iShares Russell 2000 ETF - IWM 0.00%↑

Bases are developing all over the market across a broad range of sectors, casting a temporary shadow over the magnificent 7 heavy weights.

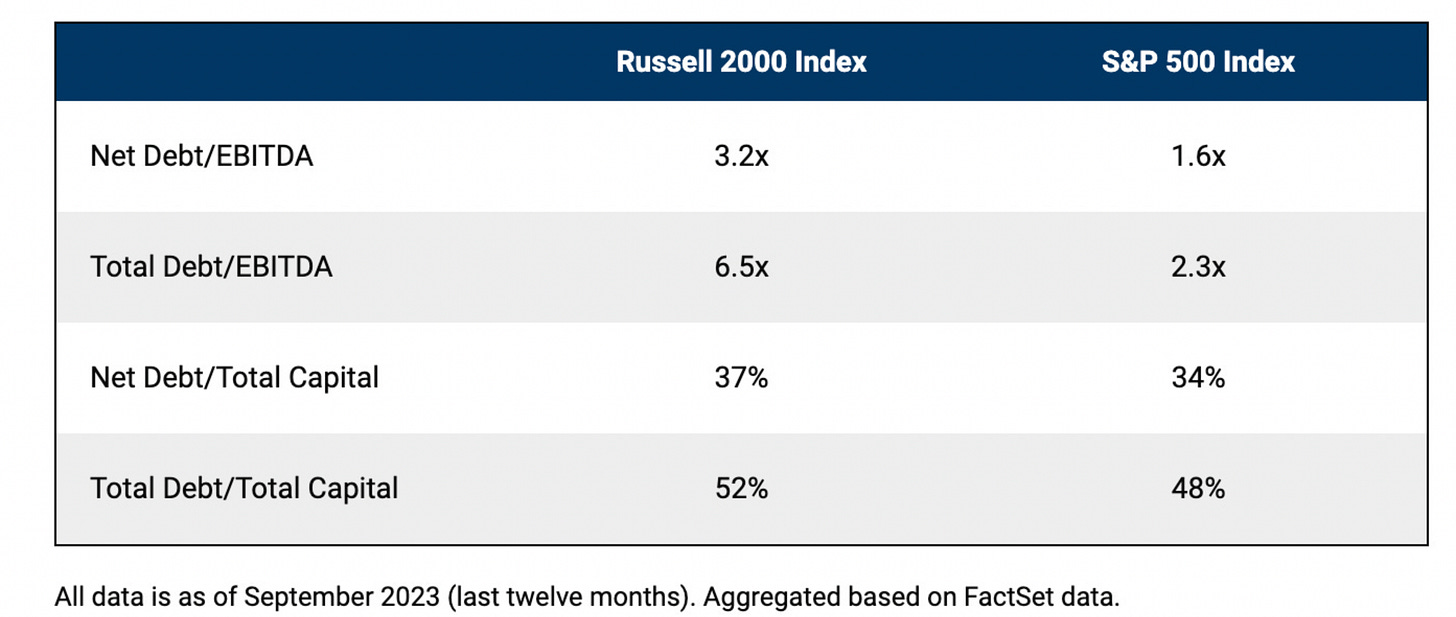

Small caps have been range bound between $163 and $200 for over 2 years, struggling to find its footing as the S&P 500 and Dow Jones Industrial Average notch record highs almost weekly since the start of 2024.

It is likely we see a test of the November 2021 record high on the Russell 2000 by the end of the year.

Wall Street is expecting at least three rate cuts by the end of 2024 - making small cap stocks more attractive to investors.

Small cap companies are more sensitive to higher interest rates due to their dependance on debt to fund operations, over 40% of Russell 2000 companies lost money over the last 12 months - lower rates would provide much needed relief.

