Bulls Make Money, Bears Make Money, Pigs Get Slaughtered!

There are two bifurcated narratives on Wall Street surrounding Artificial Intelligence.

The Bears claim AI is another hype cycle that will drive valuations to nose bleed levels, without any real use case or justification.

Similar to the 3D printing and Cannabis manias that propelled stocks to the stratosphere, but ended in tears for speculators who got caught up in the hype.

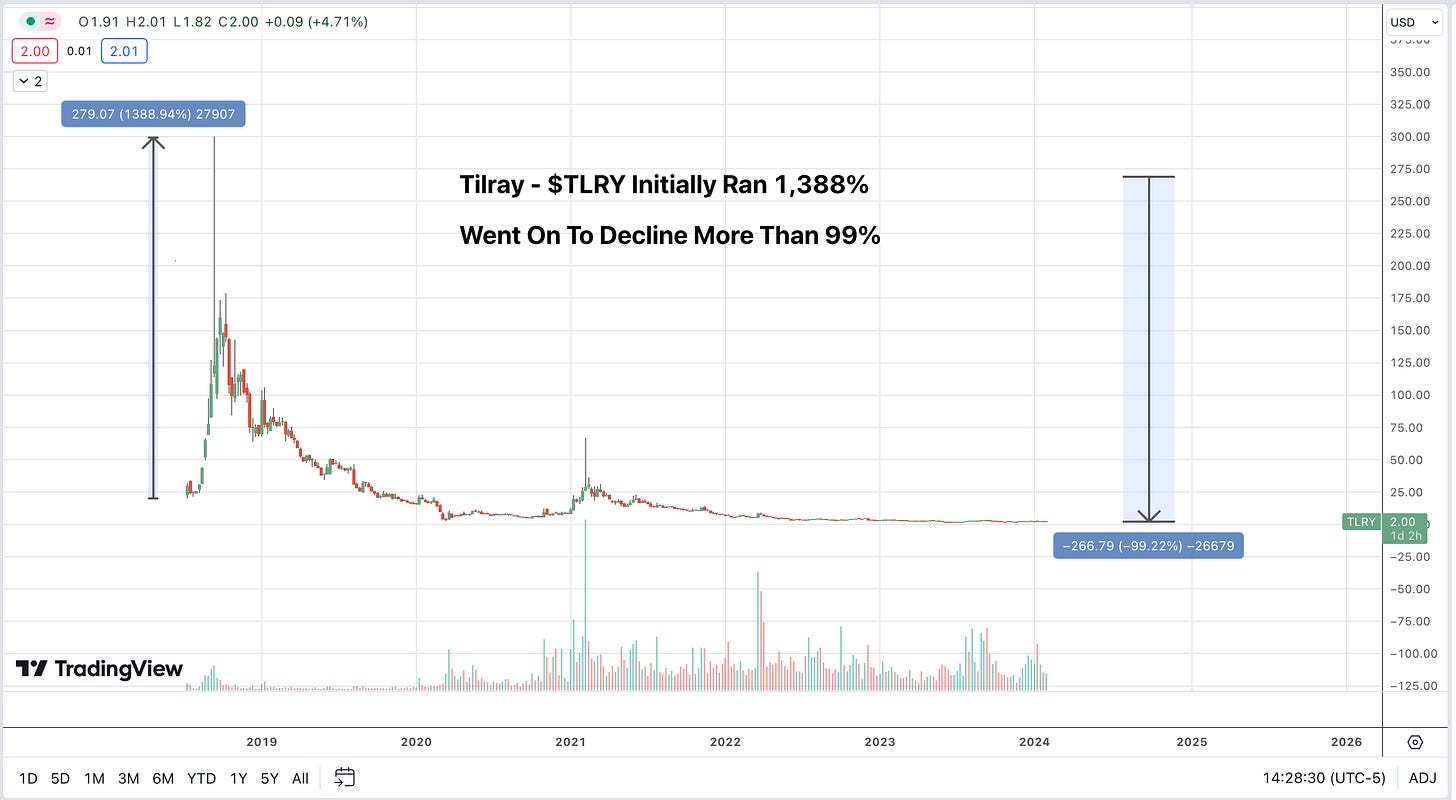

Tilray - TLRY 0.00%↑ was the poster child for the 2018 Cannabis bull market.

