The Qualities of Leading Stocks - MARKET UPDATE - Ethereum ETF Approved

Mega Cap Tech Earnings Hit Across The Board

We can learn from Memes

The truth is in the comedy - a reminder for investors to stick with the quality instead of speculating on what could be.

Investors often try to get cheeky by purchasing stocks with no earnings, no sales and no proven product - betting on the “next best thing”.

The next best thing is likely already outperforming the market and is doing so for a reason: Sales are ramping, earnings are exploding and TAM (total addressable market) is expanding.

May 22, 2024 marked the sixth beat and raise earnings report for NVDA 0.00%↑, the stock is up over 400% since the 02/22/2023 earnings report.

NVIDIA is up over 100% since the start of the year, and to no surprise - the last six quarters all beat expectations with EPS growth up 429%, 593%, 486%, and 461% respectively.

Studies of TML’s (True Market Leaders) show that the bulk of a stocks move happens within a duration of 90 weeks before topping or going dormant and basing.

Lastly, in a strong market leaders will almost always be hanging out near the highs - either 52 week high or a new record high, a sign of institutional sponsorship.

Stocks that are stuck in the mud will often stay stuck in the mud, don’t bottom fish and try to pick stocks from the bottom of the barrel as very seldom do they outperform the market.

Checking In on Bitcoin

Bitcoin is forming a handle since making a run to new record high territory at $73,000.

Structure is near perfect with price running up the right side of the base, handling and creating a shake out before taking off again past the March swing high.

Bitcoin’s handle is getting a little long in the tooth at nine weeks in duration, the longer it takes to break out - the higher the probability of a break down.

You can set your stop loss on the break through the bottom of the handle.

We are bullish Bitcoin and Ethereum after the recent Ether ETF approval.

Negative News Positive Catalyst

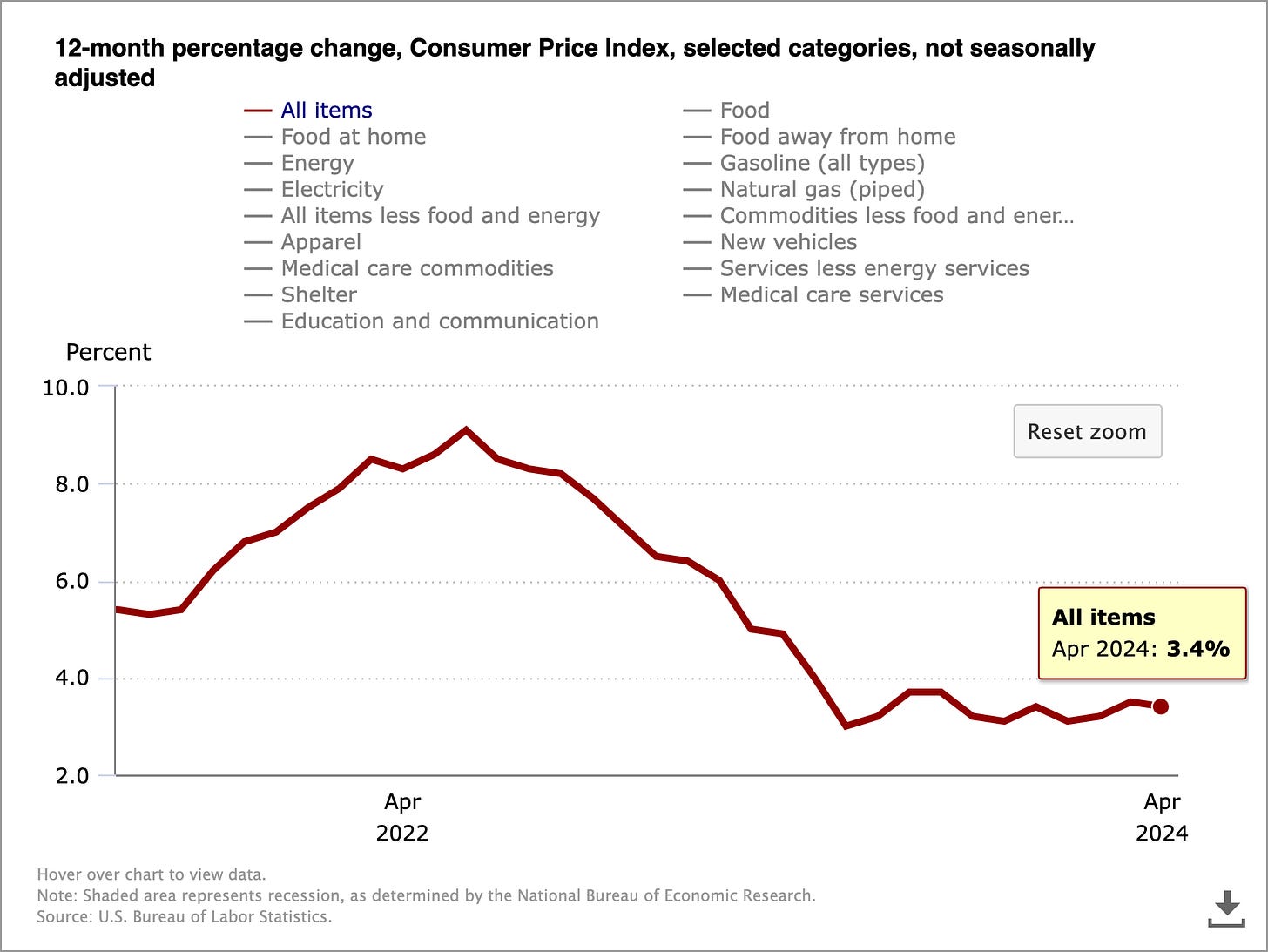

Inflation remains elevated in the United States with the latest CPI report for April coming in at 3.4% - much higher than the Feds 2% target.

