First……. A Look Abroad

December 25, 1989 was the last time the Japanese Nikkei 225 traded into new high territory, 34 years, 1 month and 27 days ago.

The Nikkei 225 has since been carving out a monster 34 year base - quietly running up the right side while investors are egregiously underexposed.

Only 23% of people in Japan in their 20’s invested in mutual funds last year, up from only 6% in 2016.

54% of Japans house-hold assets are estimated to be in cash or simple deposits.

That is a lot of fire power on the sidelines as The Nikkei 225 breaks out - many have missed the move and will pile in at higher prices.

The lock out rally, defying extreme negative sentiment.

Low Birth Rates

Aging Population

$9.2 trillion public debt ( 263% of GDP)

Bears are still rampant on Wall Street regarding Japan, all while price continues to climb. (With the help of a declining ¥)

Price matters - the market is telling you to pay attention.

India Leads - Nifty 50

India outperforms, we expect this trend to continue well into the next decade as significant manufacturing infrastructure projects act as a tail wind for the economy.

To take on new found demand, India will need to make significant logistics infrastructure investments to stay competitive.

2021 and 2022 were years of supply chain bottlenecks - the next decade will bring about a “global reorganization”, away from China and in our view, India will benefit most.

Mexico - IPC MEXICO (^MXX)

IPC Mexico is starting to lead, showing relative strength breaking back above previous 2017 highs.

We draw evidence of a growing manufacturing infrastructure in Mexico from an S&P Global Market Intelligence Study

The share of US television imports coming from Mexico rose to 74.7% in 2022 from 54.1% in 2016.

The share of US computer servers imports from Mexico rose to 79.3% in the past 12 months from 77.2% in 2016.

The U.S. China trade war worked to Mexicos benefit.

“Mexico's share of US imports of the products covered by Section 301 tariffs imposed by the Trump administration on imports from mainland China rose to 17.2% in the 12 months to May 31, 2023, from 15.5% in 2016.” - S&P Global Market Intelligence

‘Made In Mexico’ Is The New "‘Made In China’ - LISTEN HERE

Follow price, follow the money - we can use stocks as a leading economic indicator.

Often, smart money is accumulating stock for a reason and selling stock for a reason - as Japan, India and Mexico outperforms we can work backwards and discover why.

We have our answer.

Hospitality Stocks Lead | Consumer Confidence Retreats

The Conference Board’s latest consumer survey showed that Americans attitudes towards the economy declined in February.

The negativity was broad based with households earning less than $15,000 and those earning more than $125,000,” turning negative.

The Stock Market Is Not The Economy

While consumers turn a little negative - hospitality stocks outperform with accelerating earnings and guidance.