The stock went up 1,388% during the mania, then went on to decline over 99% once the bubble popped.

Many once hot cannabis stocks went to zero, Tilray is on its way.

During the 3D Printing bubble stocks such as 3D Systems Corporation DDD 0.00%↑ went up as much as 2,000% only to reverse course and fall over 95%.

Will the same be true for the coming wave of AI IPO’s and should investor be scared?

The AI Bulls

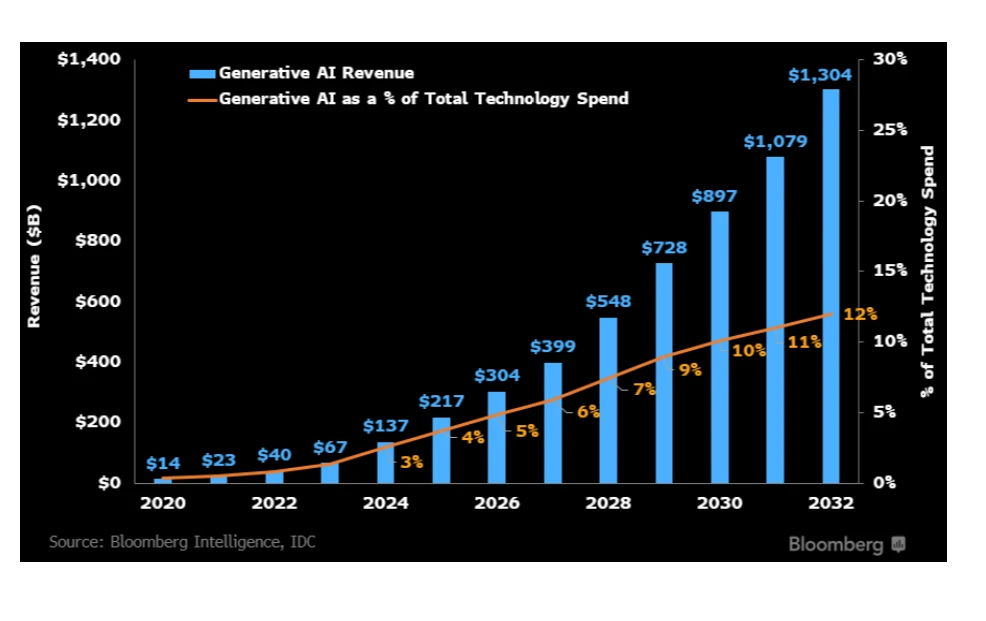

Some Bulls believe that Generative AI will become a $1.3 Trillion Market by 2032 with AI products adding an additional $280 billion of new software revenue.

According to Bloomberg, Generative AI makes up only 1% of total IT hardware, software services, ad spending, and gaming market spending.

By 2032 Bloomberg expects the total to account for 10% of the potential $1.3 Trillion market.

There will be winners and losers in the AI cycle, the question is, how can we participate, make money and at the same time limit our risk.