Higher inflations pushes retail and institutional investors into finite assets like Gold, Silver, Bitcoin and commodities in general.

Inflation hit a low in June 2023 at 3% and has since struggled to make further progress towards 2% - is sustained 3% inflation the new normal?

Shelter will be the deciding factor to how fast the headline number will retreat towards 2%.

The good news is we are making progress but the progress has been a slow but steady grind lower - real estate being less liquid, generally takes longer to adjust to a higher rate environment.

Above all is supply and demand - the more units set to come onto the market the more demand is satiated and prices will ease.

Inflation Has Affluent Consumers Trading Down

Walmart reported outstanding results pushing the stock to a new record high.

Earnings per share: 60 cents adjusted vs. 52 cents expected

Revenue: $161.51 billion vs. $159.50 billion

Net income: $5.10 billion

According to data from YouGov: Consideration for Walmart among households earning over $100,000 per year has risen from 50.6% in 2023 to 54% in 2024 so far.

Does inflation have anything to do with this?

Absolutely; but to the credit of Walmart, they’ve done a great job appealing to a more affluent customer base by providing healthier options and investing heavily into e-commerce.

E-commerce growth reflects double-digit increases in store-fulfilled pickup and delivery, growth in marketplace due in part to a 36% increase in sellers, and Walmart Connect advertising growth of 26%

Consumers want great prices, healthy options and convenience.

E.L.F - TML Characteristics

A company we’ve talk about before, E.L.F Beauty: recently reported earnings that beat expectations while reporting its first billion dollar fiscal year.

Earnings per share: 53 cents adjusted vs. 32 cents expected

Revenue: $321.1 million vs. $292.6 million expected

Net Income: $14.53 million

Double digit sales growth, double digit earnings growth, double digit gross margins along with institutional sponsorship is the “magic elixir” of a True Market Leader.

Q1 2024 ELF 0.00%↑

71% Sales Growth

26% EPS Growth

71% Gross Margin

Increasing Institutional Sponsorship

Looking out into 2025, E.L.F expects full year sales to increase 20% - 22%, Adjusted EPS to be in range of $3.20 - $3.25, and Net Income in range of $187 - $191 million.

“Fiscal 2024 marked our strongest year of net sales growth on record, a continuation of the exceptional, consistent, category-leading growth we’ve delivered,” said Tarang Amin, e.l.f. Beauty’s Chairman and Chief Executive Officer. “In Q4, we grew net sales by 71% and expanded our market share by 325 basis points, marking our 21st consecutive quarter of net sales and market share growth. As we look ahead, we believe we are still in the early innings of unlocking the full potential we see for e.l.f. Beauty across cosmetics, skin care and international markets.”

As you’re searching the market for your next investment - remember the “magic elixir” of a True Market Leader.

Double digit sales growth, double digit earnings growth, double digit gross margins along with institutional sponsorship is the “magic elixir” of a True Market Leader.

BioTech - A New Bull Market

Biotechnology is not our area of expertise and therefore we feel as if we have no edge, however, BBH 0.00%↑, looks to be trying to emerge out of a stage 1 base.

With all the talk about AI and machine learning - much of the outstanding innovation in biotechnology is being overlooked.

If you have a background in Biotech or biology, there is likely a significant opportunity for you to quickly identify the winners in this new emerging cycle.

For us, we will stick to price - if BBH 0.00%↑ can sustain a break out over $170 on high volume, this may be actionable.

It is best to wait for price to work its way through most if not all of its over head supply before engaging.

If the Biotechnology sector as a whole gets trending here, there is going to be an unbelievable opportunity to generate alpha in the individual stocks.

If you have an edge - USE IT!!!!!

Ethereum spot ETFs approved by SEC

We are what you would call Bitcoin maximalists, but with the SEC giving the green light to spot Ethereum ETF’s we might just change our tune.

The recent ruling by the SEC further solidifies crypto into the financial markets and legitimizes the asset class.

ETH is currently forming a multi year cup with handle, a break out over the handle at $4,110 will warrant a position in size - laddering up through and into record highs.

As the market adapts we adapt and with the SEC providing at least a little bit of regulatory clarity, more market participants will feel comfortable adding exposure to the asset.

We thought we were extremely early with Bitcoin in 2017 - we continue to hold the view that we are in the very early innings of adoption with Bitcoin and crypto assets.

As a reminder, the global crypto market cap is $2.55 trillion.

Thats about 1 NVIDIA, the entire ecosystem - think about that.

We think Bitcoin alone goes to $10 trillion over time.

Video Coming Soon

Coming soon! Behind The Street will be publishing market update videos every other day and a market outlook video on Sundays.

Stay tuned for an official launch date, we will upload on YouTube.

Thank You

A big THANK YOU to all of our clients! Without your support we wouldn’t have been able to secure #1 Medium Team - Transactions.

Updates

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.

Is there a systematic way to track TMLs using the metrics described above? As in, show me all stocks which recorded double digit growth in sales, earnings etc. or is this something you got to 'hunt' for per stock instead instead of pulling a summary at scale