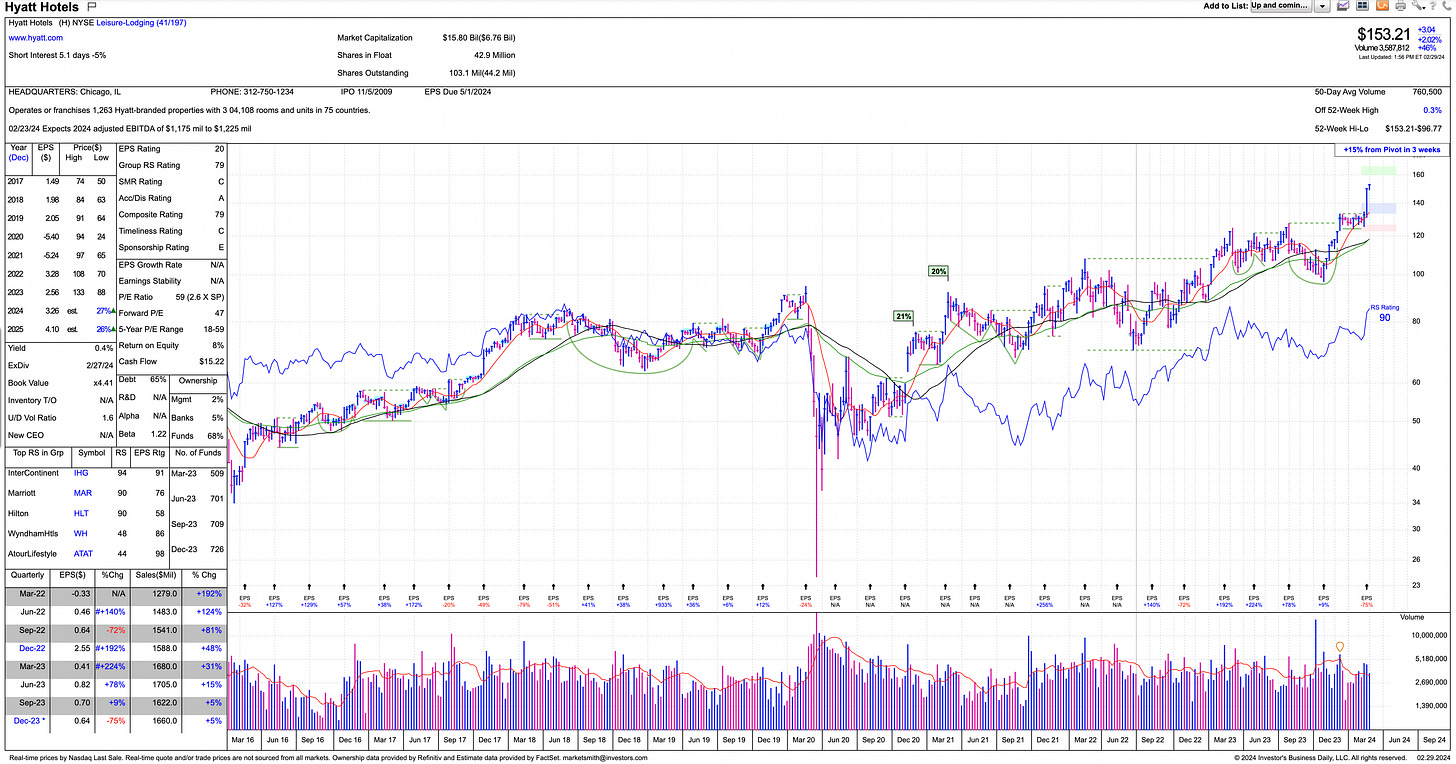

Hyatt Hotels H 0.00%↑ rose 13% into new all time record highs after a better than expected earnings report.

Highlights:

Returned $500 million to shareholders

Record Fees

Highest Free Cash Flow in Company history

Mark S. Hoplamazian, President and Chief Executive Officer of Hyatt

"The fourth quarter marks the completion of a transformative year and demonstrates the progress towards our strategic vision and earnings evolution. RevPAR growth exceeded the high end of our guidance range and we had industry leading net rooms growth for the seventh consecutive year. This led to a record level of fees and the highest free cash flow in Hyatt's history. We returned $500 million to our shareholders and achieved an asset-light earnings mix of approximately 76% for the full year, a testament to the successful execution of our strategy."

Record profits drove Hilton HLT 0.00%↑ up 10% after earnings and into fresh new all time record highs.

Hilton CEO Christopher J. Nassetta made an appearance on CNBC eight months ago forecasting the strongest summer in company history and a full return to pre pandemic business travel through 2024 - 2025.

He was right.

Below is an excerpt from Hilton’s Q4 2023 Earnings Call Transcripts on February 7, 2024.

Hilton CEO Christopher J. Nassetta

We are happy to report a great end of what was another really strong year for Hilton. For the year, system-wide RevPAR grew 12.6% versus 2022 with solid growth across every major region and chain scale. Compared to 2019, RevPAR increased 10.7%. Strong top line performance drove record adjusted EBITDA of nearly $3.1 billion, up roughly 20% year-over-year to the highest level in our company's history.

How Long Will The Hospitality Boom Last?

The good news is that we can look for clues in industries that provide essential services to the hospitality and hotel industry.

Ecolab ECL 0.00%↑ reported better than expected earnings sending the stock up over 10% as it builds out the right side of a cup base, hitting a 52-week high.

Ecolab gave great guidance:

1Q 2024: Expect first quarter 2024 adjusted diluted earnings per share in the $1.27 to $1.37 range, +44% to 56% versus last year reflecting short-term benefits from lower delivered product costs.

