Santa’s First Stop - Wall Street

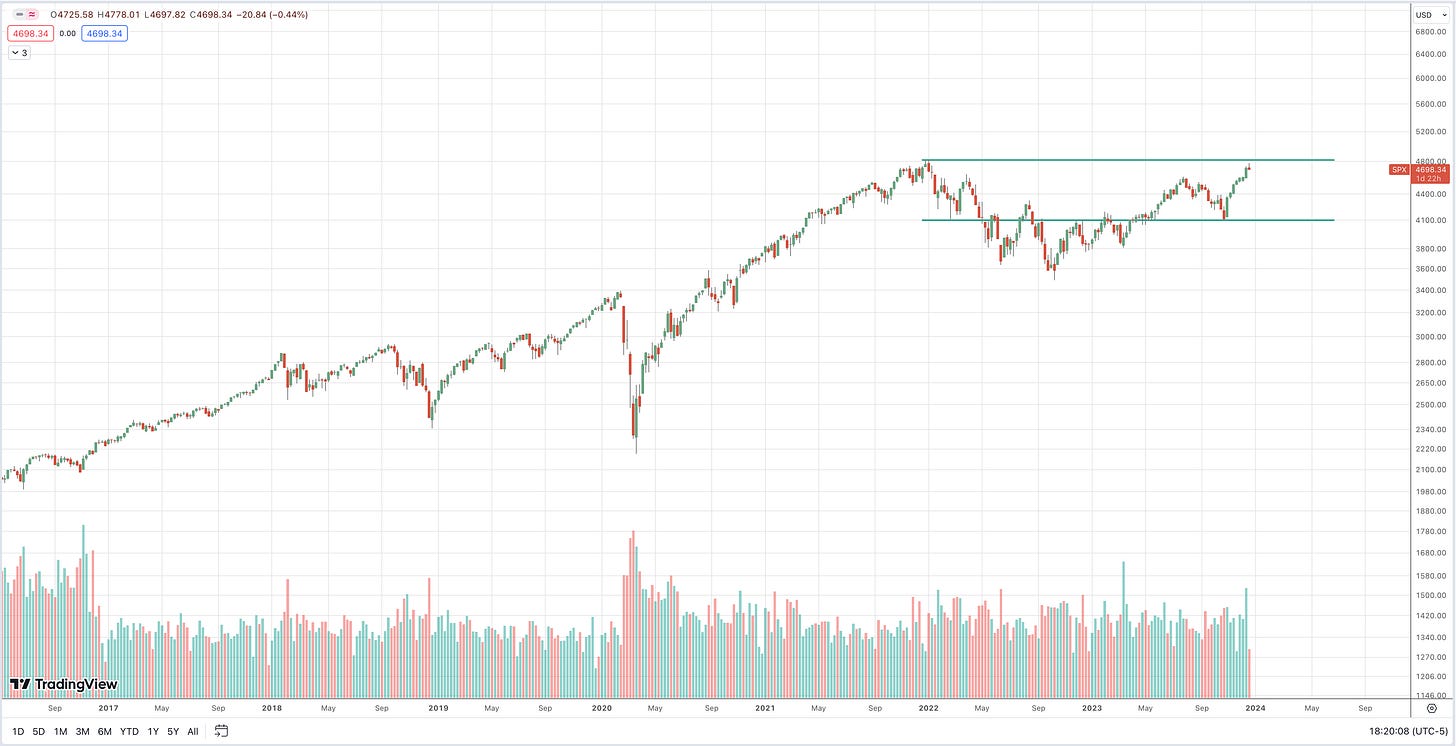

It appears that Santa took the express train to Wall Street this year as the Dow Jones Industrial Average and Nasdaq 100 hit new all time record highs.

The S&P 500 is just 30 points away from breaking out over the January 2022 record of 4,818.

