A Bucking Bull Market.... Don't Get Thrown Off!

The Average Duration of a True Market Leader is 90 Weeks

A New Bull That Will Buck

As our confidence grows that a new bull market has arrived - we are cognizant to the fact that bulls are wild and sometimes, they kick!

See More Stock Market Cartoons from HEDGEYE

The S&P 500 has closed up nine weeks in a row since October 30, 2023 - 668 points or just over 16%.

At one point extended 7% above the 50 day moving average and currently 9% above the 200 day, it is normal for the market to take a pause and digest such a ferocious rally.

The NASDAQ Composite has experienced similar action building out what appears to be the right side of a massive cup base.

So long as volume tapers throughout the handle and there’s not a disturbing break of a major moving average - it is our view that investors should lean bullish.

Finding A Diamond In The Rough - TML’s

The market is in a corrective phase, below are a few guard rails, tips and statistics we can use to prevent this bull from throwing us off its back - causing us to dislodge our core positions in potential leading stocks.

Look for strength in a weak tape, identify stocks going down less or even closing green on days the general market is selling off.

Institutions tend to step in and support the very best merchandise on the market - buying true market leaders (TMLs) and selling the laggards.

It should become quite obvious the names that institutions are supporting as these names will often have much tighter trading ranges, high liquidity and shorter correction duration.

The above chart depicts Enterprise Software giant ServiceNow NOW 0.00%↑.

As the general market was selling off, this name was bucking the trend, closing at the high of the day and breaking out into new high territory.

We are six days out from earnings - it is important to watch how the stock reacts to the report - this may gap and go on a beat and raise.

Similar action could be seen in CrowdStrike CRWD 0.00%↑, charging to test its previous record high set in November 2021.

We can see clear accumulation running up the right side of the base with heavy volume on up days with price trading in very tight ranges, not “whipy and sporadic”.

When a stock is very volatile - trading in wide ranges, this is a signal that the stock is changing hands frequently and not being heavily accumulated by institutions, thus increasing the odds the stock breaks down.

We like to refer to this as “endless chop” - try to identify very tight and orderly trading action. The more charts you look at the easier to identify.

NVIDIA NVDA 0.00%↑ is probably the top true market leader of the cycle so far, an institutional darling due it its earnings power and liquidity.

Notice the action running up the right side of the base, extremely tight and orderly with volume increasing on up days and volume taper on down days.

When the handle started to form as the stock approached new high territory - price action remained in a tight trading range with volume drying up.

A clear sign that institutions are not selling the stock - a few weeks later NVIDIA breaks out to new record highs while the general market was correcting.

Gaining Perspective

According to research performed by Roppel Capital Management, the average duration of a true market leader is roughly 90 weeks.

During the 1999 - 2000 bull market the average pull back in the top 12 leading stocks was 18% with the two largest pull backs recording 30% and 27% declines respectively.

The smallest pull backs within the 90 week duration was 11% and 12%.

Pictured above is a monthly chart of QCOM 0.00%↑ on January 3, 2000.

The stock gained over 2,500% before putting in a generational top when the market crashed at the onset of the tech & telecom bust.

The biggest mistake you can make is selling true market leaders up 20% at the start of a new bull market.

Now that we know the average correction size, what about duration of these corrections during the 1999 - 2000 bull market?

According to Roppel Capital Management pull back durations in the tope 12 stocks in 1999 were as followed.

Shortest Duration: 1 Day

Longest Duration: 24 Days

Median Duration 11.5 Days

Average Duration 6.4 Days

Judging by the data the bull market of 1999 saw an average of an 18% pull back in 6.4 days in the 12 leading stocks

Talk about a wild ride on a bucking bull!

“A Diamond is just a piece of charcoal that handled stress exceptionally well”

In conclusion, look for stocks trading at or near 52 week highs with explosive earnings and sales growth. Look for stocks being supported and closing green whilst the general market is selling off, and lastly - stick with liquid names, institutions need liquidity.

Welcome To Earnings Season

It’s that time of year again and to kick us off we have financial institutions up on the chopping block.

It is extremely important to pay attention to bank earnings because we can use it as a proxy to gauge the health of the U.S. consumer, small businesses and large corporations.

Bad News First

We have been watching a concerning trend of higher credit delinquencies accelerating towards Pre-Pandemic levels, inferring that consumers are burning through savings built up throughout 2020 - 2021.

At Bank of America BAC 0.00%↑ total net charge-offs increased by $261 million to $1.2 billion in 4Q23 driven primarily by higher credit card losses.