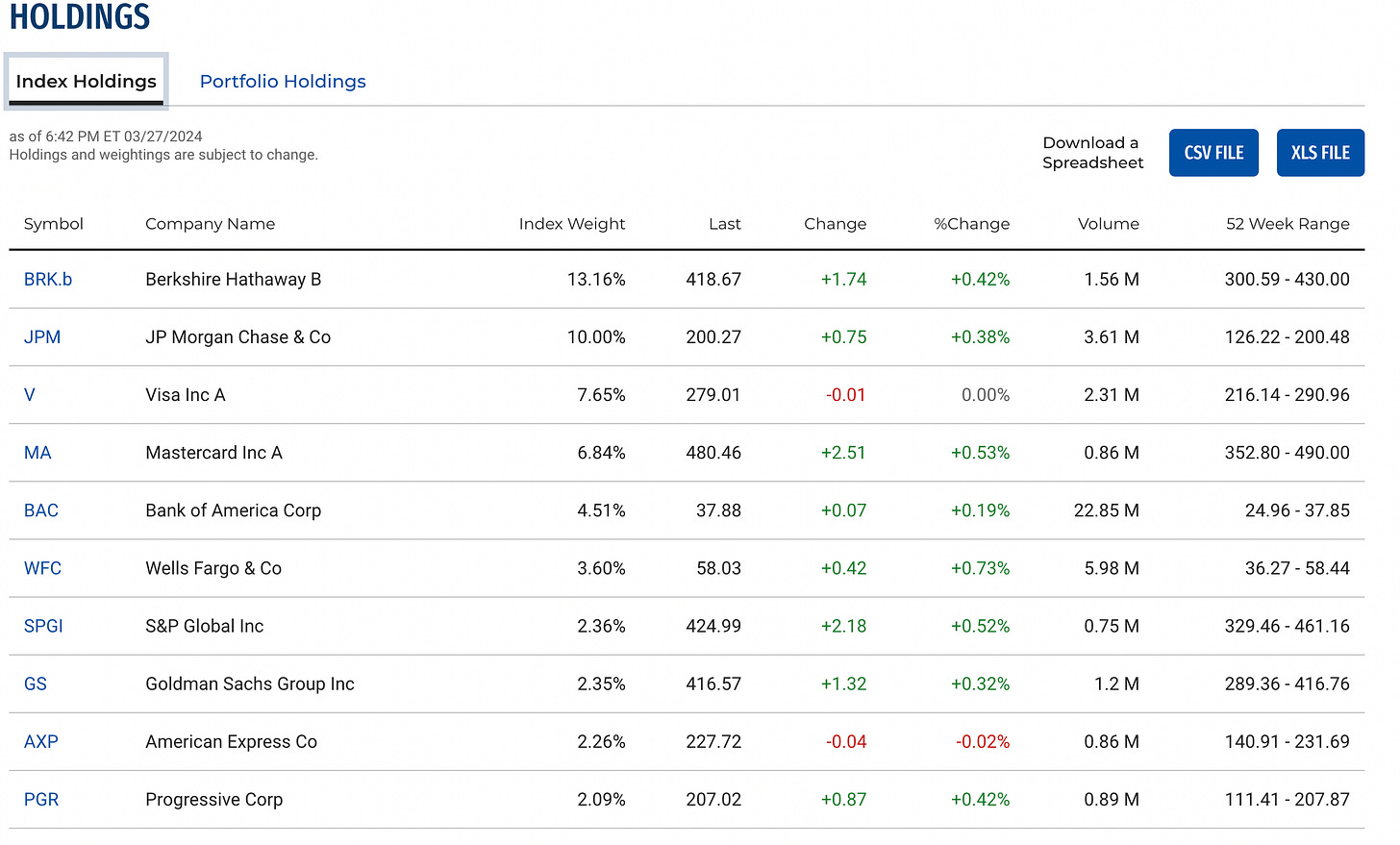

SPDR Select Sector Fund - Financials XLF 0.00%↑

The financial sector is rocking, testing a break out into new high territory after building out over a year long base through 2022 - 2023.

This is actionable into new highs.

