Welcome To Earnings Season - Volatility Incoming!

Earnings Season kicks-Off with Major Banks.

Indexes Extended Into Earnings Season

The S&P 500, going into earnings season is 10% extended above the 50 day moving average.

Same story with the tech heavy NASDAQ 100 - extended 18% above its 50 day moving average.

Why does this matter and why should we pay close attention?

When major indexes achieve 8% - 10% extension above the 50 day, the likelihood of a broader pullback increases - especially during earnings season when volatility explodes.

If the major indexes are extended 8% - 10% above the 50 day - leading individual stocks (High Beta) that are market leaders could be twice as extended.

Beta represents how volatile one asset is compared to another.

Traders and portfolio managers will have a look at the overall beta of the individual stocks in their portfolio heading into earnings and hedge appropriately.

For example:

A beta greater than 1.0 indicates that a stock is more volatile than the market. If a stock's beta is 1.2, the stock is assumed to be 20% more volatile than the market.

A beta of -1.0 means that a stock is inversely correlated to the market benchmark on a 1:1 basis.

A beta less than 1.0 means the stock is less volatile than the market.

Read: What is Beta Weighting & Why You Should Use It

In conclusion: major equity indexes and leading stocks, particularly technology stocks, are extended heading into earnings season - trim or hedge going into the report.

Remember, if the S&P has an 8% pull back to the 50 day - many high beta tech stocks will probably correct by a factor of 2.

Financials XLF 0.00%↑

We have been quite bullish on the financial sector in 2024, particularly bulge bracket investment banks and boutique investment banks.

As discussed in prior issues of Behind The Street: HERE we believe 2024 is the year we start to see a significant uptick in deal flow on Wall Street.

Increased Mergers & Acquisitions

Increased IPO Activity

Pictured above is the SPDR Select Financial ETF XLF 0.00%↑ - punching through to a new all time record highs last week.

Goldman Sachs GS 0.00%↑ reported second quarter earnings on July 15, below are some notable highlights.

The firm ranked #1 in worldwide announced and completed mergers and acquisitions for the year-to-date.

On July 12, 2024, the Board of Directors of The Goldman Sachs Group, Inc. approved a 9% increase in the quarterly dividend to $3.00 per common share beginning in the third quarter of 2024.

Investment banking fees were $1.73 billion, 21% higher than the second quarter of 2023.

Goldman Sachs broke out to a new record high but pulled back amid a general market correction.

