Market Performance Review

The S&P 500 returned 24.2% for investors in 2023 and is currently on pace for yet another 20%+ gain in 2024.

Will recent rate cuts throw fuel on the markets fire or fan out the flames? Let’s dive in and find out.

The Federal Reserve cut interest rates by 50 basis points on September 18 bringing the Fed Funds rate to 4-3/4 - 5 percent.

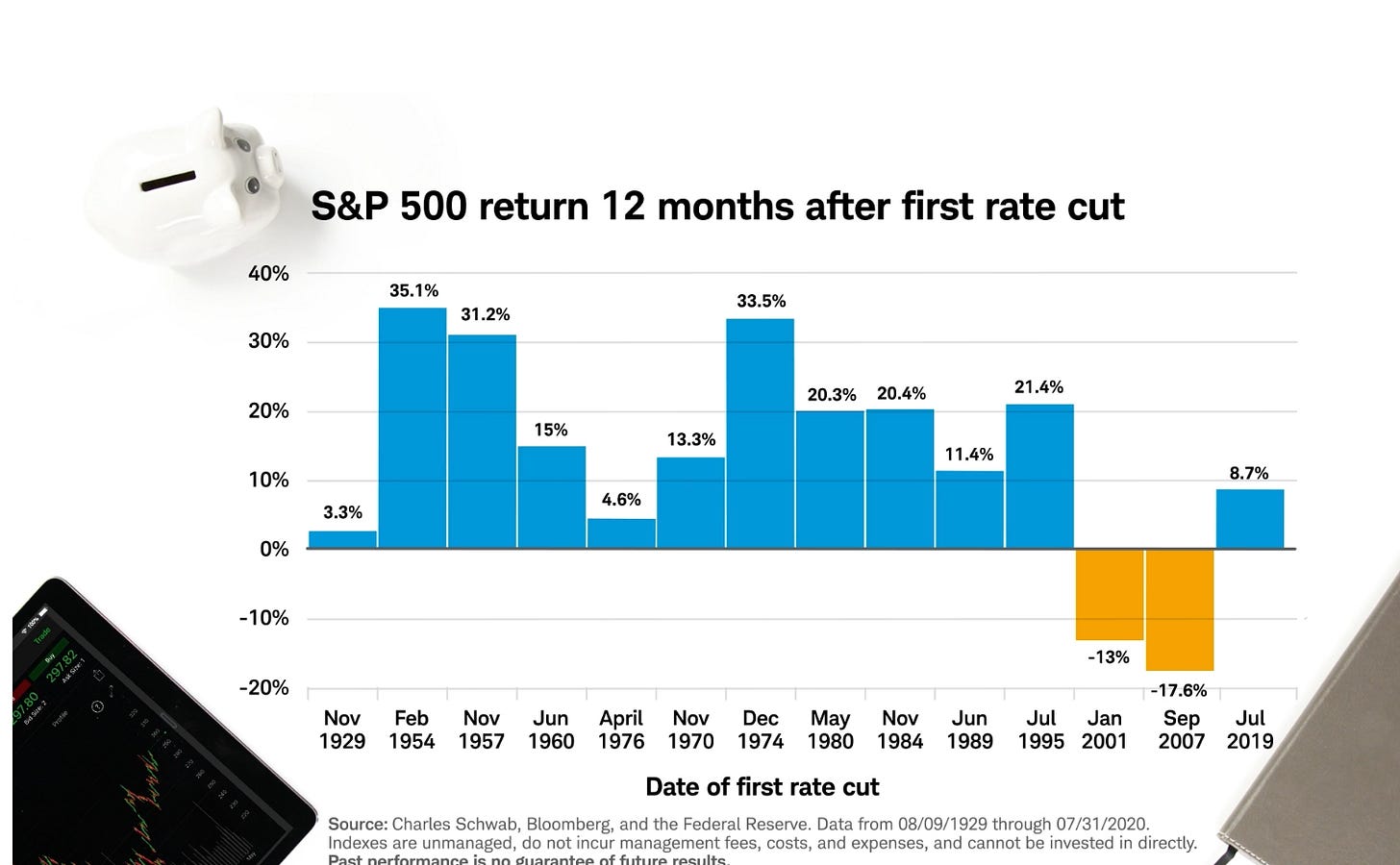

You may have heard that the market tends to fall after the first rate cut, referencing the 17.6% decline in the S&P 500 in September 2007, or the 13% decline in January 2001.

