Bad News, Positive For The Market?

Unemployment Higher, Job Growth Slower, Fed Funds Rate Unchanged

Monetary Policy Update

After 11 interest rate hikes, the Federal Reserve decided to leave the Fed Funds Rate unchanged in a target range between 5.25%-5.50% while continuing to reduce its securities holdings.

The Federal Reserve uses its balance sheet to influence longer-term interest rates by creating stimulative or restrictive monetary conditions.

When the Federal Reserve wants to stimulate monetary conditions they will expand the size of its balance sheet by purchasing treasury securities and mortgage-backed securities.

To restrict growth, the Fed will shrink the size of its balance sheet by letting assets roll off and even sell assets ahead of maturity date.

Fed Chair Jerome Powell was clear during his speech that the Federal Reserve would remain steadfast in its pursuit of price stability ( 2% inflation ) and maximum employment.

Rate Hikes Are Working

The good news is that rate hikes and restrictive monetary conditions have proved successful in reducing inflation from a high of 9.1% in June 2022 to 3.7% as of September 2023.

Unemployment Up - Wage Growth Slows

The bad news is that job growth is slowing and unemployment is rising.

U.S. payrolls fell to 150,000 in October, much less than the 170,000 expected by economists and down significantly from September’s 297,000.

The labor force participation rate declined to 62.70% and remains below the long term average of 62.84%.

The labor force participation rate is a better gauge on the health of the U.S. workforce as it is the sum of the total number of employed persons and unemployed persons looking for work in the United States as a percentage of the working age population.

We are also seeing a steady year over year decline in average hourly earnings, a signal that employers are not having to be as aggressive with compensation to attract top talent.

The hiring boom of 2021 - 2022 was to meet demand sparked by unprecedented fiscal and monetary stimulus, now employers are looking to reduce headcount.

2023 has been a year of major layoffs in big tech as firms look to cut costs and reduce corporate bloat built up during the pandemic.

Mark Zuckerberg's planned “year of efficiency” has lead to a reduction in 24% of META 0.00%↑ entire workforce.

U.S. Manufacturing Activity Declines

Economic activity in the manufacturing sector contracted in October for the 12th consecutive month following a 28-month period of growth.

The Institute for Supply Management October 2023 Manufacturing PMI came in at 46.7%, down from 49% in September.

The manufacturing sector accounts for 20% of the U.S. Economy, making the ISM Manufacturing Report on Business an important leading economic indicator.

Both professional traders and portfolio managers as well as the Federal Reserve use the ISM PMI report to help make trading decisions and set monetary policy.

New Orders are contracting at a faster pace down 3.7 percentage points while Employment transitioned for the first time from growing to contracting, down 4.4%.

Over the last 12 months manufacturing has been contracting in the United States as the Federal Reserve imposed tighter monetary conditions.

When money becomes expensive, manufacturers are deterred from borrowing to increase manufacturing capacity and grow their businesses, thus cooling the economy.

Exactly the goal of the Federal Reserve, slow the economy and bring down inflation.

Get Long Japan?

The Japanese NIKKEI 225 put in a top back in 1989 and has traded lower to sideways ever since.

The NIKKEI is currently outperforming, building out the right side of a 34 year base approaching a new record high.

Expect significantly higher prices on a breakout into new high territory.

American investors have been underinvested Japan over the last decade, this could be an opportunity to enter a trade that isn’t crowded.

I suspect Japan to benefit from the reorganization of the global supply chain away from China, this catalyst alone could propel Japan into a golden age.

See BlackRock CEO Larry Fink talk about client investor interest in Japan.

