to process as a Google search.

Goldman Sachs Research estimates the overall increase in data center power consumption from AI to be on the order of 200 terawatt-hours per year between 2023 and 2030.

By 2028, Goldman Sachs expect AI to represent about 19% of data center power demand.

Read Full Report: Here

We are already starting to see some of the largest Cloud Computing players invest millions in anticipation for whats to come.

According to CNBC: AMZN 0.00%↑ AWS announced it has signed an agreement with D 0.00%↑ Dominion Energy, to explore the development of a small modular nuclear reactor, near Dominion’s existing North Anna nuclear power station.

Microsoft MSFT 0.00%↑ is also making arrangements to go nuclear to help power the needs of data centers.

According to CNBC: Microsoft will purchase electricity from the Three Mile Island Plant in a 20-year agreement to match the energy its data centers consume with carbon-free power.

Constellation described the agreement with Microsoft as the largest power purchase agreement that the nuclear plant operator has ever signed.

Read the full CNBC article: HERE

Yet another Cloud Computing giant GOOGL 0.00%↑ is skating towards nuclear in a recent deal with small modular reactor developer Kairos Power.

“We believe that nuclear energy has a critical role to play in supporting our clean growth and helping to deliver on the progress of AI,” Michael Terrell, senior director for energy and climate at Google

As Peter Lynch describes in his famous investing book One Up On Wall Street - pay attention to emerging trends, where are the smarted people in the world looking?

Well, the smartest minds at the worlds most powerful technology companies are looking at nuclear and you should too.

Pictured above is the VanEck Uranium & Nuclear ETF NLR 0.00%↑ - breaking out into 52 week highs on a substantial uptick in volume.

In addition, the Range Nuclear Renaissance ETF NUKZ 0.00%↑ is breaking out into new high territory over a previous swing high.

We bring this to your attention to put an emphasis on the importance of moving the Nuclear sector onto your watch list.

No one knows who will be the winners in AI, but we all know that the AI race will require significant power, and in our view - nuclear seems to be the front runner as the engine behind AI.

Plan accordingly.

TSMC - Keeping The Cycle Alive

Taiwan Semiconductor TSM 0.00%↑ reported earnings that beat expectations, giving the market confidence that the boom in chip making for mobile devices and AI still has legs.

“our business was supported by strong smartphone and AI-related demand for our industry leading 3nm and 5nm technologies,” - TSMC Earnings Call Quote

Not only did the stock soar to a new record high but net income rang the register to the tune of $10.1 billion for the quarter.

Gross margin expanded to 57.8% from 54.3% last year.

“We have talked to our customers all the time, including our hyperscaler customers who are building their own chips. And almost every AI innovator is working with TSMC,”

TSMC Chairman and CEO C.C. Wei

Demand is robust, earnings continue to come in strong and the sector outperforms.

The iShares Semiconductor ETF SOXX 0.00%↑ is consolidating just below a pivot point on a high cup with handle base.

After a better than expected earnings report from TSMC, it is likely this ETF opens higher over the pivot point.

Bitcoin - It’s Go Time

Back on March 14, 2024 we thought we’d identified one of the most symmetrical and bullish cup with handle patterns of our careers - it was on Gold.

READ HERE: Bitcoin & Gold At Record Highs

Below is an excerpt from our March 14, 2024 Newsletter as gold was just breaking out over $1,900 from a monster cup with handle base - our price target $3,000/oz.

We now see a similar set up right now on Bitcoin, a near perfect cup and handle after several years of consolidation.

Pictured above shows a weekly chart of Bitcoin with historical cup with handle break outs from multi year bases.

This set up above presents an asymmetric risk/reward profile to go long Bitcoin on a break out of the handle and to stop out on a break below.

Our immediate Bitcoin price target on an upside breakout from the handle is $106,000 or roughly 50%.

Another very important factor at play here is that Bitcoin is trading near record highs while retail interest in Bitcoin is at record lows!

Above is a screen shot of the search term “bitcoin” on Google trends, hovering near record lows - meaning retail (dumb money) has zero skin in the game.

Retail is usually late to the party while institutional investors slowly accumulate and build position before a major run up.

Bitcoin Price at Record highs + No Retail Exposure = Rocket Fuel.

Corroboration In Coinbase

Potentially confirming the potential break out in Bitcoin is the constructive building out of a stage 1 IPO base on COIN 0.00%↑.

The chart of Coinbase pictured above shows the clear build out of a stage 1 IPO base in a cup with handle formation.

Additionally, earnings and sales growth is starting to accelerate with the last three quarters posting 100%+ earnings growth and 50%+ revenue growth.

A break over $281 is actionable on Coinbase.

Paul Tudor Jones Documentary Trader

As a bonus to this weeks Behind The Street, below you will find a link to the Paul Tudor Jones Documentary - often removed from the internet.

Take some time out of your week to watch this film, this documentary is more relevant than ever as we have many macro trade set ups in the market.

If you enjoy our newsletter - please share it with your co-workers, friends and family.

5 Beekman Street Penthouse

Take a look at our newest listing at 5 Beekman Street PH 51.

Listing Information: 5 Beekman Street #PH51 3 Bed 3.5 Bath 3,554SF

Updates

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.

Thanks for reading Behind The Street ! Subscribe for free to receive new posts and support my work.