Earnings suffered across the board through most of 2022 in the banking and financial sector - but has since seen a sharp uptick in earnings and positive outlook for 2025.

JP Morgan Chase JPM 0.00%↑ is the second largest holding behind Berkshire Hathaway in the XLF 0.00%↑ .

JP Morgan Chase just took out its previous record high, rallying into earnings on April 12.

It is good news for the general market to see outperformance in the financial sector as we can infer that the U.S. economy is strong.

Remember, stocks are forward looking by six months - Investment Banks both bulge bracket and boutique are trading at or near 52 - week highs and many into new record highs.

Evercore EVR 0.00%↑

Houlihan Lokey HLI 0.00%↑

Citigroup C 0.00%↑

Bank of America BAC 0.00%↑

Wells Fargo WFC 0.00%↑

Morgan Stanley MS 0.00%↑

Retail and consumer banks look great with the only sore spot being the regional banking sector.

Goldman Sachs GS 0.00%↑ is breaking out from a tight handle - testing new highs.

Notice the earnings block on the left and try to draw a correlation to price action in the stock.

Goldman Sachs had a lights out year in 2021 with full year EPS of $59.34 due to record IPO and M&A activity.

The tightening cycle by the Federal Reserve brought the IPO and M&A market to a complete stand still - no deals no earnings for Wall Street’s largest players.

The good news is that earnings are expected to rebound through 2024 - 2025 due to a pick up in deal making on the street, resulting in a turn around for the stock.

SPDR Select Sector Fund - Energy XLE 0.00%↑

Energy is primed and ready to go as the XLE 0.00%↑ is looking to break out of a two year handle over $94.66.

The above chart shows all price action since inception - late 1990’s. A break out above $94.66 could send the energy sector etf to $120 - a new record high.

Both technicals and fundamentals paint a bullish picture for the XLE.

Crude Oil is slowly creeping up again after a multi year bear market, the summer travel season particularly in the United States looks as robust as it’s ever been.

The top of crude oil’s trading range is $94, should price work its way towards that target over the summer - oil stocks will surly print record highs across the board - lifting the XLE to our $120 target.

ConocoPhillips COP 0.00%↑ is the third largest holding in the XLE 0.00%↑ with a total weight of 9%.

The stock is emerging out of a deep cup with handle base towards record highs and trading above all major moving averages.

Diamondback Energy FANG 0.00%↑ is just emerging from a similar patter - breaking out into new record high territory.

Full year 2025 EPS is seen up 10% to $19.87 - potentially on the low side if crude oil gains more than expected, right now the market is showing us where the leaders are.

Look for stocks with strong earnings and sale growth trading at 52 - week highs or into new record highs - many energy / oil names meet this criteria.

Gold - It’s Officially Go Time

If you’ve been a subscriber to Behind The Street for the past year - you’ve been well aware to one of the most perfect sets ups in the market - Gold.

Gold has officially completed a strong break out from a perfect 12 year long cup and handle pattern.

The flight to safe haven assets leads us to believe the market shows little confidence of inflation returning to the Federal Reserves 2% target by the end of the year.

Inflation is likely to remain elevated around 3% for some time - especially after recent news of a new $1.3 Trillion spending bill.

U.S. Housing Market

Home Builder stocks are still acting extremely well - trading at 52 - week and new all time record highs. Pictured below is the SPDR S&P Homebuilders ETF XHB 0.00%↑

This week brought about New Home Sales data that showed new home sales falling 0.3% in February but up 5.9% year-on-year.

There were 463,000 new homes on the market at the end of February up from 457,000 in January.

More supply coming on the market should continue to cool prices and help consumers achieve the goal of home ownership at a time when interest rates on a 30YR Fixed stands at 7%.

NOTE: The median new house price in February was $400,500, the lowest since June 2021 and down 7.6% from a year ago - this is great news.

Home builders / new developers have more tools at their disposal to get deals done such as rate incentives, buy-downs and paying for closing costs.