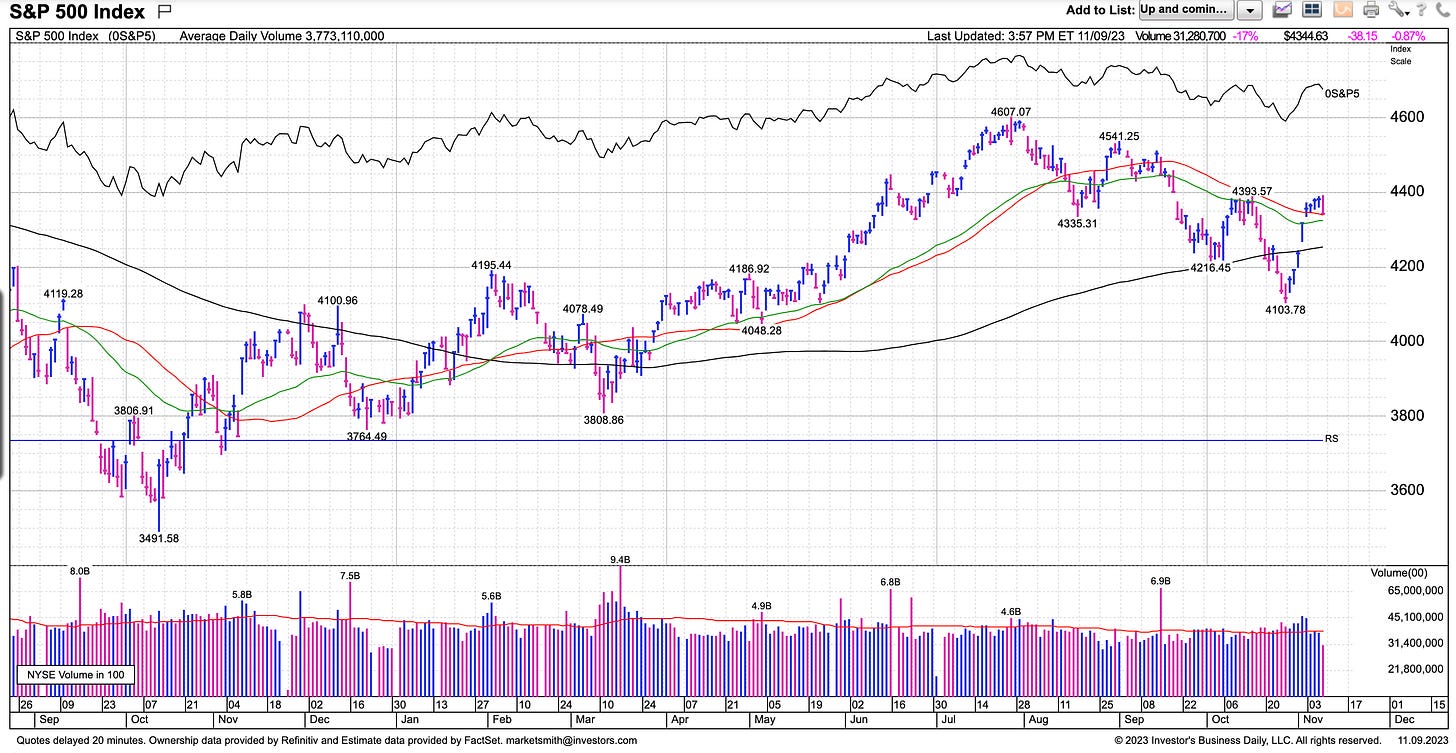

The Bad News Was Good News?

After Fed Chair Powell’s speech the US 10-YR Treasury Yield declined from nearly 5% down to 4.81%, a 20 basis point move.

The market reaction says the Fed may be nearing the end of its tightening cycle.

This sparked a rally in stocks that at the time were extremely oversold, lower bond yields are generally stock market positive.

When rates are low, the present value of a company’s future cash flows are worth more and when interest rates start moving higher, the present value of the company’s future cashflows decline.

The discount rate reduces future cash flows, so the higher the discount rate, the lower the present value of the future cash flows. A lower discount rate leads to a higher present value.

With bad news such as higher unemployment, lower payroll growth and deteriorating manufacturing activity, the market suspects that the Federal Reserve is getting closer to achieving its goal of slowing the economy and restoring inflation to 2%.

Potentially resulting in easier monetary conditions in the future, good news.

Yield Curve Transition

It is not only important to know where the yield curve is right now, but to know where it is coming from and where it is heading.

After the move in the US 10-YR, it has pushed the yield curve closer to un-inverting.