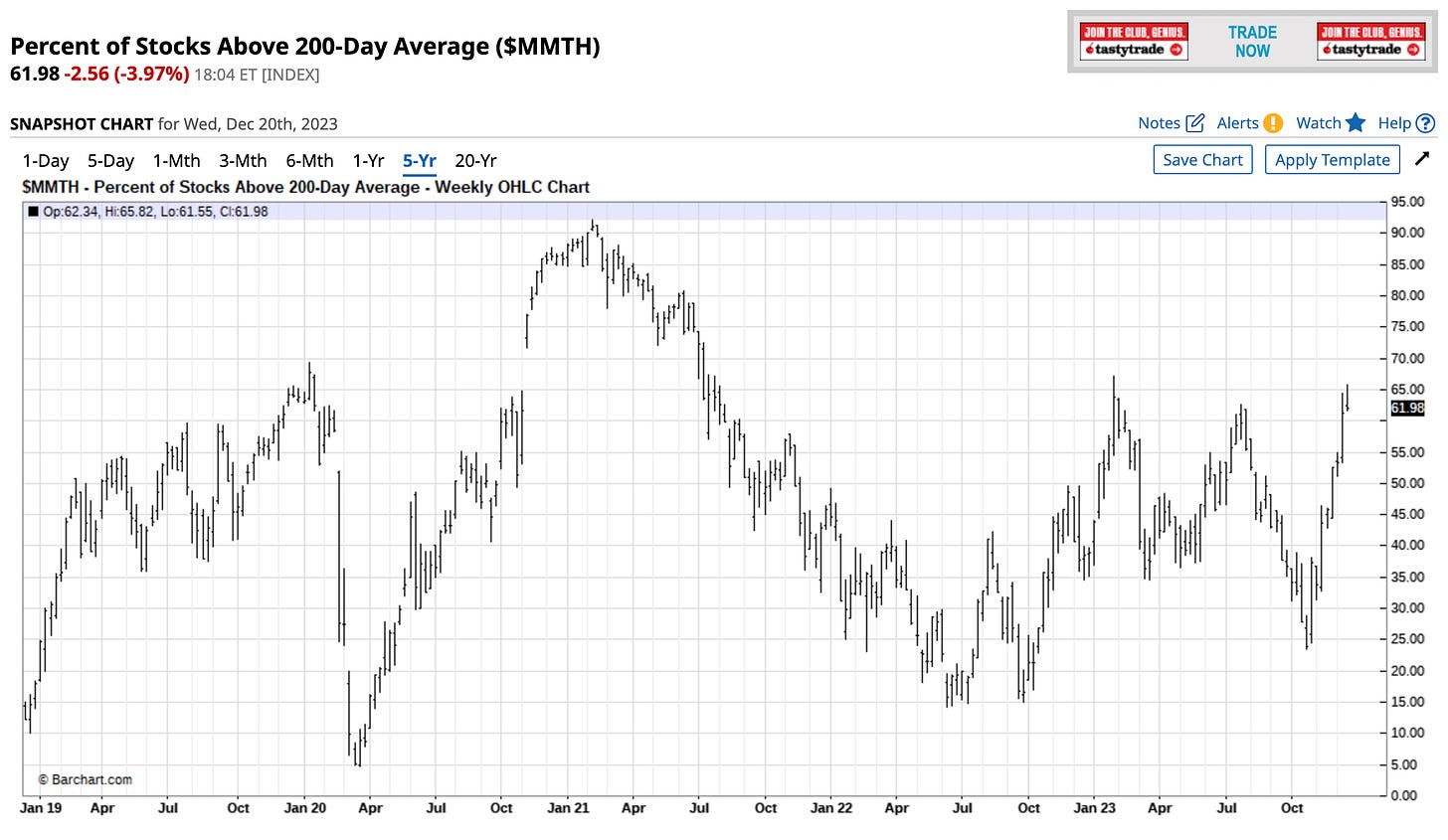

Many market participants still believe that the recent rally in stocks have been supported by only a handful of mega cap tech names, the magnificent 7.

However, when we look “under the hood” of the market we find a significant improvement in breadth.

The percentage of stocks trading above their 200 day moving average is back above 60%, signaling more participation from a broader range of sectors.

Small caps are also starting to participate in the rally with the IWM 0.00%↑ iShares Russell 2000 ETF up over 20% from its October lows.

