The Bases Are loaded

It’s a warm summer night in the Bronx, the bases are loaded at Yankee Stadium with Aaron Judge up to the plate.

Despite all the distractions, screaming fans, flashing lights and opposing team hecklers, the expectation is for Judge to crush one into right field - over the wall for a game winning grand slam.

Countless hours of preparation, working a systematic framework and blocking out distractions prepared Judge for this moment.

To capitalize on an opportunity to propel his team to victory and level up his life.

If you're reading this, you’re probably not a Yankee All-Star, but you do have the same opportunity to seriously level up your life in 2024.

The bases are loaded.

Block Out The Noise

2024 will be absolutely relentless with distractions, poking and prodding at you with the goal of making you strike out just as the stars are aligning for you to take your life to the next level.

It’s an election year - the media is going to do everything in its power to try and get a rise out of you, to get you charged up - angry and distracted from your goals.

Don’t take the bate - throw all of your time, energy and focus into yourself this year.

Do not let the “information fatigue” from the election year delay you from getting after it.

Use the time you would have spent arguing politics on Facebook, watching CNN and Fox News on working a systematic framework for success.

While the rest of the country is distracted, irritated and upset - take the other side of the trade and double down your efforts on your business.

Build marketable skills to get a one up on your competition.

Your discipline to be selfish this year will equal freedom, unlimited opportunity and a shot at seriously leveling up your life.

Joe Biden and Donald Trump will be just fine regardless of the result - but who is going to take care of you and your family?

That is your responsibility, duty and obligation - focus your efforts here.

The bases are loaded, step up to the plate and go crush one over the wall.