Transition Example:

Steep - Flat - Inverted

Inverted - Flat - Steep

The above chart depicts the spread between the 10-YR and 2-YR Treasury, currently inverted but fast approaching un-inverted.

As the Yield Curve transitions from an inverted curve to a steep curve, yields on the longer end of the curve should continue to rise, putting pressure on businesses and consumers.

Long term debt is generally the most closely related to consumers and businesses with the example of the very popular 30-Year Fixed Mortgage and Auto Loans averaging in a rage from 36 - 84 months.

With rates continuing to rise should the Federal Reserve not intervene, consumer spending could take a material hit as we are already seeing credit card delinquency heading towards pre-pandemic levels.

We wrote about this here: READ HERE

More Stress On Commercial Real Estate

In the last issue of Behind The Street we talked about the looming stress on Commercial Real Estate, particularly office.

The latest blow to commercial operators is the recent chapter 11 filing of co-working giant WeWork WE 0.00%↑.

As of the first quarter of 2023, WeWork leased nearly 7 million square feet of office space in NYC, representing 61.4% of the co-working market according to Gabe Marans, vice chairman of property advisory Savills.

WeWork will terminate 70 leases according to court papers. WeWork has 47 locations in New York City and 35 will shut down, at one point WeWork was the largest private tenant in Manhattan.

There will most likely be some form of restructuring for the company, but the impact on large commercial operators that had WeWork as an anchor tenant will be severe.

$1.5 trillion worth of commercial real estate loans will mature over the next 3 years.

With vacancy increasing across the country, commercial operators will be in a position of declining rent rolls and increasing costs, and now WeWork has already amended more than 590 of its current leases, unloading $12 billion in future rent obligations.

A major blow to landlords.

Finding Alpha - Cybersecurity

There is always a bull market somewhere, you just need to know where to look.

My bull thesis for cybersecurity is the answer to a simple question.

What software in your tech stack is nice to have verses a must have?

As businesses look to cut costs, an easy way to do so is by cutting unnecessary SaaS spend. You can stop paying fort ZM 0.00%↑ as you have MSFT 0.00%↑ Teams for free in Microsoft office.

However, businesses and governments cannot afford to cut cybersecurity spending, if anything, I am forecasting a significant increase in spending over the next decade.

Palo Alto Networks PANW 0.00%↑ is trading near 52-week highs and all time record highs while continuing to produce great results on revenue and earnings growth.

Palo Alto Networks is expected to report earnings on November 15 after the bell.

CrowdStrike CRWD 0.00%↑ is another name trading near 52-week highs and making steady progress on revenue growth and earnings growth.

Watch for stocks bucking the trend and performing well while the market is in correction as these are usually the leaders in the next cycle.

According to McKinsey & Company the total addressable market for cybersecurity is expected to reach $2 Trillion over the next few years.

With an expanding total addressable market, necessity and priority of the service and scalable distribution model, I would look to add exposure to the cybersecurity sector through companies with high market penetration, growing sales and earnings at a 25% CAGR.

NYC Real Estate Update/Featured Listing

Listing inventory in Manhattan stands at 8,320 with a median list price of $1,747,297 and median price per square foot of $1,130.

The average 30 Year Fixed Mortgage declined 19 basis points to 7.83% this week as the US10YR yield fell from 5% to 4.632%.

We just listed Penthouse 3B at The Conover in Red Hook Brooklyn.

This Penthouse sports 3 bedrooms 2.5 bathrooms and a private 1,380 SF roof deck overlooking the Statue of Liberty and the Freedom Tower.

Modern finishes define this condo—Madera white oak, wide-plank wood floors, oversized windows and 10ft exposed concrete ceilings.

The Conover is a uniquely designed and intimate 22-residence condominium building set in the most desirable location of Red Hook, arguably one of the most artistic neighborhoods in all of Brooklyn. The three-story, low-lying design of the building creates spacious layouts that maximize light and views and provide the utmost in urban living. The design scheme echoes the industrial chic of the surrounding neighborhood, balanced by warm and inviting materials.

If yourself, a family member or friend is interested in Penthouse 3B at The Conover, email me: Thomas.Malloy@elliman.com

Updates

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.