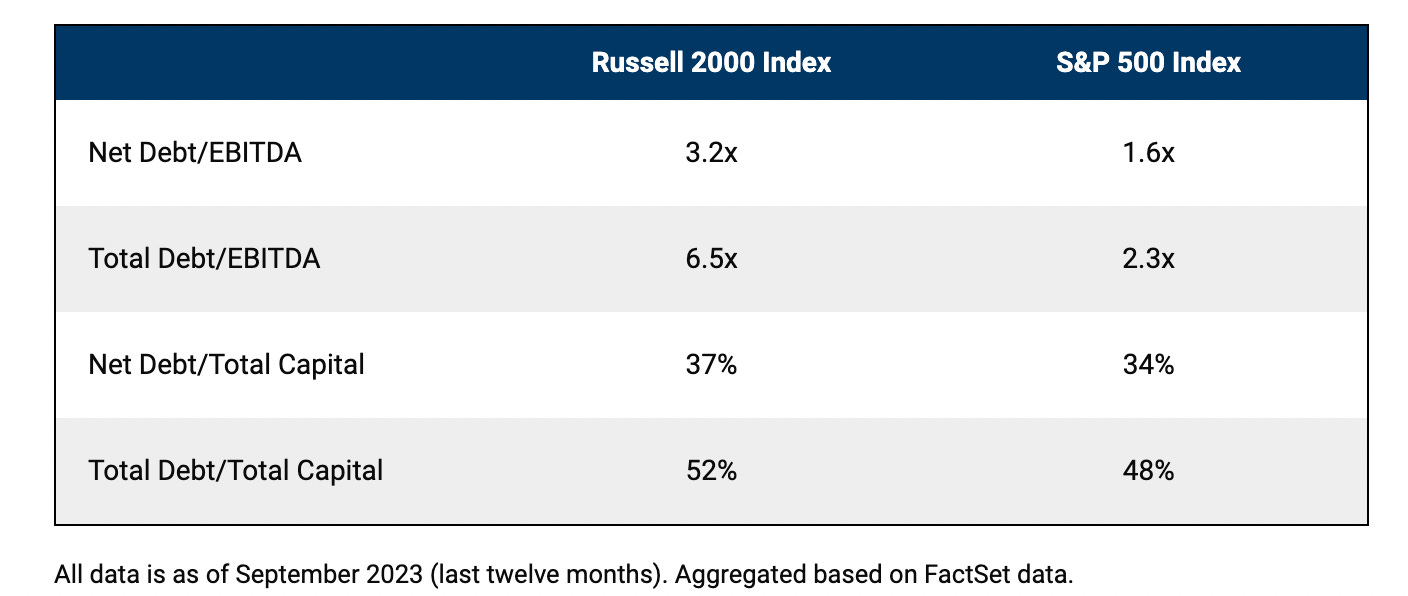

The Russell 2000 has been in a tight trading range since June 2022, failing to break out above strong overhead resistance at 200.

Small cap companies are more sensitive to higher interest rates due to their dependance on debt to fund their operations, over 40% of Russell 2000 companies lost money over the last 12 months.

If the market expects the Federal Reserve to cut interest rates in 2024, there could be further upside for the Russel as small cap companies carry a high percentage of floating rate debt.

Companies in the Russell 2000 are highly levered in comparison to larger companies in the S&P 500, so a rate cut would work wonders in helping keep debt servicing costs suppressed.

With Santa pushing stocks into new high territory, the indexes are now aggressively extended from their 200 day moving averages.

QQQ 0.00%↑ is trading nearly 15% above its 200 day, historical extension over 15% warrants a pull back to digest the move.

Many are calling for a double top across the board on the S&P 500, Dow Jones Industrial Average and NASDAQ.

With a pull back looming, who will be there to buy the digestion?

Record “Dry Powder” On The Sidelines

It’s not only stocks that are hitting fresh record highs, cash in money market funds seem to be smashing a new record every quarter - and for good reason.

Investors can now receive a 7-day yield over 5%, just by parking their cash in a liquid money market fund.

As the Federal Reserve began quantitative tightening - raising interest rates, investors began funneling money into money market funds to take advantage of a higher “risk free” rate of return.

