IT'S A GLOBAL LIQUIDITY PARTY!

Pan Gongsheng, Governor of the PBOC: "To (QE) Infinity and Beyond"

People's Bank of China - Going All Out

In an effort to meet China’s 5% economic growth target for 2024 the PBOC announced new measures to revitalize a slowing economy.

These are unprecedented programs that will provide economic stimulus equivalent to the pandemic rescue packages of 2020.

This QE Bazooka comes at a time when the Hang Seng Index is trading near 52 week lows, and China’s big tech stocks are trading with single digit PE multiples with double digit growth rates.

Will new found QE be the match that lights a fire under a new bull market in Chinese stocks?

PBOC Stimulus Breakdown

Cut benchmark interest rate to 1.5% from 1.7%

Lower cash reserve requirement for banks by 0.5%

Cut interest rates on existing mortgages by 0.5% (Yes, existing mortgages!)

Lower down payments on second homes from 25% to 15%

New Swap facilities to buy stocks (Encouraging stock buybacks!)

It is likely Chinese stocks have found a bottom for the cycle - we can expect outperformance from China’s tech giants BABA 0.00%↑ BIDU 0.00%↑ & $TCEHY.

A word of caution: If you can’t stomach the risk of investing in China - look to other Asian markets that embrace Capitalism as they will also benefit from PBOC easing.

In our view, the fresh round of quantitative easing by the PBOC will not only benefit Chinese stocks - but provide a boost to all of Asia and increase global liquidity.

We are particularly optimistic on India, Japan, Singapore, and Korea.

Singapore & Japan - The Breakout?

In prior issues of Behind The Street we have identified established, symmetrical and near perfect decade long bases in Gold, Bitcoin and U.S. Stocks.

Read our Gold Bull Thesis: Here

We may have identified yet another opportunity.

Fundamentals must be in corroboration with technicals - pictured above is a monthly chart of the Straits Times Index, the benchmark index for the stock market in Singapore.

The Straits Times Index has failed to break out over its 2007 high of 3,900, building a flat base for over 16 years - now just 300 points away from a new record high.