Read The Bloomberg Study Here: Bloomberg Research

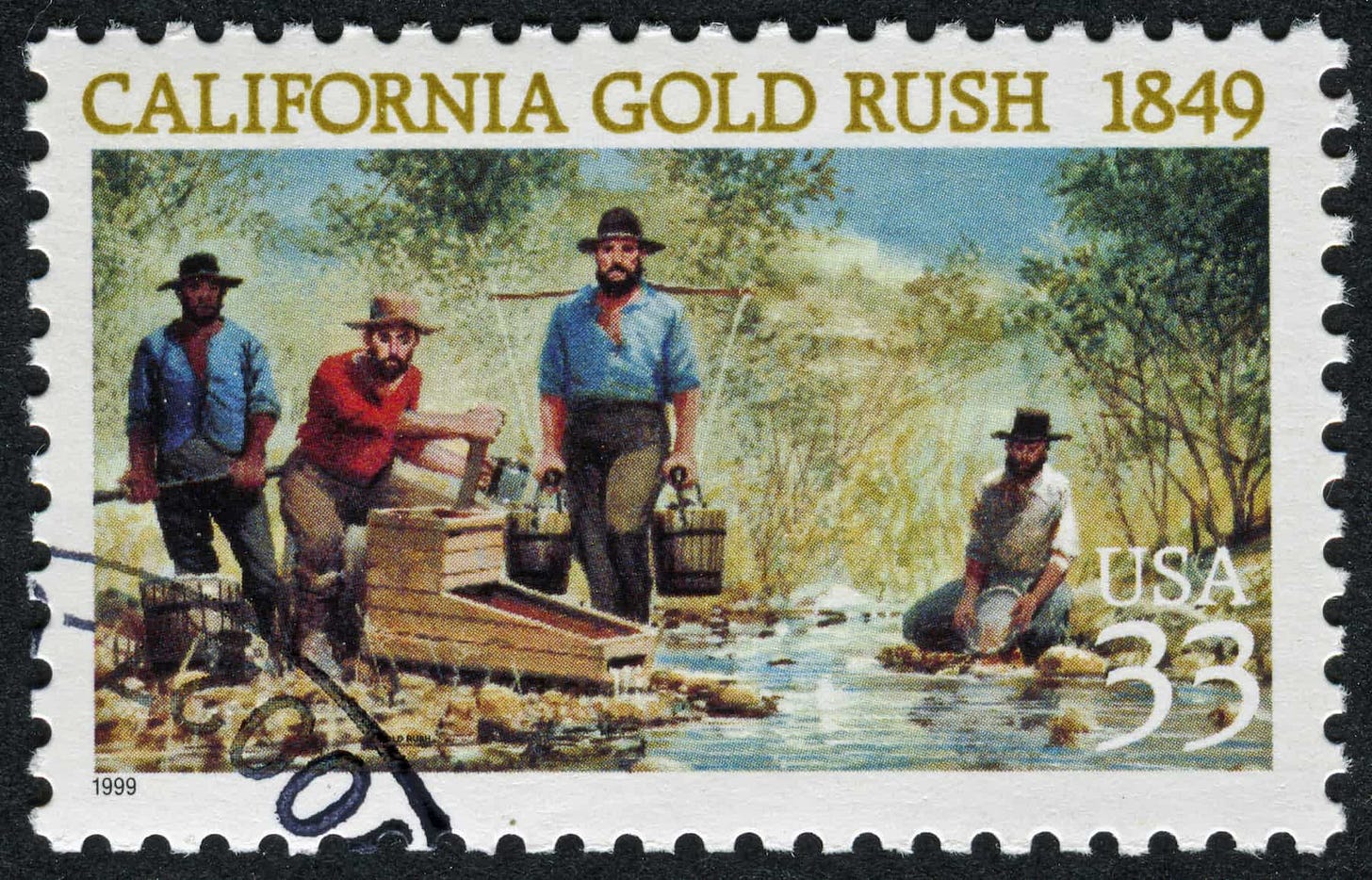

During A Gold Rush, Sell Shovels

The good news is that we can look for clues in corporate earnings reports that confirm or deny the validity of Artificial Intelligence.

We can look closely at those companies “selling shovels” to the new generation of entrepreneurs digging for gold in the new world of AI.