According to FRED data, there is now a $6 Trillion pile of cash waiting to be deployed on the sidelines.

Notice the key timeframes where money market balances have declined.

Q4 2001 - Q2 2005

Q1 2009 - Q3 2010

Q2 2020 - Q4 2020

These dates correlate with sizable corrections in the stock market where investors were likely redeploying cash into the market.

Not only deploying into stocks, but investing into real estate, private equity and venture capital.

Who is going to buy the dip when we have a sizable correction?

I can think of roughly 6 Trillion answers to that question.

Leaders Are Out - Idea Generation

The first stocks and sectors out of the gate during a new bull market tend to be the leaders throughout the cycle.

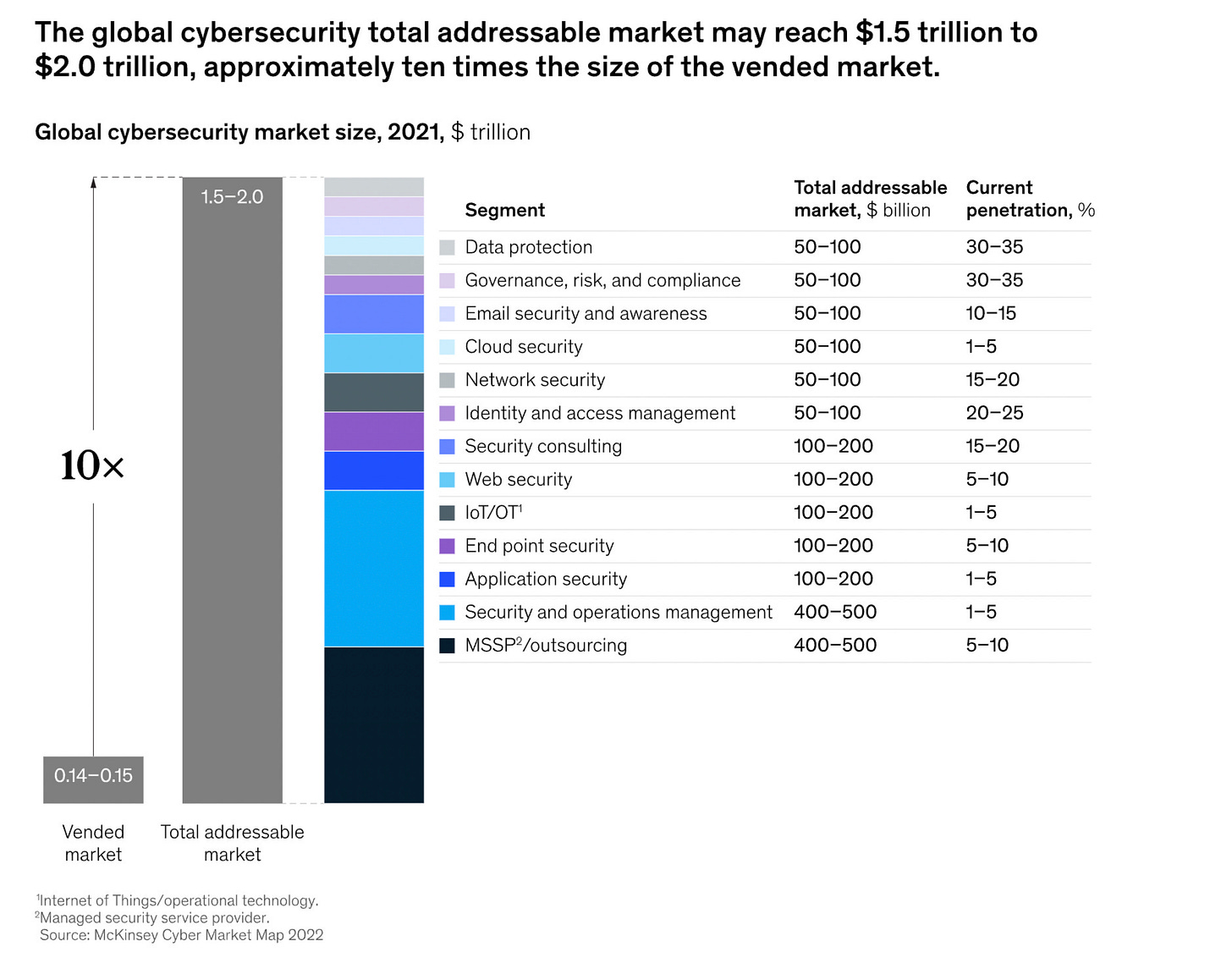

Our stand out thematic idea for 2024 is cybersecurity - particularly going into an election year.