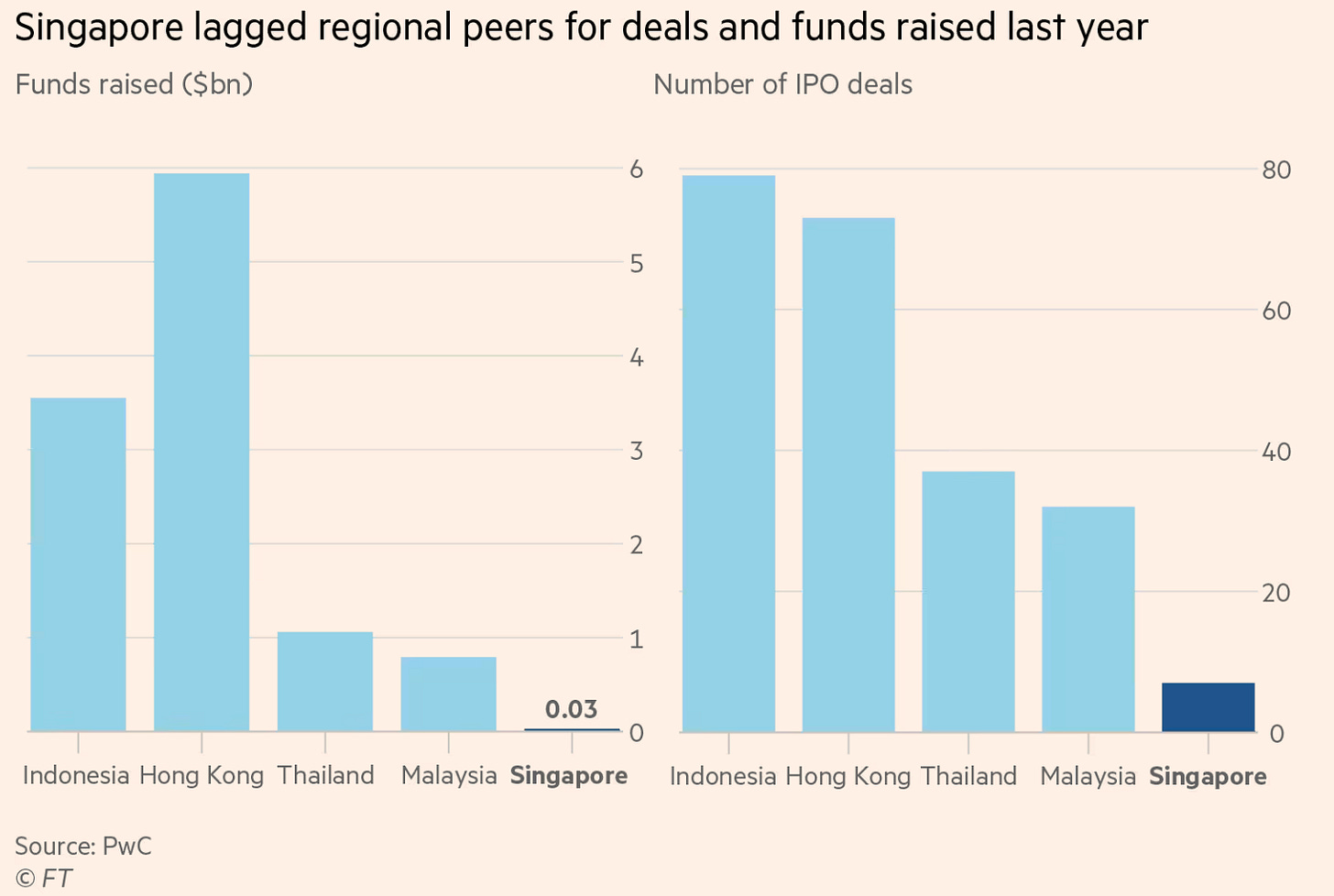

Read Here: Financial Times

If Singapore is one of the worlds most sought after financial hubs, why is this not being reflected in the stock market?

According to CNBC: Singapore’s economy is larger than Hong Kong’s, but the total value of listed companies on the Singapore Exchange is about 7 times smaller.

Singapore suffers from a lack of liquidity, thin trading volumes, poor disclosure practices and more delistings than listings over the past few years.

To address these problems the Singapore government is reviewing regulations, making efforts to increase liquidity and cut listing costs in hopes to attract new listings and boost trading activity.

This comes at a time when central banks globally are cutting interest rates, boosting global liquidity.

It is also important to note that Singapore has a high concentration of REITS (Real Estate Investment Trusts) that tend to perform better in lower interest rate environments.

As fundamental and technical factors align - Singapore is worth a watch.

Pictured above is the multi-decade long base in Japan’s Nikkei 225 index - currently forming a handle on a cup base.

We expect continued performance from Japan.

Lastly, India’s NIFTY 50 index continues to be a powerhouse in South Asia and will most certainly catch the tail winds of quantitative easing in China.

For a well balanced portfolio - it would be wise to get at least some exposure to Asia or risk manage in high quality Chinese tech stocks trading at record low PE multiples.