2024: Expect full year 2024 adjusted diluted earnings per share in the $6.10 to $6.50 range, +17% to 25% versus last year.

This is a name to watch as earnings and sales continue to ramp, a break into new highs would warrant a position.

According to MarketSmith full year estimates:

2024 EPS: $6.40

2025 EPS: $7.26

Emerging IPO Bases - Watch List

Piggybacking off of the hospitality conversation - we need to cover two recent IPO’s that we have moved onto the watch list.

Uber UBER 0.00%↑ - IPO Date: May 19, 2019

Airbnb ABNB 0.00%↑ - IPO Date: December 10, 2020

Uber is starting to emerge out of a stage 1 IPO base, breaking out into new record highs after multiple better than expected earnings reports.

Uber’s Earnings Per Share - EPS is expected to be up 123% in 2024 and an additional 44% in 2025.

The highest volume was recorded on the break out of a stage 1 IPO base back in January as institutional sponsorship continues to grow from 2,315 in September to 2,597 in December.

Airbnb ABNB 0.00%↑ is a little earlier in the process, but making progress - we advise this idea as a tier 2 idea.

Airbnb is showing similar characteristics accelerating earnings, sales and growing institutional sponsorship.

Airbnbs Earnings Per Share - EPS is expected to be up 30% in 2024 and an additional 12% in 2025.

As the base continues to build out and clears more overhead supply, a position over $212 can be warranted.

To learn more about trading IPOs - we recommend reading The Lifecycle Trade.

The Great Dealmaking Comeback

As U.S. markets continue to charge into new high territory - we are starting to see more evidence that the rally is starting to broaden out.

Boutique Investment Banks Are Participating.

Evercore: EVR 0.00%↑

Houlihan Lokey: HLI 0.00%↑

Piper Sandler PIPR 0.00%↑

Jefferies Financial: JEF 0.00%↑

Evercore is having a major earnings recovery after a rough 2022 - 2023 due to a significant slowdown in dealmaking on Wall Street do to a harsh tightening cycle.

The market is now starting to adjust to the higher interest rate environment and deals are starting to get done - markets are opening up.

Evercore is trading back at record highs after building out the right side of a cup base.

The same earnings rebound and price action can be seen with Houlihan Lockey.

Piper Sandler is approaching a buy point as it forms a handle just sky of new record highs.

2021 EPS came in at $21.92/share - went on to decline significantly to $11.26/share in 2022 and $9.29/share in 2023.

Looking out into 2024 - 2025, earnings are expected to rebound in a major way to $11.81 & $15.70 respectively.

Shifting focus to Private Equity - the market is telling us that it’s coming back in a major way.

KKR 0.00%↑ is currently at a buy point - breaking into new highs after a multi-year cup with handle base.

After an earnings collapse in 2021, KKR is in for a major rebound.