However, that only tells a small fraction of the story - in fact, more often than not the S&P 500 shows positive performance after the first rate cut.

If we expand our data set we can see that the S&P 500 is positive 12 months after the first rate cut the majority of the time.

S&P 500 POSITIVE Return 12 Months After First Rate Cut

Nov 1929: 3.3%

Feb 1954: 35.1%

Nov 1957: 31.2%

Jun 1960: 15%

April 1976: 4.6%

Nov 1970: 13.3%

Dec 1974: 33.5%

May 1980: 20.3%

Nov 1984: 20.4%

Jun 1989: 11.4%

Jul 1995: 21.4%

Jul 2019: 8.7%

S&P 500 NEGATIVE Return 12 Months After First Rate Cut

Jan 2001: -13%

Sep 2007: -17.6%

All things considered the U.S. economy is still strong with Q1 and Q2 GDP growing at 1.6% and 2.8% respectively.

Assuming increased volatility headed into the U.S. Presidential election, any major market correction if any, should be bought in our view.

A market sell off based on fear and uncertainty dependent upon the result of the election will present a buying opportunity into the tail end of Q4.

There is no guarantee we will get it, but if we do - we believe this event will be a buying opportunity.

Lower interest rates + Strong Economy = Stock Market Positive

Gold Signals Return To Easy Money

Gold has rallied over $2,600/oz for the first time in history ending the week at $2,621/oz.

The precious metal is now up over 37% since breaking out of a decade long base in January 2024 over the 2011 high of $1,924.

In our Behind The Street Newsletter Titled “Bitcoin & Gold Says Trouble Is On The Horizon!” we pointed out that Gold was starting to build out the right side of a handle on a decade long base and set a price target on Gold of $3,000/oz

READ HERE: Bitcoin & Gold At Record Highs - March 2024

See excerpt below.

We remain firm on our $3,000/oz price target and raise out confidence level being that the Federal Reserve is returning to more accommodative monetary conditions faster than we expected.