We look for solid businesses in expanding TAMs with wide moats.

Palo Alto Networks PANW 0.00%↑ was the first stock in the group to break out to new highs - currently extended from its 200 day.

True Market Leader Characteristics:

EPS Rating 98

EPS Growth Rate 22%

Return on Equity 147%

6 consecutive quarters of 50% + EPS growth

+3% Institutional Sponsorship Quarterly Increase

CrowdStrike CRWD 0.00%↑ is the second leader in the group - also extended from its 200 day moving average after building out the right side of a deep cup base.

We expect CrowdStrike to digest over the winter and attempt a break into new highs on better than expected earnings.

Generally avoid stocks with significant overhead supply - we look for leading stocks with accelerating earnings and sales trading near 52 week and all time highs.

True Market Leader Characteristics:

EPS Rating 99

EPS Growth Rate 155%

Return on Equity 30%

6 consecutive quarters of 50% + EPS growth

+3.5% Institutional Sponsorship Quarterly Increase

The most powerful true market leaders that generated the highest returns for shareholders were companies that fundamentally changed the world.

We look for businesses solving big problems for as many people as possible.

Bond Market Rebound

After Federal Reserve Chairman Jerome Powell decided to hold the Fed Funds Rate unchanged at 5.25% - 5.50%, the market began pricing in rate cuts for 2024.

In just the last 60 days the yield on the U.S 10-YR has fallen from 5.021% to 3.889%.

Bond yields fall as bond prices climb.

The recent rally in the bond market has resulted in lower mortgage rates, boosting mortgage applications and providing some relief to the slow housing market.

Higher mortgage rates have resulted in significantly less transaction volume in 2023.

Bitcoin & BlackRock

Bitcoin has been building out the right side of a cup base since the November 2022 bottom.

We can see clear accumulation throughout the base with volume significantly higher on up days than down days.

BlackRock is eyeing a Spot Bitcoin ETF approval just before the halving in early 2024.

The SEC has continued to reject Spot Bitcoin ETF applications on the grounds they do meet its investor protection requirements.

Currently U.S. investors can only buy Bitcoin Futures ETFs

Halving events happen every 4 years or 210,000 blocks on Bitcoin blockchain.

Below is the full history of Bitcoin block rewards:

The current block reward is 6.25 BTC, the next block reward will be 3.125 BTC.

This lowers the rate at which Bitcoins are generated. The halving is periodical and is programmed into Bitcoin's code.

Each halving has been followed by a major move in the price of Bitcoin - lets review each one individually below.

First Bitcoin Halving - November 2012

The price of Bitcoin went from around $13 to $150 twelve months after the halving.