The Net charge-off ratio also ticked higher to 0.45% from 0.35 in 3Q23 with the credit card loss rate returning to pre-pandemic levels.

3.07% in 4Q23 vs. 2.72% in 3Q23.

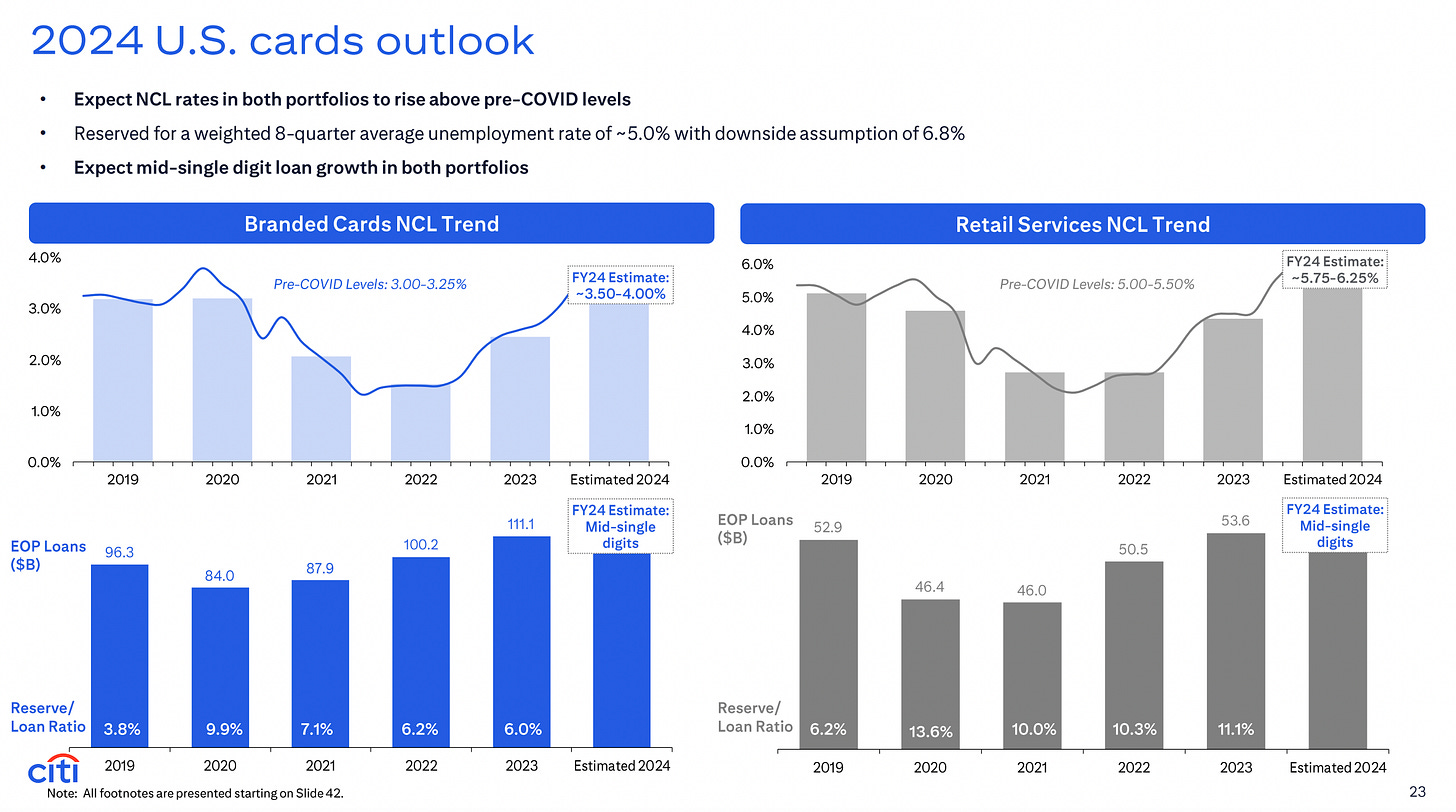

We found a similar trend at Citi C 0.00%↑.

Credit costs exploded to $2.1 billion driven by NCLs of $1.6 billion, officially marking a return to pre-Covid levels.

According to Citi 2024 U.S. Cards outlook, they expect NCL rates in both portfolios to rise ABOVE pre-Covid levels.

Not only are we seeing charge offs accelerate we are seeing credit balances increase along with 30 day delinquency rates across all loan types.