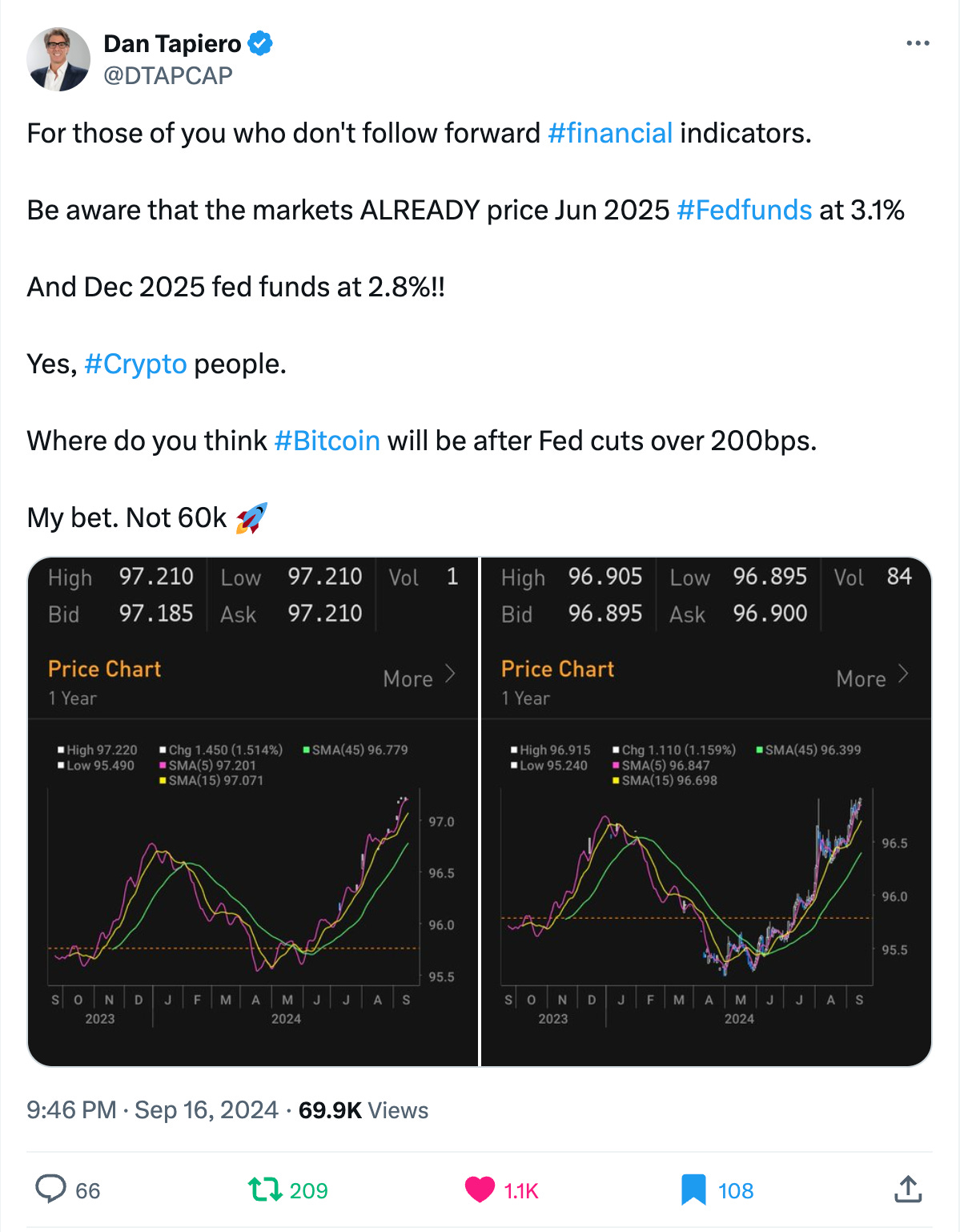

Bitcoin Bull

In addition to Physical Gold - we remain bullish on Digital Gold throughout Q4 and into 2025.

Bitcoin is carving out the right side of a handle on a cup with handle base similar to what we saw on Gold.

Unconfiscatable assets with a finite supply should perform well in one of the most uncertain political environments in U.S. history - leading into an election while monetary policy is easing.

The recent price action in Gold and Bitcoin is telling us that regardless of who wins the presidential election in November - Americans can expect more of the same.

Major Government Spending!