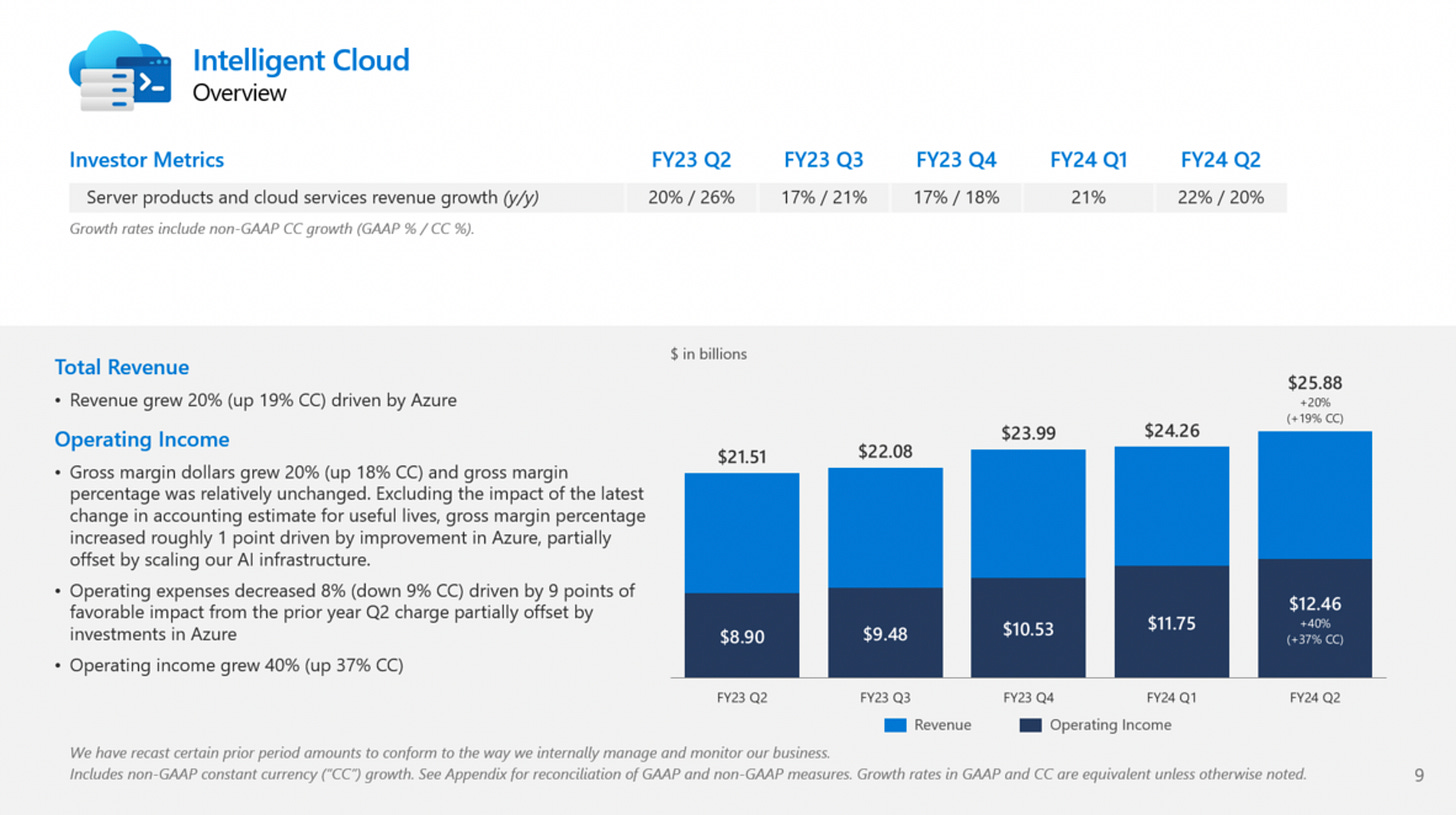

Microsoft MSFT 0.00%↑ recently reported FY24 Q2 Earnings.

Earnings: $2.93 per share, vs. $2.78 per share expected

Revenue: $62.02 billion, vs. $61.12 billion expected

Net Income: $21.87 billion

How many shovels are Microsoft selling?

We can find out by looking at the company’s Intelligent Cloud segment.

Intelligent Cloud brought in $25.88 billion in revenue, a 20% y/y increase and beating Wall Street expectation.

Digging deeper we find that 6% of Azure and other cloud services growth were tied to artificial intelligence.

Microsoft now has 53,000 Azure AI customers, and one-third of them became customers in the last year alone.