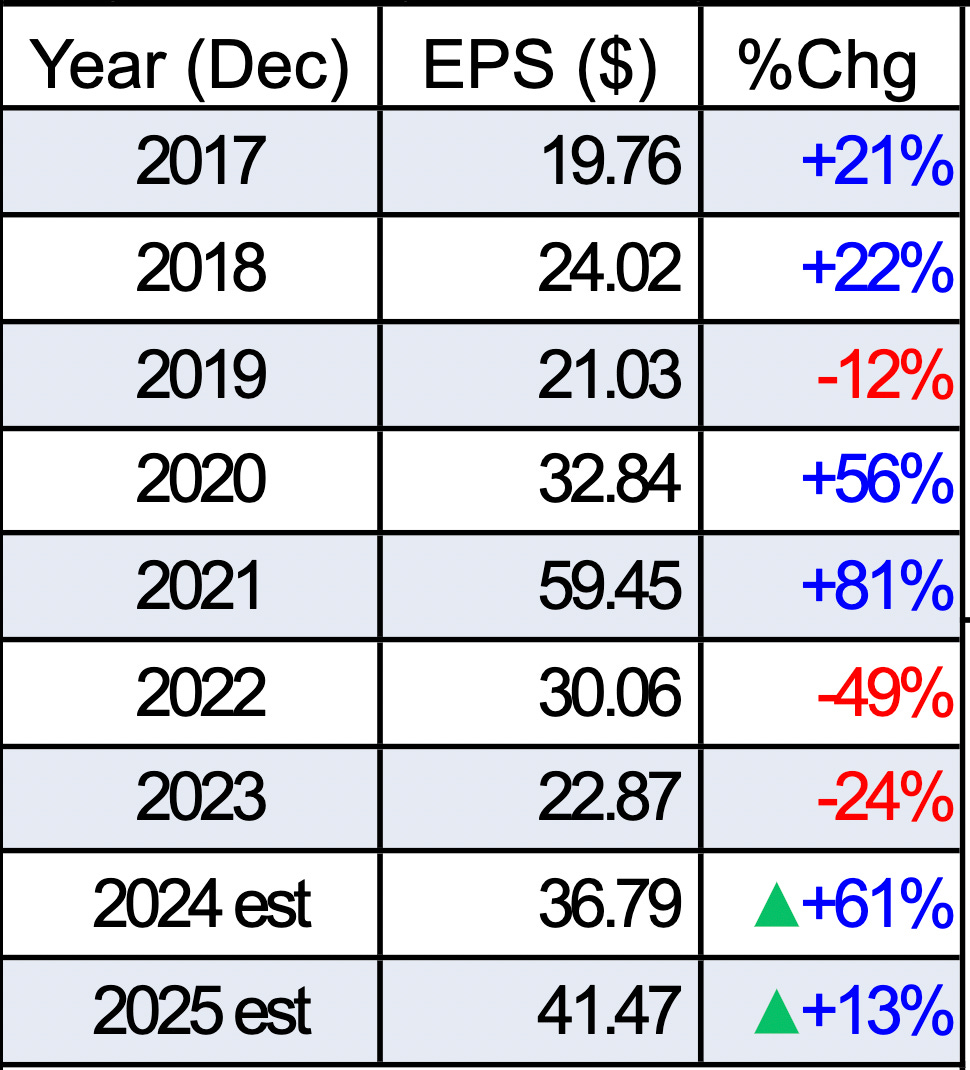

You can clearly see the earnings rebound from the 2022 / 2023 earnings decline - primarily due to the increase in Investment Banking activity.

JP Morgan JPM 0.00%↑ reported second quarter earnings on July 12, below are notable highlights.

#1 ranking for Global Investment Banking fees with 9.5% wallet share YTD

AUM of $3.7 trillion, up 15%

Investment Banking fees up 52% from Q2 2023

JP Morgan stock broke out to a new high but closed at the low of the day amid a general market pull back.

We talked about the major rebound in Investment Banking activity, thats a positive - but what about the negatives?

JP Morgan had a $3.05 billion provision for credit losses in the quarter, this is an indication that the bank believes more of its borrowers will default in the future, not a positive outlook.

The street was expecting $2.78 billion provision for credit losses.