These incentives do not exist for the most part in resales - and in an elevated interest rate environment where consumers are forced to deal with higher payments - they need all they help they can get to close the deal.

The market is telling us that most of the supply is going to need to come from the home builders.

People are reluctant to list their existing homes on the market as many home owners are sitting on record low rates under 4%.

With home prices coming down this will certainly help bring inflation down to the Federal Reserves 2% target over time.

Shelter accounts for a large portion of overall CPI - but shelter is also the slowest category to react to a higher interest rate environment.

Why? Liquidity.

The more liquid the asset class - the faster it reprices to adjust to a higher rate environment.

Taylor Morrison Home TMHC 0.00%↑ is leading into new high ground along with Pulte Group PHM 0.00%↑ and Toll Brothers TOL 0.00%↑

These three stocks are your liquid leaders in the home building sector.

The Return Of The Dead! IPOs

The Renaissance IPO ETF IPO 0.00%↑ is making a comeback after an absolutely brutal bear market - down 70% from its 2021 peak to 2023 trough.

We have covered this many times on previous issues of Behind The Street - quantitative tightening brought about a total shut down for the IPO market and sent valuations of newly public companies into a tail spin.

After a brutal two year bear market and many investors confident that the tightening cycle has reached its conclusion - the IPO pipeline looks robust and deals are getting done.

This can also be seen in the favorable price action in financial stocks ( talked about above )

Now is the time to study the work of Richard Wyckoff.

A few recent issues from 2021 are starting to come back to life as earnings and sales rebound - HOOD 0.00%↑ and COIN 0.00%↑

Robinhood Markets is emerging out of a stage 1 base as earnings and sales increase - the price action on the right side of the base is met with increasing volume, a sign of institutional accumulation.

Coinbase is showing similar action, making its way through overhead supply as it builds out the right side of an IPO cup base.

Earnings and sales are increasing steadily helped by the recent approval of the new Spot Bitcoin ETFs and the broader rally in Bitcoin.

$6 Trillion On The Sidelines

Everyone is either call for or waiting for a crash in both stocks and real estate with many claiming they will be there to buy and pick up the pieces.

The problem is - everyone is thinking the same and we have a record number of cash on the sidelines just sitting in money market funds to the tune of $6.3 trillion.

Important to note that all that money is compounding out at around 5% now that real rates are positive - but what will happen to those funds assuming the fed cuts rates three times this year?

In our view, that money will once again be forced to chase yield - coming off the sidelines to be put to work in the market.