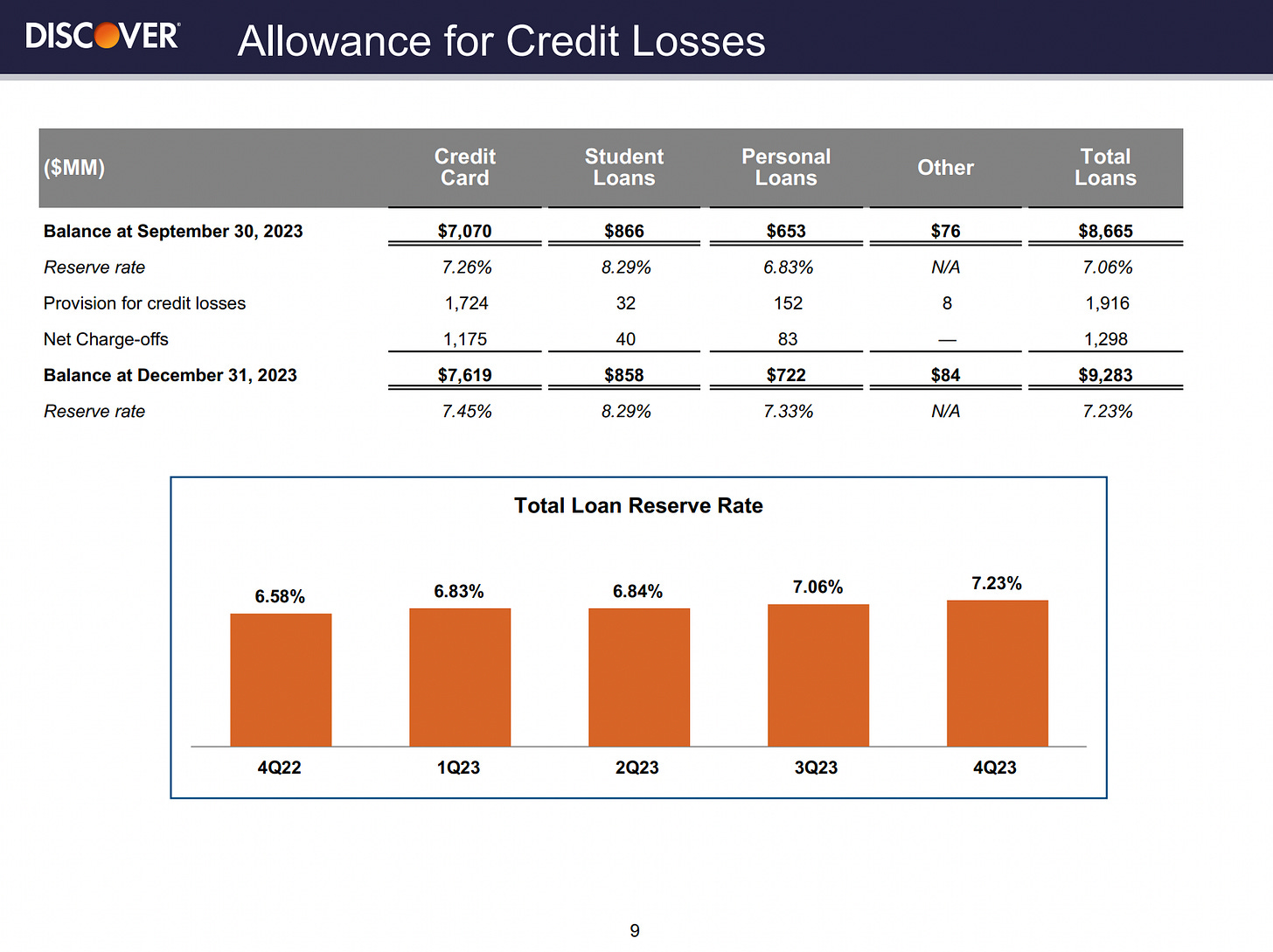

Discover Financial DIS 0.00%↑ shows credit card balances up 5% q/q and 13% y/y to $102 billion.

Credit Card 30-Day Delinquency Rate was up 46 basis points q/q and 134 basis points y/y to 3.87% in 4Q23.

Personal loans are also seeing an uptick in both balances and delinquency.

Discover saw a 3% q/q and 23% y/y growth in personal loan balances while delinquency was up 190 basis points y/y at 1.45%.