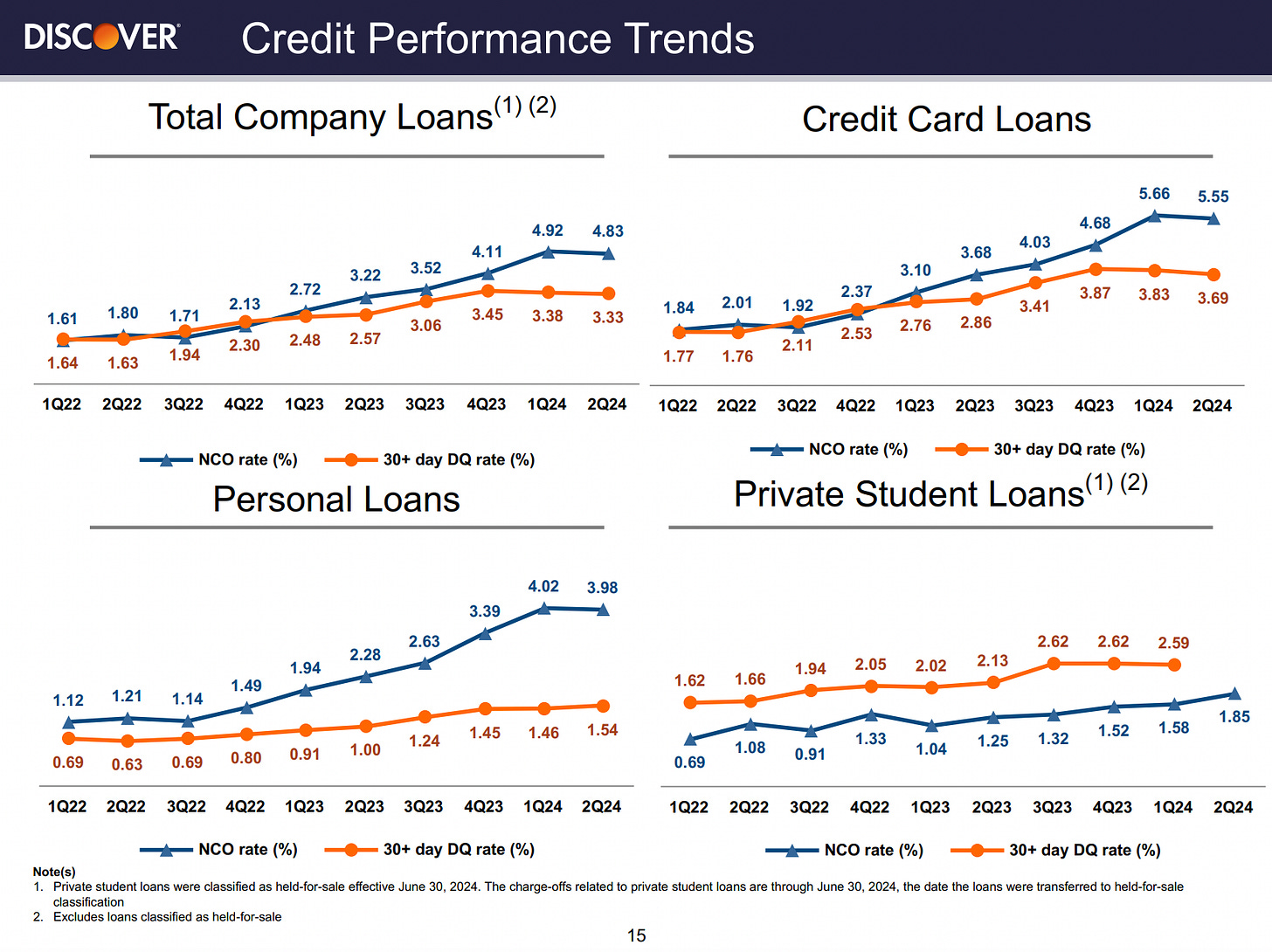

This is a trend to watch across all major credit card issuers - 30, 60, 90 day delinquency rate on cards.

Although still at historically low levels the trend is important to watch.

Discover Financial DFS 0.00%↑ a major credit card issuer reported earnings that beat Wall Street expectation on both the top and the bottom line.

EPS: $6.06

Net Income: $1.5 Billion

ROE: 40%

Pictured above is the 30 day delinquency trend for credit card loans at Discover Financial, up from 1.77% in Q1 2022 to 3.69% Q2 2024.

Although a significant increase - this is in line with a reversion back to pre pandemic trend and remains manageable.

In conclusion:

The financial sector remains extremely healthy in the U.S. with an increase in Investment Banking and M&A activity, but small signs are showing a weakened consumer.

We’ve Got The (Gold) Bug

In a prior issue of Behind The Street titled URGENT: Inflation Here To Stay? Gold Record High. we pointed to the once in a lifetime cup with handle base on gold.

Gold is up 28% since breaking out of a decade long cup with handle base, and we think the move is just getting started.

With extreme uncertainty and fear following the assassination attempt on President Donald Trump leading into the November Presidential elections - investor should continue to want safety and security.

In addition, both President Biden & President Trump are BIG Spenders - regardless of the election results you can guarantee larger deficits.

If Trump is elected, you can expect a weaker U.S. Dollar, also positive catalyst for Gold and Bitcoin.

Digital Gold (Bitcoin)

Bitcoin has been struggling to break out of a 980 day cup with handle base, the handle is now going on 140 days.

The 50 week moving average is curling up supporting price - this can be used as your line in the sand.

This is a great risk reward set up to go long over new highs of the handle.

Still Watching Netflix

We think the turn around story for NFLX 0.00%↑ is still very much in play and price action has been supporting out thesis.

Netflix stock is no stranger to a large correction in share price, so far, the stock has done a great job of working its way though much of its overhead supply - just shy of record highs.

A new position on a break out to new highs poses a great risk reward opportunity.

Earnings July 18:

Earnings per share: $4.88 vs $4.74

Revenue: $9.56 billion vs.9.53 billion

Net income: $2.15 billion up from $1.49 billion in Q2 2023

The above earnings block depicts a strong EPS rebound from the company’s 2022 mishap - it appears management is righting the ship as earnings are seen up 53% in 2024 and another 21% in 2025.

Highlights:

Advertising-supported memberships grew 34% during the second quarter compared to the year-earlier period.

Paid memberships rose 16.5% year over year to 278 million.

277.65 million global paid memberships

The two undisputed leaders in media are YouTube and Netflix in our view.

Lower Rates - Small Caps Benefit

Federal Reserve Chair Jerome Powell hinted at the possibility of rate cuts in September - markets are now pricing in the probability of 75 basis points worth of cuts by year end.

Watch Fed Chair Jerome Powell discussion with David Rubenstein, chairman of the Economic Club and co-founder of The Carlyle Group HERE

The Russell 2000 IWM 0.00%↑ quickly broke out of a flat base on heavy volume after the messaging from the Fed Chair.

Small caps tend to carry heavy debt burdens - as interest rates increase, debt servicing becomes increasingly difficult.

The possibility of lower interest rates will provide much needed relief for smaller companies with large amounts of debt outstanding.

Watch large commercial operators as well as regional banks with large exposure to CRE office debt - interest rate cuts will benefit these players as well.

$2.2 trillion in commercial debt is set to mature before 2028, and much of that will have to be refinanced at higher rates if the Federal Reserve holds it’s Fed Funds rate steady at 5.25% - 5.50%.

Video Coming Soon

Coming soon! Behind The Street will be publishing market update videos every other day and a market outlook video on Sundays.

Stay tuned for an official launch date, we will upload on YouTube.

Thank You

A big THANK YOU to all of our clients! Without your support we wouldn’t have been able to secure #1 Medium Team - Transactions.

Updates

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.

Great work again Tom. Enjoyed the newsletter!

Hello Tom, just received your newsletter. 7:33 pm