Pick Your Spots

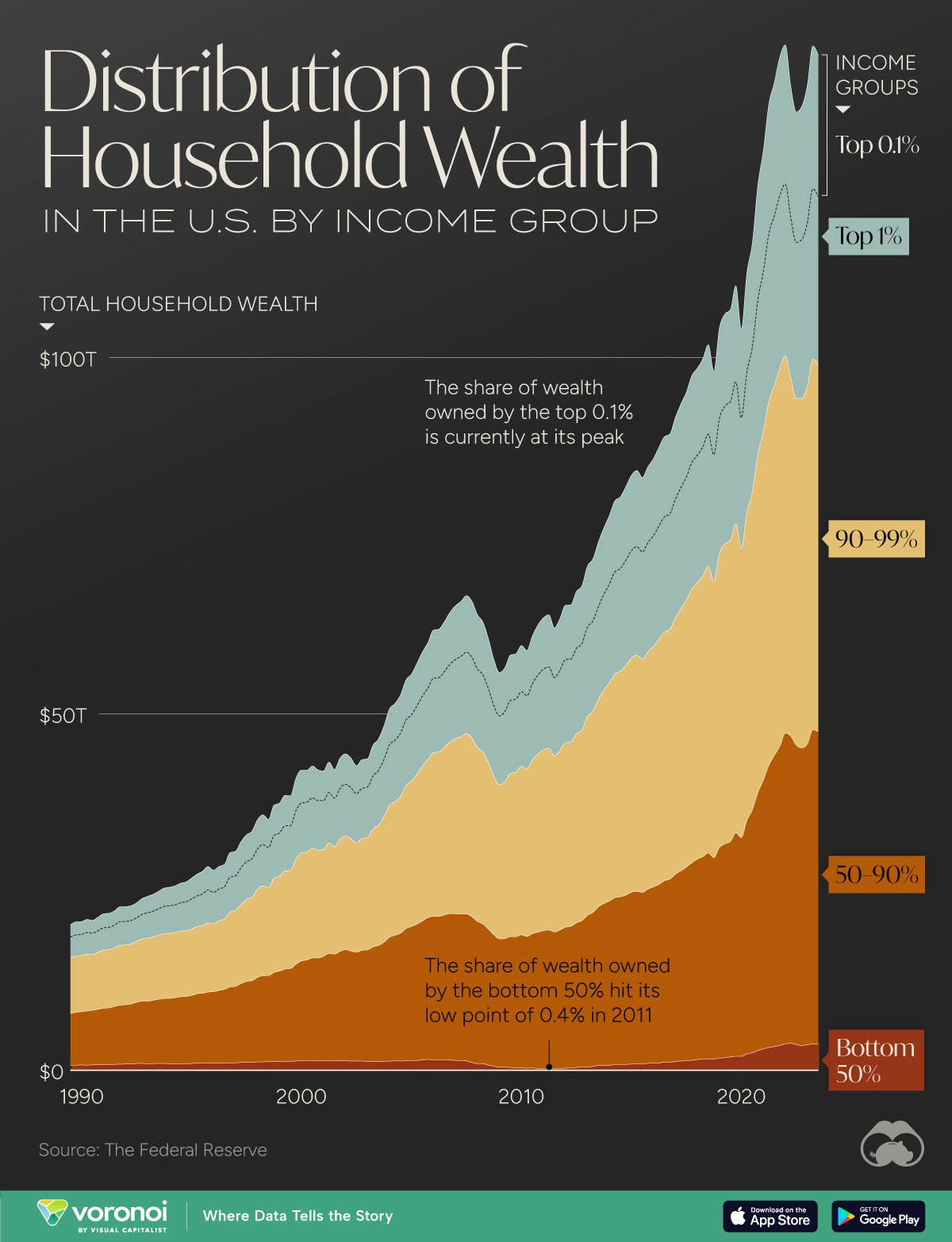

Remember, not everyone will benefit mutually and we must reflect on what extremely loose monetary conditions have done in the past.

What we like to call: The creation of the extreme haves and extreme have nots.

Visualizing Wealth Distribution in America (1990-2023)

Post 2008 financial crisis we entered the decade of ZIRP - Zero Interest Rate Policy.

The question is, who had access to the cheap money? Answer: The wealthy.

Over the past decade the wealthiest Americans got increasingly more wealthy due to the fact that they had access to all this cheap money and own the majority of assets.

We may have not seen a a huge uptick in inflation in regards to CPI - but the inflation of asset prices surly showed through.

Hence the bifurcated economy we currently have today - we can see this data show up in corporate earnings reports.

"We believe the softer sales trends are partially attributable to a core customer who feels financially constrained," Todd Vasos, Dollar General's chief executive officer

A very telling story when the CEO of Dollar General signals that the core customer base are financially constrained.

“The record 2023 results, the ambitions that we have on 2024, together with the exceptional visibility on our order book allow us to look at the high-end of 2026 targets with stronger confidence.” - Ferrari CEO Benedetto Vigna

Interesting contrast between the two quotes from Dollar General CEO Todd Vasos and Ferrari CEO Benedetto Vigna.

Higher end consumers seems to be doing better than ever while the lower end seems to be struggling more than ever before.

We are not saying go short Dollar General and go long Ferrari - we are advising to pay attention to this trend and invest accordingly.

With the recent 50 basis point rate cut by the Federal Reserve we can expect more of the same going forward and a widening of the wealth gap.

5 Beekman Street Penthouse

Take a look at our newest listing at 5 Beekman Street PH 51.

Listing Information: 5 Beekman Street #PH51 3 Bed 3.5 Bath 3,554SF

Updates

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.

Thanks for reading Behind The Street ! Subscribe for free to receive new posts and support my work.