The Market That Overcame Adversity

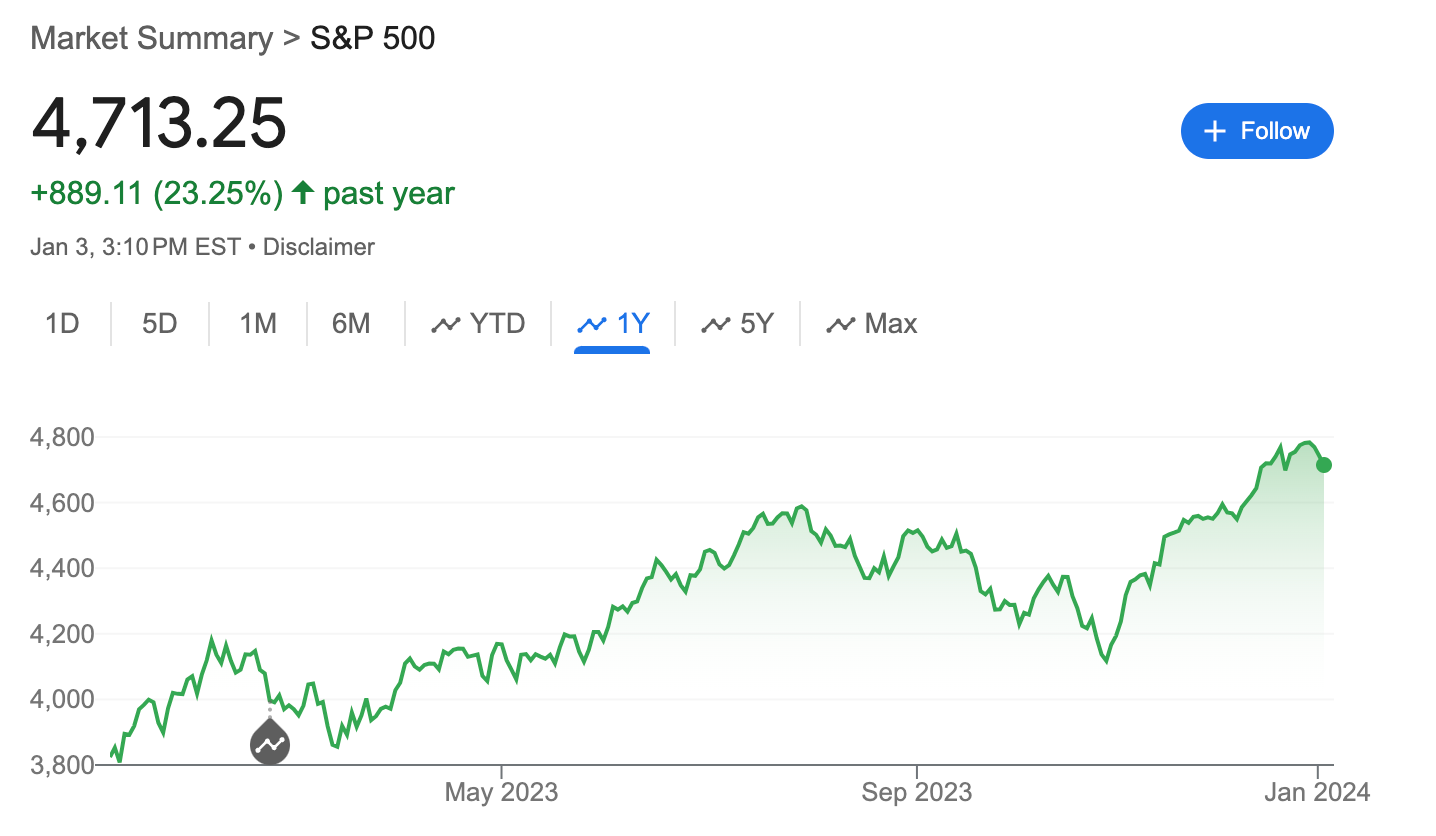

The market had every opportunity to give the bears a crash of a lifetime in 2023.

Collapse of Silicon Valley Bank ($209 Billion) - March 10, 2023

Signature Bank Failure ($110 Billion) - March 12, 2023

First Republic Bank ($213 Billion)- seized by FDIC on May 1, 2023.

FOMC raised rates to 5.25%–5.50% at the July 2023 meeting, marking 11 rate hikes and the tightest monetary conditions in a decade.

War in the Middle East - Israel/Gaza

Instead, the S&P 500 finished the year positive +24%

The tech heavy NASDAQ 100 gained over 55%

With the Dow Jones Industrial Average making a new all time record high, up 14%.