2022 EPS: -0.91

2023 EPS: $4.09

2024 EPS: $5.00

2025 EPS: $6.05

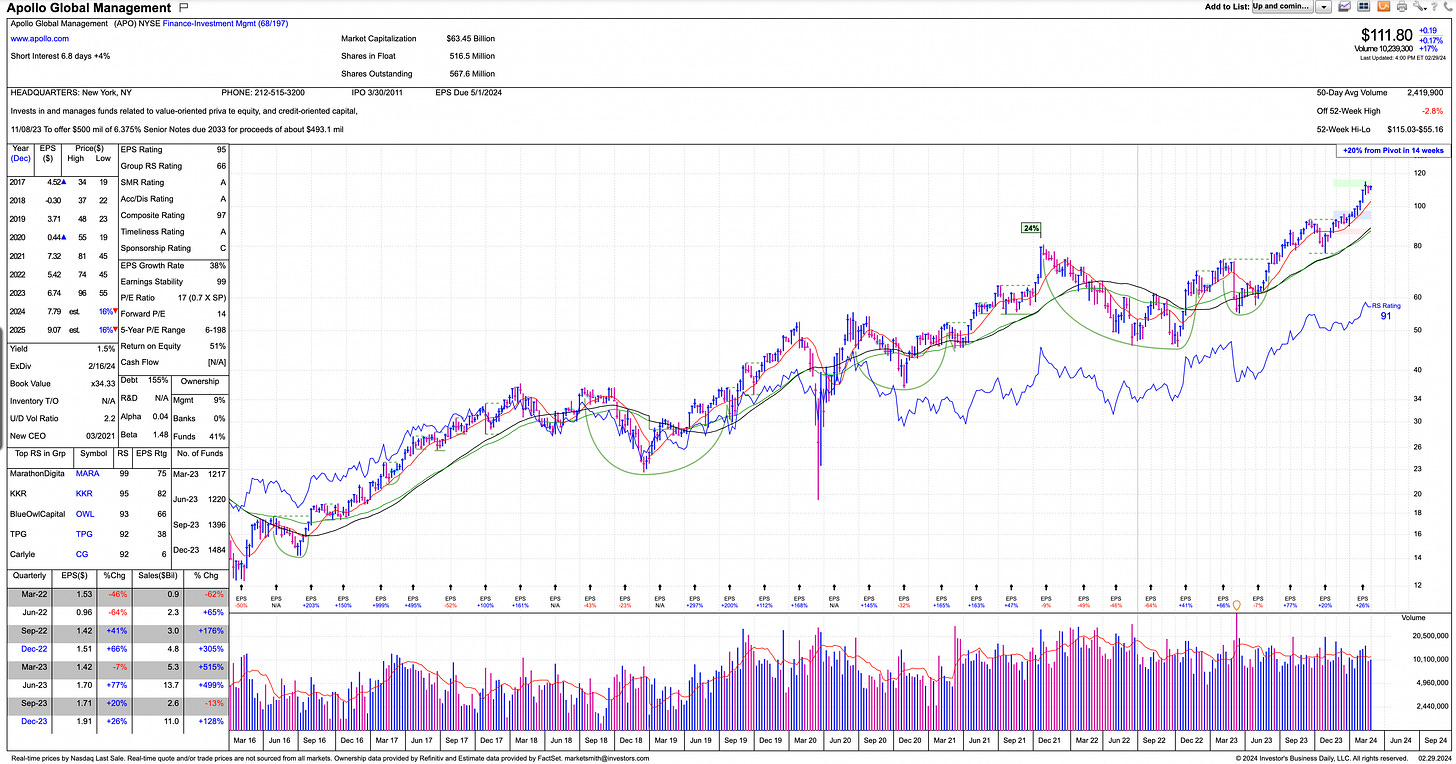

Exact same action can be found in Apollo Global Management APO 0.00%↑

It is important to focus on stocks making new 52-week and record highs.

We can work backwards and often, there is a reason why stocks are leading - Earnings & Sales acceleration are common catalysts.

Risk On With Bitcoin

The recent move in Bitcoin exceeded even our expectations.

We have been covering this monster base in Bitcoin for almost a year in the newsletter - with a deep dive on the Bitcoin halving cycle.

Bitcoin has increased $20,000 since our halving cycle bull thesis was published.

The Blackrock Spot Bitcoin ETF BITI 0.00%↑ took in just over $520,000,000 just yesterday.

A supply shock may be coming soon.

The interesting aspect of this bull cycle is that it is severely underflowed by the general public.

Overall public interest in Bitcoin is down year over year and down significantly from its peak in 2017.

This tells us that smart money has been the main participant in this rally, leaving the public under exposed to the asset - all while we are a stones throw away from a new all time high.

Remember - we can use Bitcoin’s price action to measure risk appetite of investors.

This is very much a ‘Risk On’ occurrence - confirming the Bull Market in other asset classes, particularly - U.S. Equities.

There is one thing that may knock this Bull Market off course…………..

See below:

See you in the next issue of Behind The Street.

New York City Real Estate - Featured Listing

One57 157 W 57th Street New York, NY 10019 - the first building ever constructed on New York’s Billionaires Row.

Check out the last available sponsor unit in the building.

1 Bed 1.5 Bath

1,021 SF Interior

393 SF Private Terrace

5 Star Hotel Park Hyatt In Building

Bathrooms are custom designed by Thomas Juul Hansen

Swimming Pool

Spa

List Price: $3,950,000

Updates

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.

Thanks for putting together this information.