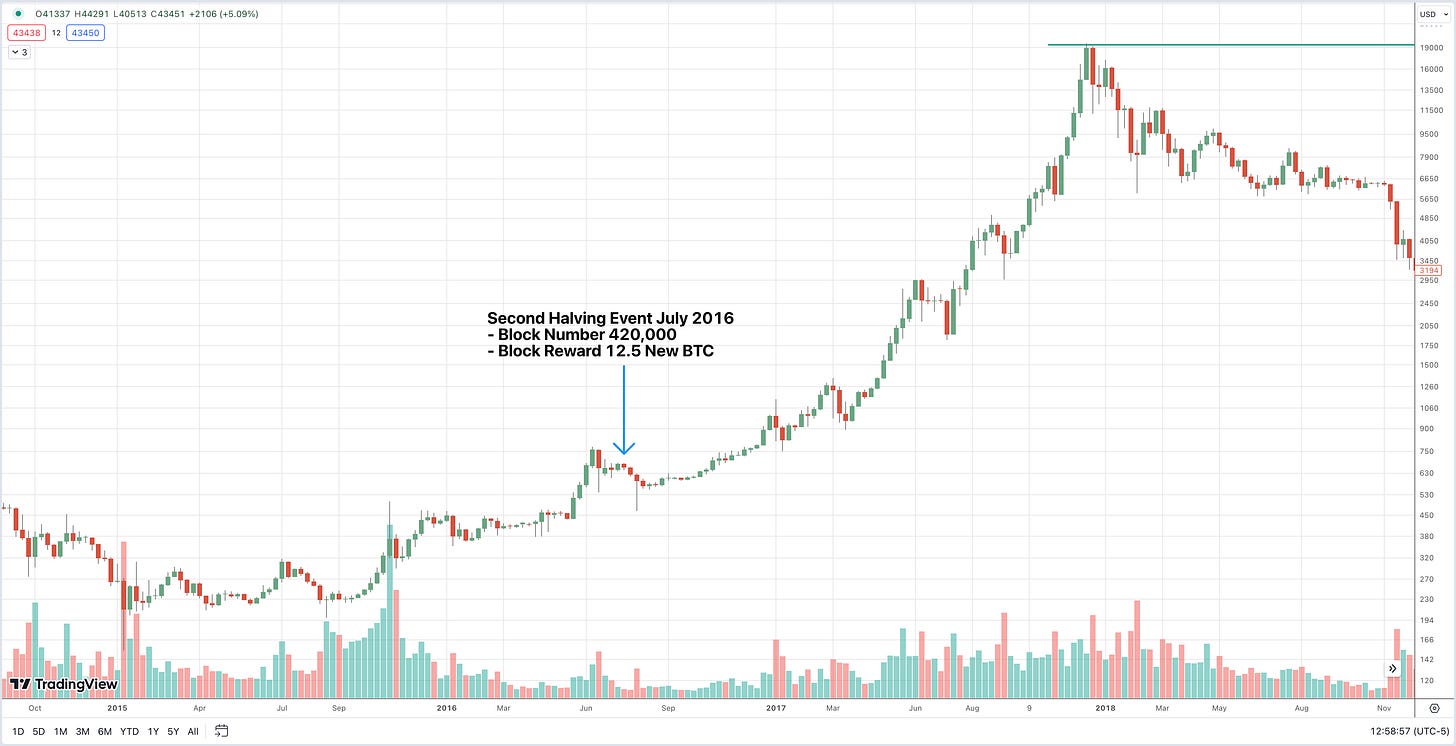

Second Bitcoin Halving - July 2016

The price of Bitcoin went from around $650 to $2,500 twelve months after the halving.