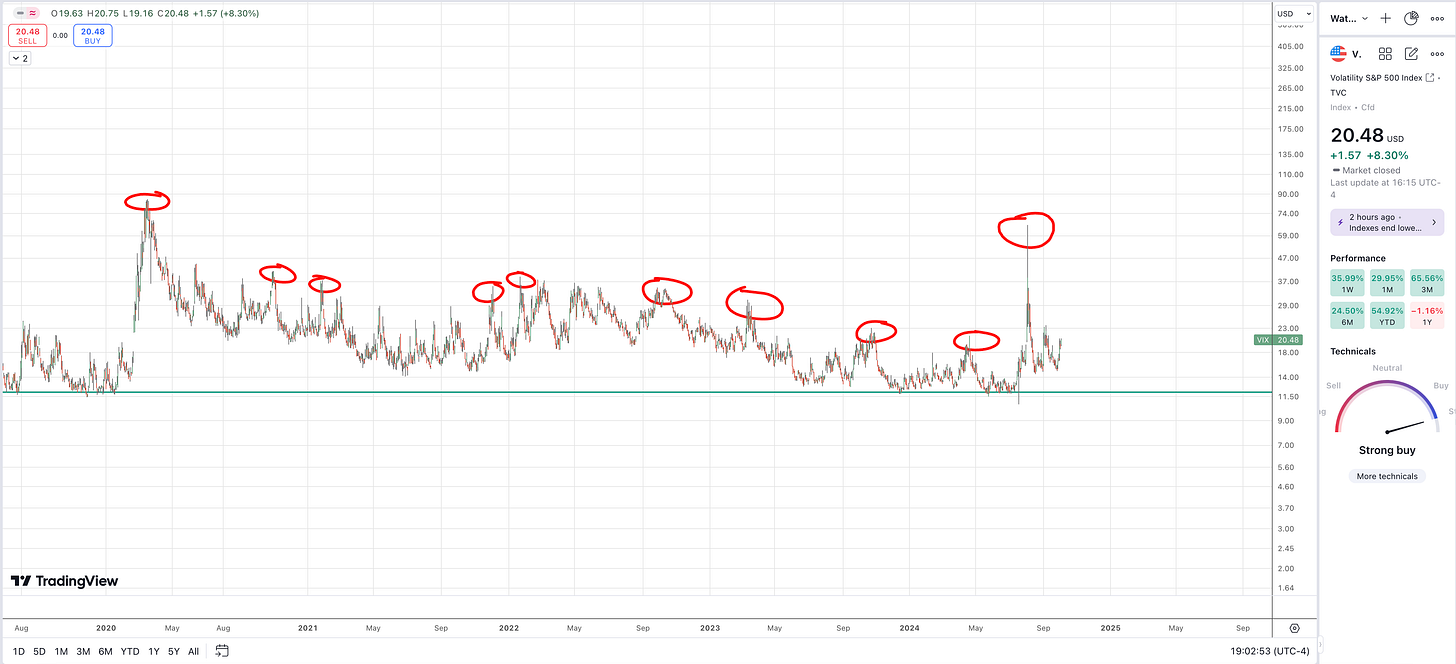

Pre Election Volatility - Prepare!

32 days - thats how long we have until we elect the next President of The United States.

The run up into the election usually is met with increased volatility with a ‘return to normal’ post election.

According to the above post by Marlin Capital on X , the brunt of the move in volatility happens between October 2 and November 5, election day.

With the way the media is turbo charging this election with reckless lies and rhetoric aimed at both sides - expect outsized volatility during this cycle with a blow off in the vix.

“Trump will be a dictator on day one and eliminate democracy”

“Comrade Kamala will be the end to Capitalism as we know it”

The examples (propaganda) above have been continuously pushed on the American public for the past several month - causing extreme fear and anxiety.

We expect a short term irrational volatility event based on the result of the election, however, if we do indeed get this sell off, in our view - it is a massive buying opportunity.

Remember: Fear and uncertainty leads to volatility which creates mispricing and mispricing presents savvy investors with opportunity.

The U.S. Economy is strong and will continue to perform regardless of the election result - expect increased spending and ballooning deficits under either administration.

A Bullish Outlook

You may not have heard, but U.S. GDP was revised upward for the last quarter to a solid 3% annual rate.

Keep in mind this was before the Federal Reserve cut interest rates by 50 basis points - we are likely to see Fed easing hit the economy over the next six months.

Fed chair Jerome Powell is cutting rates and reverting back to quantitative easing as the US economy is still strong.

In addition, U.S. corporate profits hit an all time record high in the second quarter under a more restrictive Federal Reserve.

Margins and profits tend to expand when the Fed starts to ease.

Looking forward, the market is assigning a high probability that the Fed Funds rate will fall further to 3.25% - 3.50% by the end of Q1 2025.

In other words, we are headed for an even more accommodative monetary environment in 2025.

When the Federal Reserve started their hiking cycle they also began to restrict liquidity by shrinking the size of their balance sheet shown above.

Assuming we see a change in direction from the Fed, we can expect an even more accommodative environment - resulting in a bullish set up for U.S. equities and other assets.

We have a strong economy, a healthy consumer, cooling inflation, more fiscal stimulus on the way and an accommodative monetary environment.

View the Fed Balance Sheet Here.