Above we’ve included an excerpt from Microsoft’s earnings call where Karl Keirstead of UBS touched on the impressive lift AI had to Azure - but questioned Microsoft’s ability to meet the wave of demand.

Alphabet GOOGL 0.00%↑ recently reported Q4 Earnings.

Earnings: $1.64 per share vs. $1.59 per share expected

Revenue: $86.31 billion vs. $85.33 billion expected

Net Income: $20.7 billion

Google recently launched its largest and most capable AI model - Gemini.

Google plans to license Gemini to customers through Google Cloud as their go to market strategy for monetizing AI.

Demand is growing at Google Cloud as revenue posted $9.19 billion vs $8.94 billion expected.

26% growth in Q4 with operating income of $864 million compared to a loss of $186 million same quarter last year.

Alphabet reported its fastest quarter for revenue growth since early 2022 - per CNBC

They’re going to be hundreds if not thousands of AI start ups - most will fail, other will win big.

We don’t necessarily have to be smart enough to pick the winners - we can bet on the companies “selling shovels”.

Corroboration In Semiconductors

Currently the market is telling us that the AI boom is real - we can look to strength in semiconductor stocks for confirmation.

AI tools will be powered by semis - if revenue growth is robust and earnings are accelerating, this tells us that demand for AI chips is high.

NVIDIA NVD 0.00%↑ continues to break out from a cup with handle base into new highs - extended, but shows the point that we have corroboration in price.

Open AI continues to be a large customer of Nvidia’s chips along with Microsoft - it’s important we look to the companies that are supplying the backbone to the AI movement.

Another semiconductor company that will power AI is AMD 0.00%↑.

Advanced Micro Devices CEO Lisa Su is forecasting a bold $400 billion total addressable market by 2027.

Watch her latest appearance on CNBC above.