Not to sound the alarm bells here, but it is important we watch closely this trend and check back next quarter to see if there are any signs of stabilization in net charge-offs and delinquency.

Good News

The outlook for deal flow on Wall Street in 2024 seems optimistic according to some of the top investment banks, particularly Goldman Sachs.

In the last issue of Behind The Street we outlined our thesis for a return of PE, M&A and IPO markets for 2024. READ HERE

CEO David Solomon told analysts that he was “pretty optimistic” about an improvement in mergers and capital markets activity “in the second half of this year.” on the most recent earnings conference call.

Watch Goldman Sach Co-Head of Global M&A Stephan Feldgoise HERE

Full year 2023 Earnings: Goldman Sachs brought in $8.52 billion in net income on $46.25 billion in revenue.

Goldman Sachs ranked number 1 in M&A, equity & equity related offerings and common stock offerings.

The bank is forecasting five rate cuts in 2024 leading clients to feel comfortable taking on new debt to fund operations, expand the business and make deals.

Goldman Sachs has been performing well going into the end of 2023 - price tends to lead by 6 months, the market may be telling us that M&A activity will be robust in 2024.

Monetary Policy Update

The Fed will kick off 2024 with their first FOMC meeting on January 30 - 31.

Currently the Fed Funds rate is in a range between 5.25% - 5.50%.

According to the CME Fed Watch Tool it is expected that there will be a rate CUT at each FOMC meeting this year with the January 30 - 31 meeting being the exception.

This means that there is a 34.5% chance the Fed Funds rate will be 3.75% - 4.00% by the end of 2024.

You can access the CME Fed Watch Tool HERE

Aside from interest rate policy, the Fed continues to shrink the size of its balance sheet.

The Federal Reserve uses its balance sheet to influence longer-term interest rates by creating stimulative or restrictive monetary conditions.

When the Federal Reserve wants to stimulate monetary conditions they will expand the size of its balance sheet by purchasing treasury securities and mortgage-backed securities.

To restrict growth, the Fed will shrink the size of its balance sheet by letting assets roll off and even sell assets ahead of maturity date.

Should the Fed achieve a soft landing while cutting rates - the equity market could just be getting started.

A Look At Housing

A big narrative breaker has been the housing market - many prominent analysts on the street have been calling for a catastrophic collapse in residential housing.

Despite the tightest monetary conditions in over a decade, homebuilders are one of the top performing sectors in the market.

SPDR S&P Homebuilders ETF XHB 0.00%↑ broke out of a cup with handle base into new high territory as the general market pulled back.

According to Axios America is short around 3.2 million homes and much of that inventory needs to come from U.S. Home Builders.

With housing prices still elevated across much of the United States, new inventory is needed to satiate the continuous demand for housing.

This should provide homebuilders such as PHM 0.00%↑ and TMHC 0.00%↑ tailwinds over the next five years.

Spot Bitcoin ETF Approval - The Top?

January 10, 2024 marks a historic day on Wall Street as the first ever Spot Bitcoin ETF gains approval from the SEC.

With a Spot ETF approval, select and approved ETF’s will be allowed to buy the underlying coins for custody as opposed to speculating on futures contracts (derivatives).

The more money that flows into the Spot ETF’s, the more Bitcoin they must buy.

Looking at a weekly and monthly chart of Bitcoin we can see some clear topping action, perhaps an intermediate term top in a larger bull market.

If January’s close stays consistent with current price action, it would mark a very nasty “shooting star” bearish candle.

Buy the rumor, sell the news may be the case here.

Even if you have no interest in Bitcoin and cryptocurrency, you still still pay close attention to its price action as you can use it as a measure of “risk appetite” in the market.

Bitcoin and other cryptos are very much risks assets that are highly highly correlated to high beta growth equities.

New York City Real Estate - Featured Listing

We just listed Penthouse 3A at The Conover in Red Hook Brooklyn.

List Price: $2,600,000

Common Charges: $810

Taxes: $1,696

This Penthouse sports 3 bedrooms 3 bathrooms and a private 850 SF Roof overlooking the Statue of Liberty and all of Lower Manhattan.

Click Below to see an exclusive video tour!

Listing Highlights:

850 SF Private Roof

Sauna & Cold Plunge Included

Madera white oak, wide-plank wood floors

Large Kitchen Island Stain and Heat-resistant Quartz Countertops.

If yourself, a family member or friend is interested in 199 Conover Street Penthouse 3A email me: Thomas.Malloy@elliman.com

Updates

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.