S&P Market Performance- Election Years

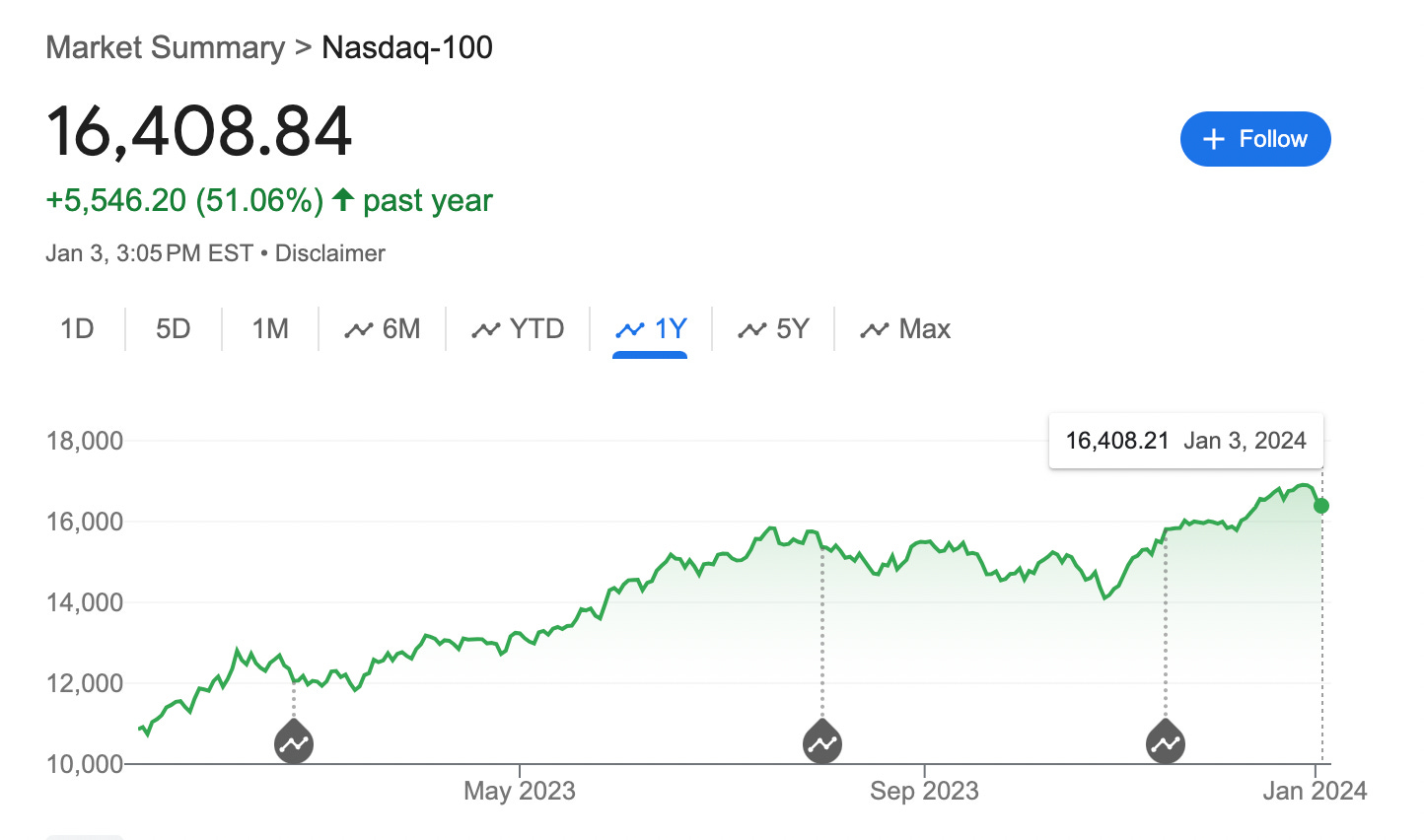

Data shows that S&P 500 returns are often muted in presidential election years with an average gain of 11% - Quite the contrast from last years 24%.

The year prior to an election year the S&P 500 on average returns 17%.

The question is, can we draw accurate conclusions from such a small data set?

There have only been 24 presidential elections since 1928.

A Few Interesting points to note according to First Trust Portfolios L.P.

When a Democrat was in office and a new Democrat was elected, the total return for the year averaged 11%

When a Democrat was in office and a Republican was elected, the total return for the year averaged 12.9%

Over 80% of election years provide positive returns for the S&P 500

What about the best performing sectors during presidential election years?

Energy and Financial Services are the top performing sectors while technology lags significantly and historically produces the lowest returns.