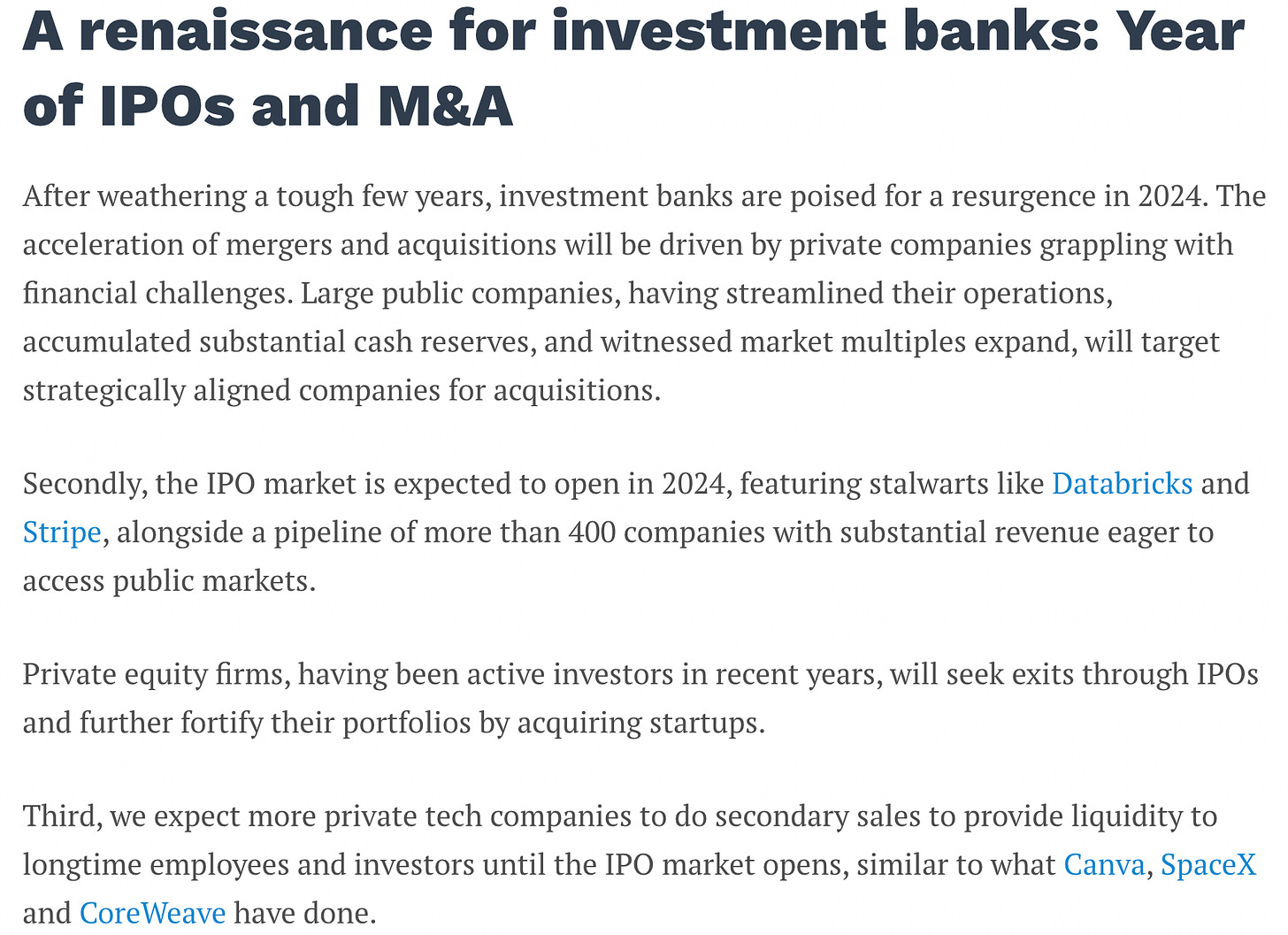

Where Are The Artificial Intelligence IPO’s?

In previous newsletters we outlined the sluggishness of the IPO markets in 2022 - 2023.

There were 1035 IPOs on the US stock market in 2021, an all-time record. It was 120.4% higher than the 480 IPOs in 2020, which was also a record.

As the Federal Reserve started to hike interest rates, the IPO markets came to a screeching halt - there were just 181 IPOs in 2022, an 83% decrease!

CEO of Citadel - Ken Griffin sees the recent blockbuster Arm Holdings plc ARM 0.00%↑ IPO as a strong indicator that Capital Markets are reopening for IPO’s.

This could spark a new wave of deal making on Wall Street and bring about a wave of pure play AI IPO’s.

It is our view that until we start to see actual AI companies come public, we are still in the early innings of an AI induced bull market.

Monetary Policy Updates

The first Federal Open Market Committee (FOMC) meeting of the year kicked off January 30 - 31.

The Fed held steady with a pause in the hiking cycle, the current Fed Funds Rate is 5.25% - 5.50%.

Federal Reserve Chairman Jerome Powell shot down the chance of a rate cut in March, saying that the Fed is committed to getting inflation down to the 2% mandated target.

Despite Jerome Powell’s conviction of no rate cut in March, the CME Fed Watch tool is still showing a 42.8% probability we end the year with a Fed Funds Rate of 3.75% - 3.75%.