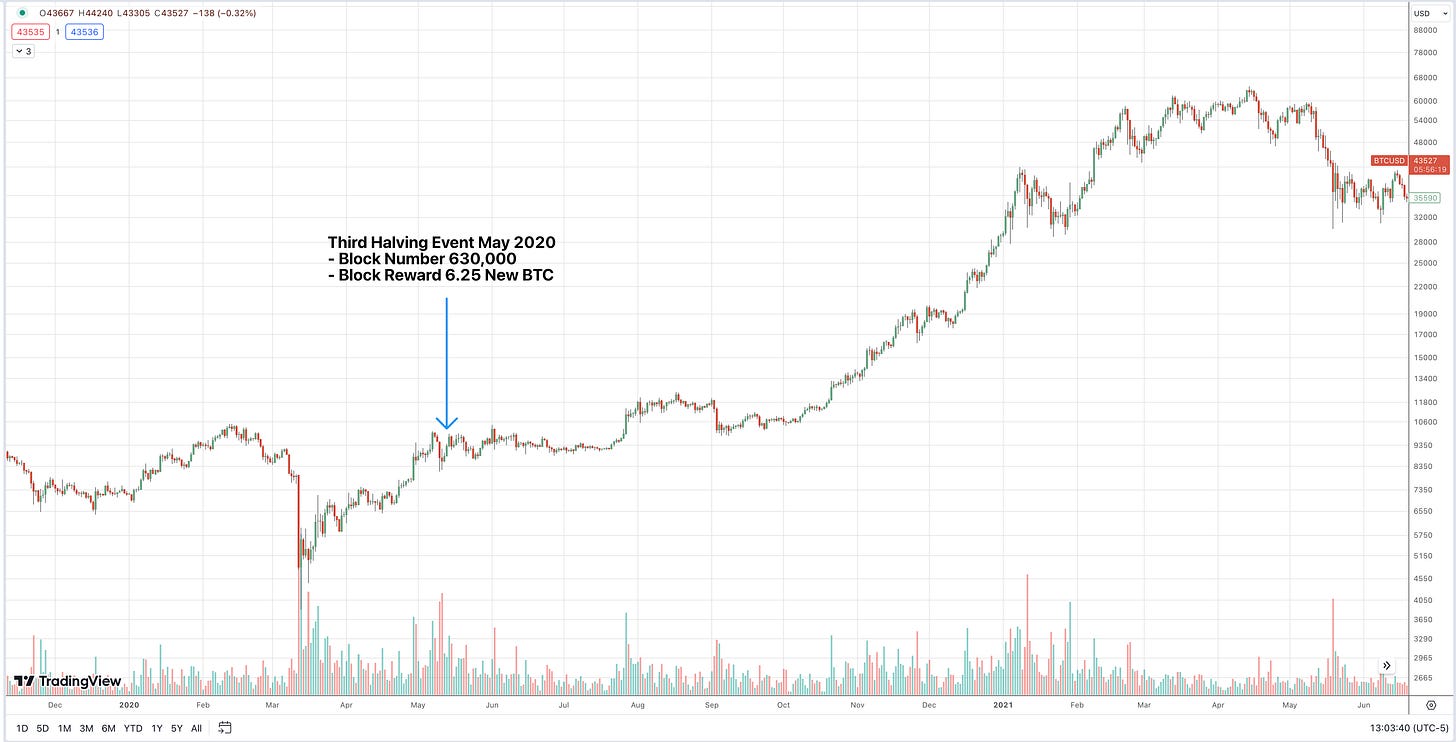

Third Bitcoin Halving - May 2020

The price of Bitcoin went from around $9,700 to $57,000 twelve months after the halving.

The theory is that once BlackRock gains approval for the first Bitcoin Spot ETF, the access will be opened up for the masses to gain exposure to Bitcoin.

It is our view that if you are going to add exposure to Bitcoin, you self custody with full control over your private keys.

The true value proposition of Bitcoin is that it is unconfiscatable money.

Generational Wealth - Compounding

The biggest mistake we see is when investors sell great businesses for small gains of 20% or 30% at the start of a new bull market.

OWN IT! Ron Baron's Keynote Speech at the 30th Annual Baron Investment Conference

Ron Baron is the the founder of Baron Capital, an investment management firm based in New York City with approximately $45 billion in assets under management.

Baron Capital manages the Baron Funds - one of the most successful growth stock mutual funds on Wall Street.

Rons philosophy is to identify great visionaries running incredible businesses that are changing the world - buy them and hold onto them.