Looking For Trends

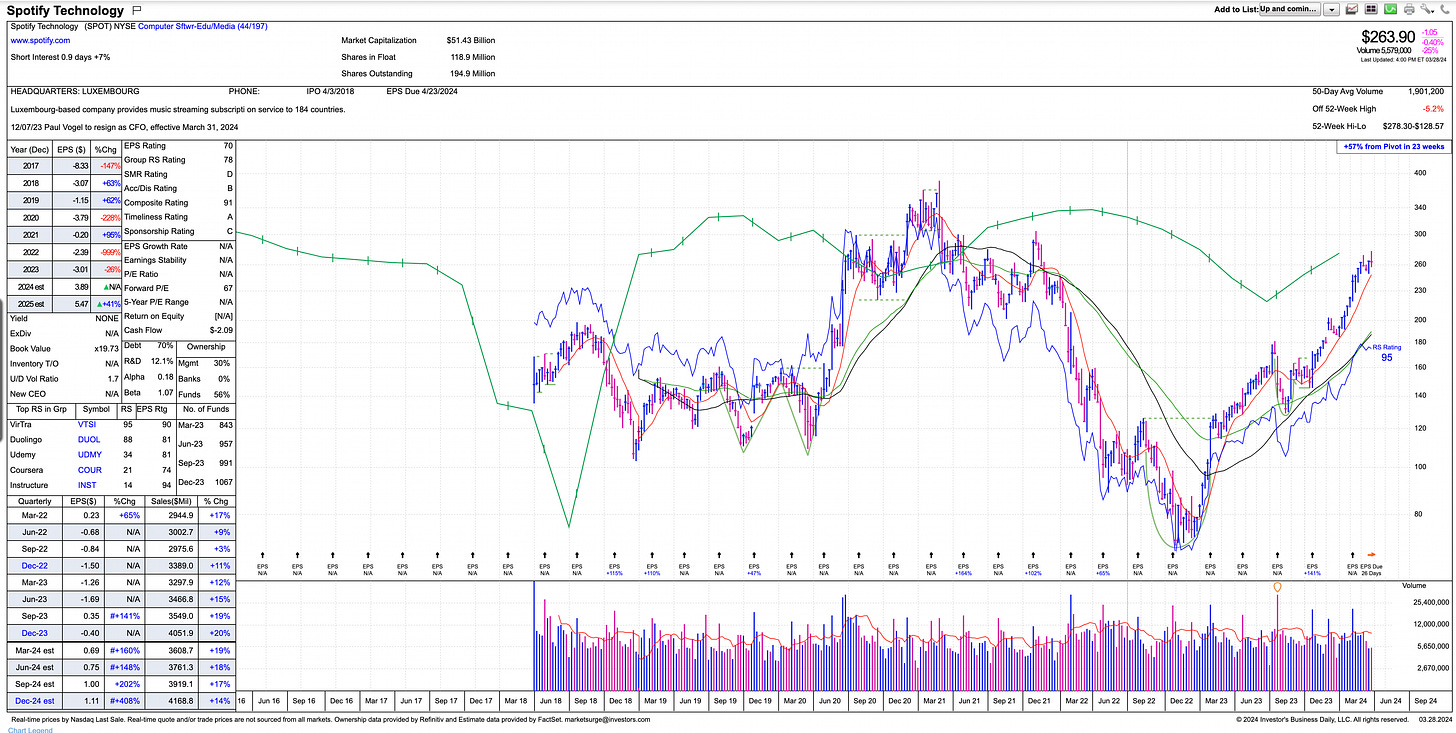

Legacy media is dying and that is reflected not only by declining TV ratings but by the appreciation in the share price of SPOT 0.00%↑

There is no doubt that the future of content and media is streaming, follow the trend and follow the money - adapt or die.

Earnings are starting to accelerate for Spotify as the stock approaches a new high - 2025 EPS estimates are $5.47 up 41%.

Famous podcaster Joe Rogan brings in roughly 11 million listeners per episode compared to CNN’s Primetime Anchor Anderson Cooper pulling around 238,000.

Advertisers seek out the eye balls - follow the money.

Platforms such as YouTube and Twitch are set to benefit from this shift.

Twitch is owned by AMZN 0.00%↑ , YouTube owned by GOOGL 0.00%↑

NYC Real Estate Update/Featured Listing

Check out our 3 Bed 3.5 Bath listing at 5 Franklin Place in Tribeca.

List Price: $3,495,000

Features:

Swimming Pool

Gym

Children’s Play Room

Parking in Building

Updates

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.

Very helpful - thank you Tom

Some times you are so full of yourself. I can remember a woman asking you if gold is a good investment back around January or February of 2024 on one of your Walks and Wall Street streams on you tube. You told her that you didn't think that buying gold was a good idea. How did that answer to her turn out?

Myself, I'm 76 and have been buying gold coins and now ETF's. I think any younger person and in fact anyone should at least have a 10% gold portfolio. I was taught that to me by my very smart father, probably the most important thing he ever taught me.

The dollar is done. Forget your optimism. Something will replace it and it won't be bitcoin. One ounce of gold will purchase exactly what it did in 1971, will the dollar. The dollar is down about 88% since then.

Still love Walks and Wall Street. Don't watch it as much, usually when your in Miami.

Remember, some times the charts you are using are fake numbers, but "Humane Nature" is never wrong .P.S. Inflation will never see a steady 2% again.

Keep up the good work.

Hollywoodbob