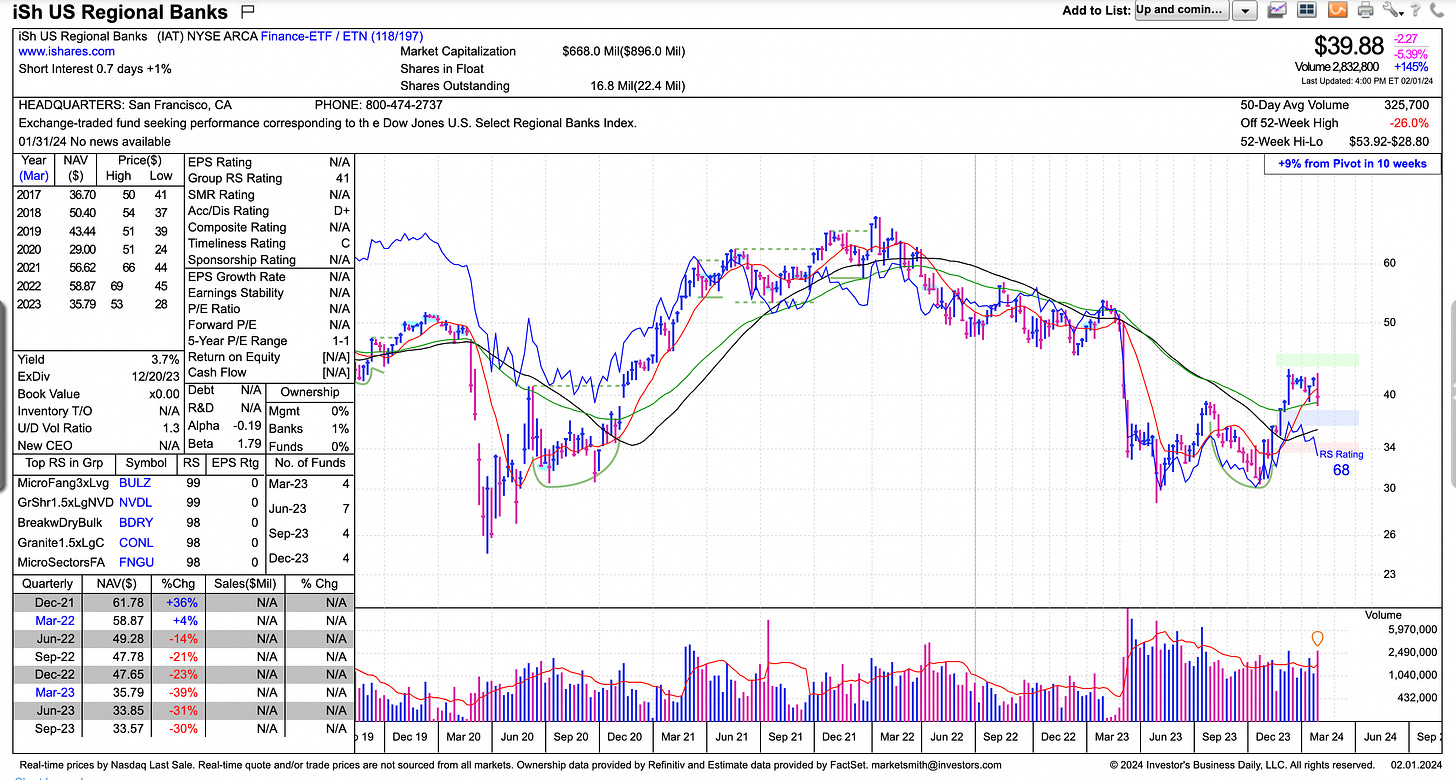

Is the market suggesting the Fed will be forced to pivot due to some black swan event?

Do we see more trouble in the Regional Banking Sector on the horizon?

We will explore this and more in the next issue - Behind The Street.

New York City Real Estate - Featured Listing

75 First Avenue is one of the most luxurious residential boutiques in the East Village designed by star Italian architect Stefano Pasqualetti.

Penthouse 8A is on the market for $5,250,000 and sports 3 Bedrooms 3 Bathrooms and over 1,100 SF of exterior space with unobstructed views of Midtown Manhattan.

Listing Highlights:

3 Bed 3Bath

1,757 INT SF

1,100 EXT SF

White Calacatta Oro Marble Countertops & Backsplash

High-end Appliances from Miele

Nublado Raw Textured Marble Walls

Click Play Below To Tour Penthouse 8A at 75 First Avenue

Updates

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.

See you in the next issue - Behind The Street.

Bravo Tom - the tour was just amazing in the video! You are paving the way in so many levels in your walk with higher success, and I feel inspired watching your RE clips that are the example of your path.

Congratulations,

Nina - So CA

Tom,This issue with it's focus on AI was not only informative,but you made it also fascinating. AI will quickly become part of everyone of us,and it's evolution will surely catch all of our interests!! This was a great issue!!