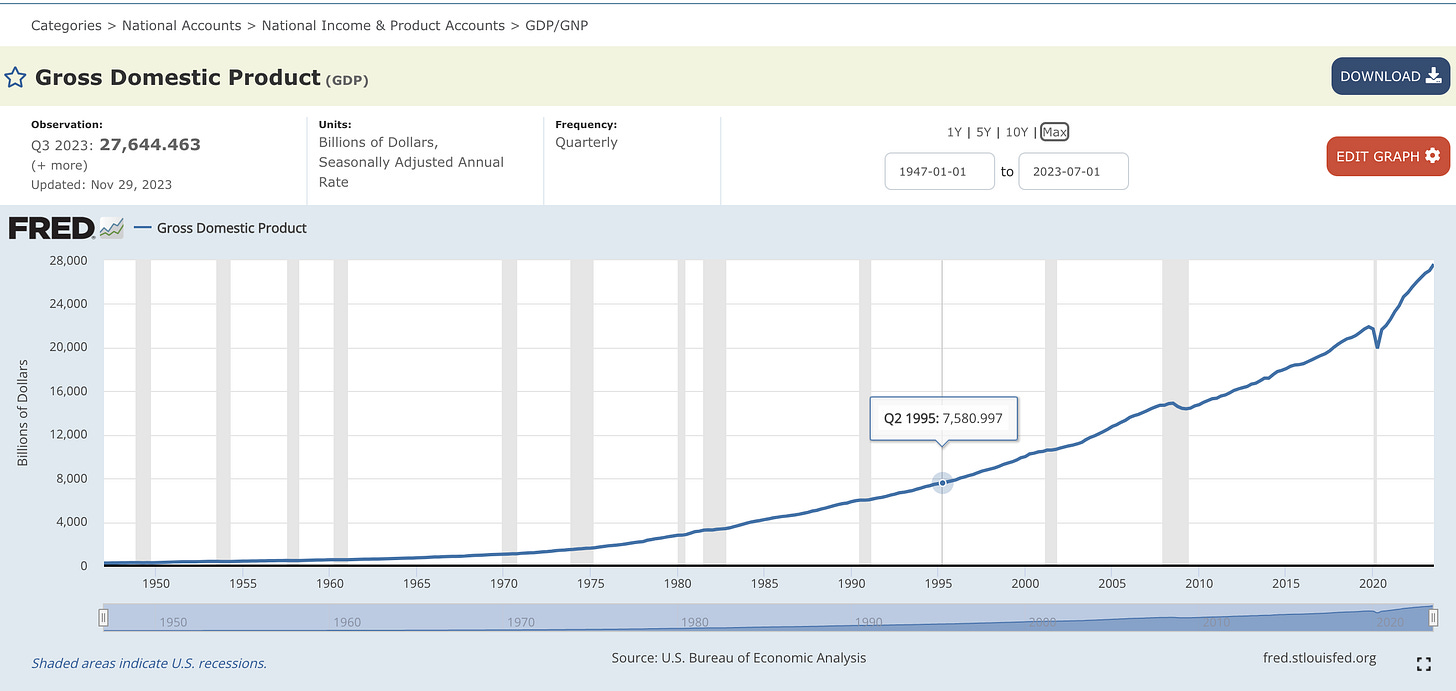

I was born in Q2 of 1995 - total U.S. GDP was just $7.5 Trillion.

Fast forward 28 years and total U.S. GDP sits at almost $28 Trillion - nearly quadrupled.

Stay relentlessly optimistic on the United States of America as it will continue to produce the worlds most lucrative opportunities in perpetuity.

Expand your time horizons and learn to see the bigger picture - double down on great businesses and own them.

The thunder money is made when you can sit long enough to ride a stock that matures from a mid cap to mega cap, and that takes time.

If you have a winning stock the best thing you can do is sit, similar to how the best Bourbons sit in the barrel for over 10 years.

New York City Real Estate - Featured Listing

Our newest Penthouse listing at 435 West 19th Street sits in the heart of Chelsea just steps away from The High Line and is on the market for $5,750,000.

This 3 Bed 3.5 Bath spans 1,901 SF with an additional 742 SF of exterior outdoor living space with views of the Empire State Building, Chrysler Building and Hudson Yards.

Listing Highlights:

Brazilian Luca De Luna Quartzite

German Miele Appliances

24/7 Attended Lobby

Fitness Center

If yourself, a family member or friend is interested in 435 West 19th Street PH2 email me: Thomas.Malloy@elliman.com

Video Correction: list price $5,750,000

Updates:

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.

Lastly, If You Enjoyed The Newsletter, Support My Work By Sharing It.

Good read, Tom. Thank you for your insights into the markets - it can be a jungle so this information is helpful. I appreciate you sharing your financial knowledge and nightly walks. I enjoy both immensely.

Tom,you are so skillful at taking a concept that may be complicated to some,and condensing it into easily digestible segments-I always said you have great 'presentation' skills!!! Hat's off to the last newsletter of 2023. Merry Christmas Tom!