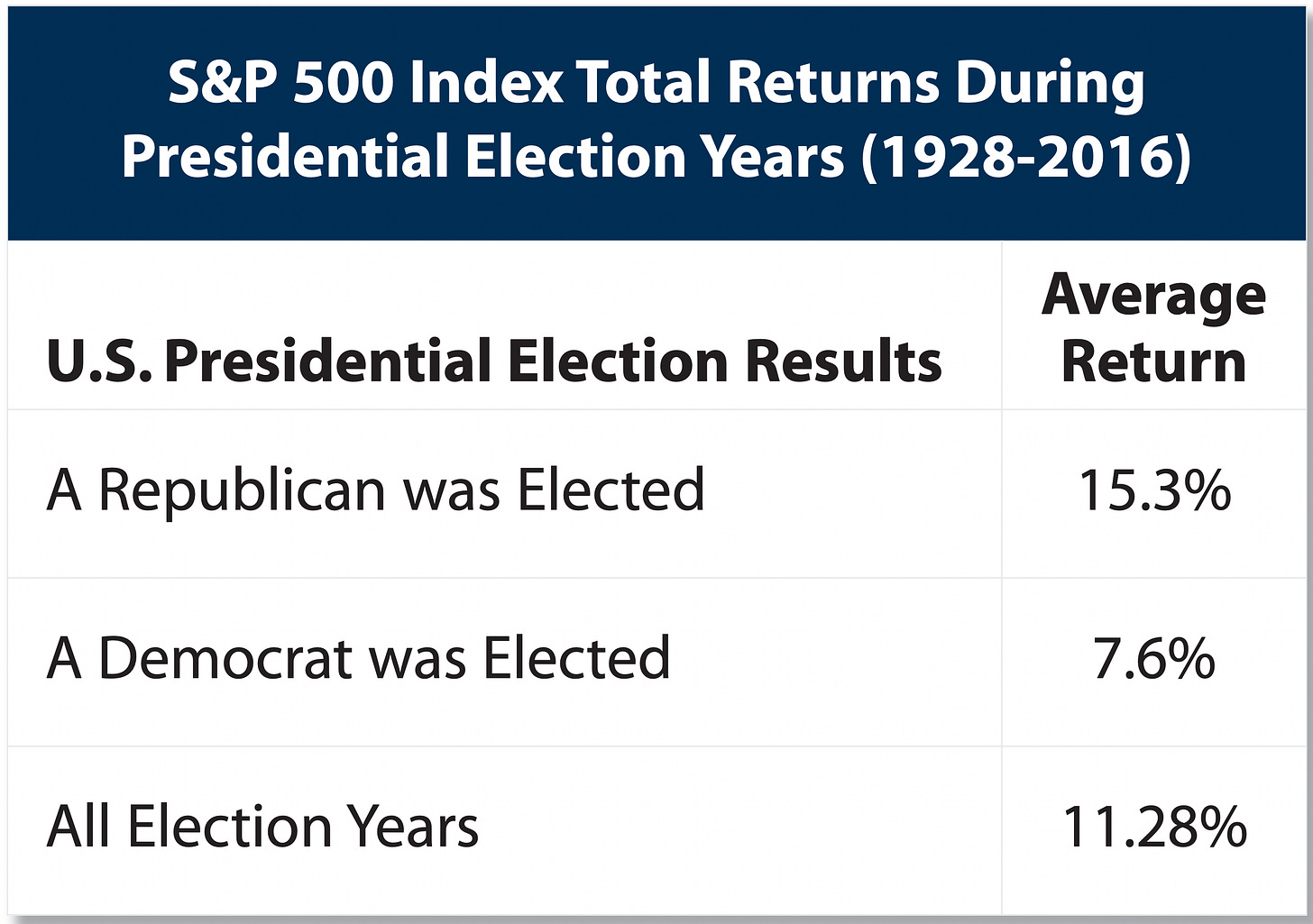

Technology tends to perform well leading up to elections with 2023 being a fantastic year for semiconductors due to Fiscal Stimulus via the CHIPS and Science Act - signed into law by Joe Biden on August 9, 2022.

The iShares Semiconductor ETF SOXX 0.00%↑ was at one point up 64% in 2023 and currently up 32% since the act was signed into law.