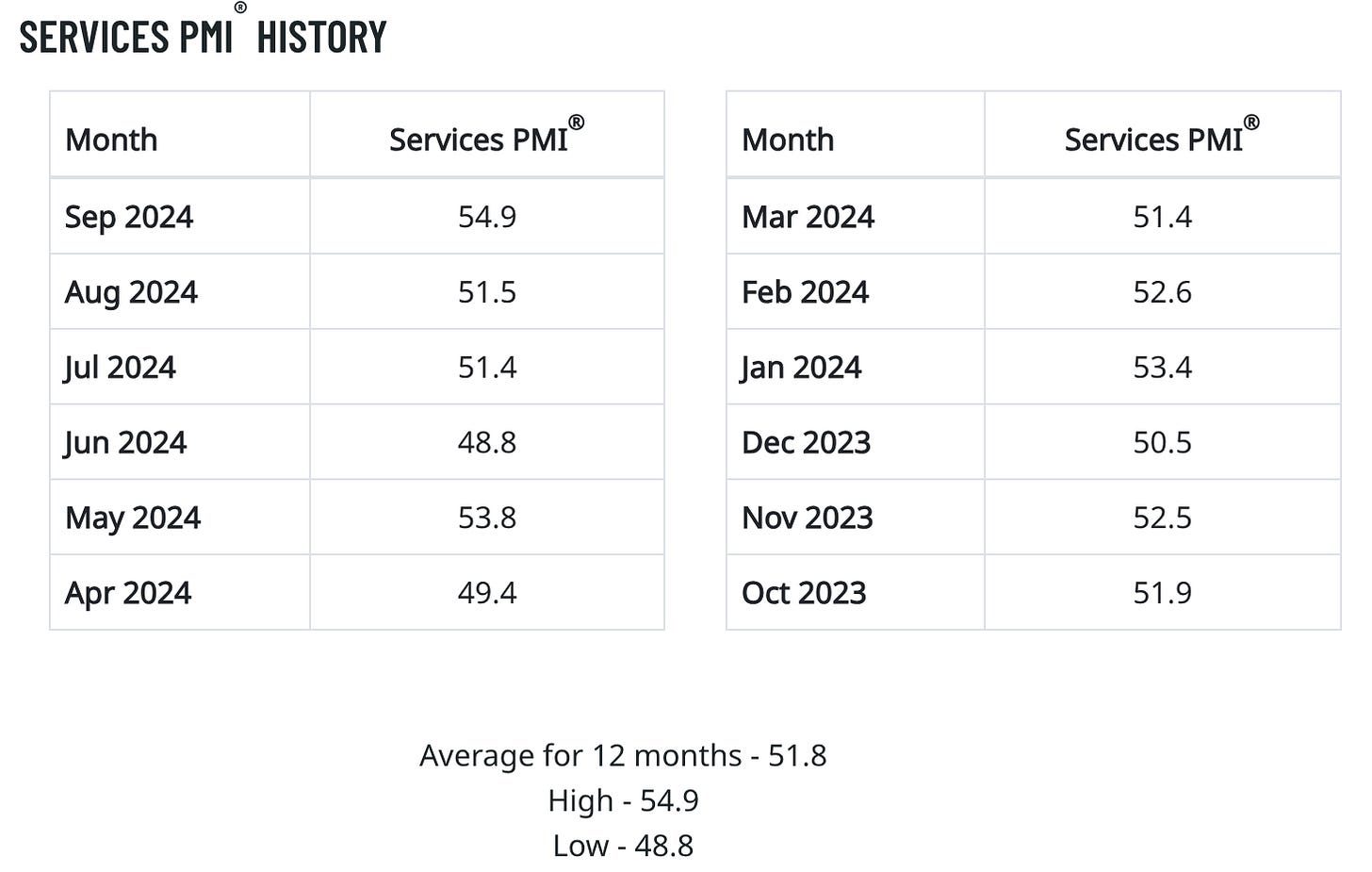

ISM Services PMI Upbeat

Economic activity in the services sector expanded for the third consecutive month in September with the Services PMI® coming in at 54.9%.

The September Services PMI recorded the highest reading in the last 12 months - showing significant strength in the service sector.

We expect even stronger readings as the election uncertainty dissipates and we move into the holiday season.

It is important that we pay close attention to key leading economic indicators in order to maintain our edge.

Read September 2024 Services ISM® Report On Business®

We will cover individual stocks and sectors in the next issue of Behind The Street.

5 Beekman Street Penthouse

Take a look at our newest listing at 5 Beekman Street PH 51.

Listing Information: 5 Beekman Street #PH51 3 Bed 3.5 Bath 3,554SF

Updates

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.

Thanks for reading Behind The Street ! Subscribe for free to receive new posts and support my work.