Institute For Supply Management Manufacturing PMI

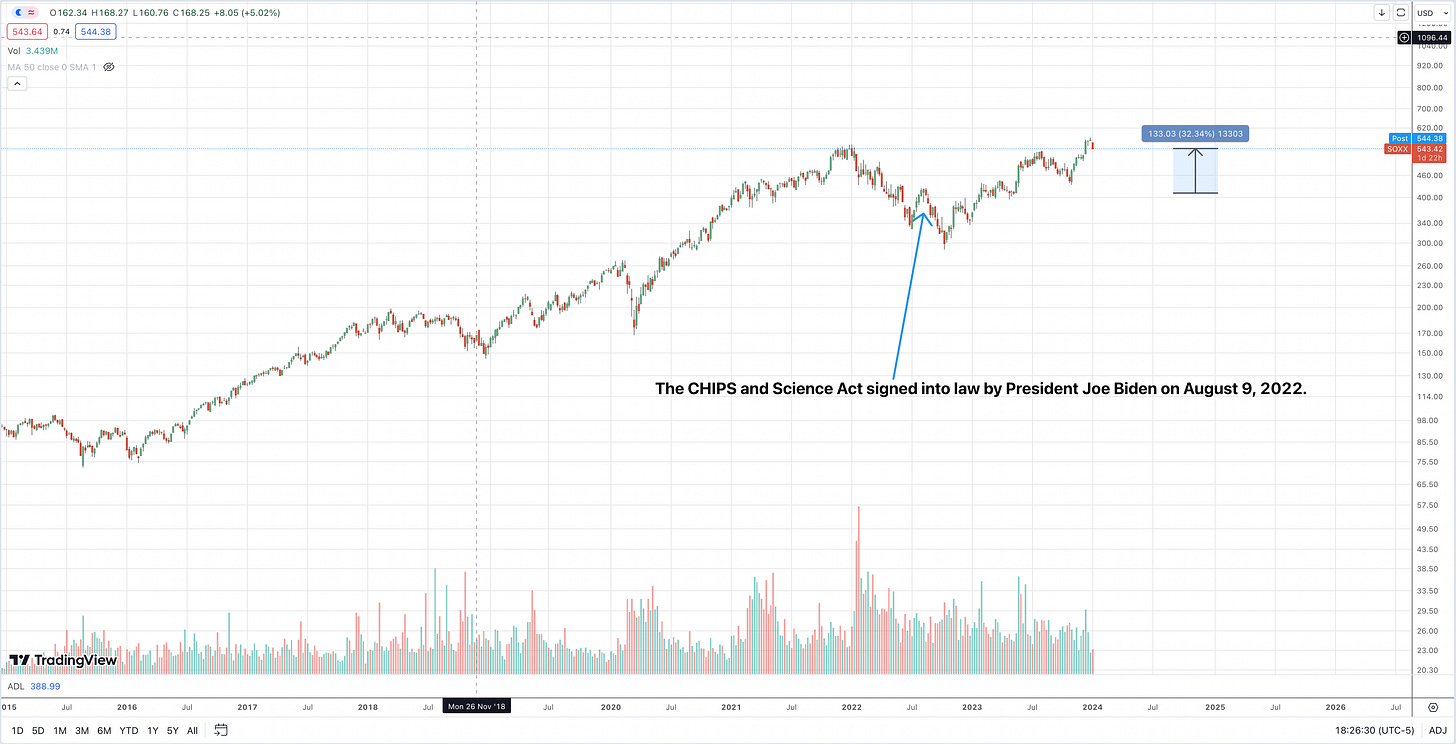

Economic activity in the manufacturing sector contracted in December for the 14th consecutive month following a 28-month period of growth.

The Institute for Supply Management December 2023 Manufacturing PMI came in at 47.4%, up 0.7 percentage point from the 46.7 percent recorded in November.

The manufacturing sector accounts for 20% of the U.S. Economy, making the ISM Manufacturing Report on Business an important leading economic indicator.

Both professional traders and portfolio managers as well as the Federal Reserve use the ISM PMI report to help make trading decisions and set monetary policy.

New Orders are contracting at a faster pace down 1.2 percentage points from the Novembers reading - while prices decline to a reading of 45.2 from Novembers 49.9.

Over the last 12 months manufacturing has been contracting in the United States as the Federal Reserve imposed tighter monetary conditions.

When money becomes expensive, manufacturers are deterred from borrowing to increase manufacturing capacity and grow their businesses, thus cooling the economy.

However, according to ISM respondents, companies are expecting the Fed to hold off on rate hikes and even cut rates in 2024 - encouraging new spend on capital investments as budgets get approved at the start of this year.

Put more focus on the trajectory of PMI numbers, not the reading itself.

Are PMIs rolling over and decelerating?

Are the PMIs starting to turn up and head positive?

Successfully identifying a trend is far more important than looking at the number.

Below is the last 12 months of PMI readings:

The Return Of Private Equity & IPOs

The Private Equity & IPO markets have been frozen in time through 2022 - 2023 after a deal making boom on Wall Street powered by pandemic stimulus.

Stocks can be great leading economic indicators as they generally price in future earnings.

Three stocks in particular may be signaling that the private and public markets will make a major come back in 2024.

KKR & Co Inc KKR 0.00%↑

Blackstone Inc BX 0.00%↑

Goldman Sachs Group Inc GS 0.00%↑

PE giant KKR & Co has rallied 48% since October as it builds out the right side of a cup base to test its November 2021 high of $84.

Stephen A. Schwarzman’s Blackstone has experienced similar action - trying to build out the right side of a cup base to test previous record highs hit in November 2021.

Lastly, Wall Street Mega Bank Goldman Sachs has recovered most of its losses since the stock rolled over in 2021.

Notice how all three stocks started to roll over at the tail end of 2021 - after a banner year for deal making on Wall Street.

The market was telling us a few months in advance that new IPOs, SPACS and PE deals were going to dry up.

When deals dry up - fee income goes away and earnings decline.

There were 1035 IPOs on the US stock market in 2021, an all-time record. It was 120.4% higher than the 480 IPOs in 2020, which was also a record.

As the Federal Reserve started to hike interest rates, the IPO markets came to a screeching halt - there were just 181 IPOs in 2022, an 83% decrease!

With the Fed nearing the end of its hiking cycle, perhaps the market is coming to terms with a higher interest rate environment so long as we don’t have additional hikes in 2024.

We don’t need rate cuts - the market is just looking for stability.

This may be the start of a new beginning for Private Equity and Investment Banking giants.

Severe Bear Market In Duration & Price

The NASDAQ put in a top 772 days ago on November 22, 2021 and has declined 6,111 points or 38% from peak to trough.

This has been a deeper bear market than the 2020 COVID crash and the longest duration since the 2008 financial crisis.

The NASDAQ topped on October 31, 2007 - declined 56% from peak to trough, and did not test the record high until 1,281 days later on May 2, 2011.

With the recent rally we are now starting to see increased participation across individual stocks and sectors - breadth is improving.

For the first time in over a year the 10 day moving average of new highs are steadily out pacing new lows.

The 10 day moving average of up volume has eclipsed down volume with the short term over bought - over sold indicator reaching extreme levels of extension, common during the first leg of a new bull.

Growth has been hit the hardest with with ARKK 0.00%↑ down over 85% from peak to trough.

As sure as the sun comes up tomorrow there will be shake outs and pull backs - however we believe the worst of the bear is over.

Currently major equity indexes are experiencing elevated levels of extension above major moving averages -its important to watch how indexes react as price corrects back to the 50 day.

Ideally, you want to see buying volume coming in around the 50 day moving average.

Should price break the 50 to the downside on an uptick in volume, that should be seen as a red flag and exposure should be reduced.

India / Japan Leads - China Lags

India and Japan continue to lead and we expect this trend to continue over the next decade.

We believe the threat of China taking over as the worlds leading super power is far over blown.

Supply chains are shifting to India, Japan, Korea and North America after Covid sent the message to diversify away from China.

The NIFTY 50 continues to break out hitting new highs.

The NIKKEI 225 continues to build out the right side of a major cup base, looking to test previous record highs set in 1989.

Investment dollars from all over the world are flowing into Japan, potentially kicking off the start of a new “golden age” for the Japanese economy.

Should the NIKKEI 225 breaks out into new high territory, a position in size can be warranted.

New York City Real Estate - Featured Listing

Welcome to Gramercy North at 139 E 23rd Street New York, NY. This is a full floor 2 Bed 2 Bath apartment with just over 1,500 SF of interior space and 580 SF outdoor patio.

Unit 2 at Gramercy North is on the market for $2,495,000.

Listing Highlights:

Low Monthly Maintenance $880

German Miele Appliances

Private Outdoor Patio

7-inch-wide pale hardwood floors

Italian-made LEMA custom closets

If yourself, a family member or friend is interested in 139 E 23rd Street Unit 2 email me: Thomas.Malloy@elliman.com

Updates

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.

Lastly, If You Enjoyed The Newsletter, Support My Work By Sharing It.

THANK YOU .. so much for your time, hard work, and your insights to educate and inform us about the financial world and also the architecture in New York City

Your walks and commentary are amazing!!

Keep up the excellent work

Great work and writing, thanks Tom!