S&P 500 NEW RECORD! Americans Don't Believe It - Here's Why

49% of Americans incorrectly think that the S&P 500 is down for the year.

The S&P 500 hit a new record high on Wednesday, but just about half the country believes that the general market is down for the year. Why?

It is true that market participation in the U.S. is at a record high with 58% of households owning stocks in 2023, according to the Fed's Survey of Consumer Finances.

However, the wealthiest 10% of Americans own over 90% of all stocks.

Read Gallup Survey: HERE

With such high concentration at the top, it’s no wonder why the average American has such a negative outlook on the market.

Americans are not just negative on stocks, they are negative on the economy.

According to Market Watch: A recent poll shows 56% of respondents said the U.S. is suffering through a recession.

Fact: The American economy is in the middle of a 4-year expansion.

The divide between your average American and the Ultra Wealthy continues with real estate.

According to Fed Data in Q3:

The bottom 50% of households held $4.8 trillion of real estate assets.

The top 1% held over $6 trillion in real estate assets.

Thats right, the top 1% of Americans hold more real estate than the bottom 50% combined.

Overall wealth held by the top 1% stands at $19.97 trillion while the bottom 50% holds just $3.66 trillion.

Inflation - A Tough Conversation

Let’s talk about inflation - you guessed it!

According to new polling data, 72% said they believe the rate of inflation is increasing.

This is correct, but inflation is down significantly from the June 2022 high of 9.1%.

April 2024 CPI: 3.4%.

The wealthiest Americans are generally insulated from inflationary pressures as the very assets they hold are simultaneously being inflated - increasing in value.

This is why inflation is a death sentence to the average American who holds little in assets and needs to rely on income to keep up with inflation.

As shown in the chart above, for most of 2021 & 2022 wages did not keep up with inflation - forcing Americans to spend a larger percentage of their incomes to survive.

This is reason enough for the Federal Reserve to be steadfast in their pursuit of 2% inflation - the average American can’t sustain with 3% inflation prints.

A Decade of ZIRP

How did we get here?

What caused this great wealth divide in America?

In an effort to bring the U.S. economy out from the depths of the 2008 financial crisis when unemployment hit 10.2% and GDP growth plummeted to -2.6%: The Federal Reserve took interest rates to zero.

Question: Who had access to all this cheap money?

Answer: The top 10% of Americas / The Wealthy.

Cheap money acted as a major economic stimulus that allowed individuals and corporations to borrow money at incredibly low rates to acquire assets and invest in businesses.

ZIRP also kicked off the strongest bull market the world has ever seen with the S&P 500 up over 700% since the financial crisis low.

Real Estate assets recovered after individuals and institutions were able to scoop up distressed assets from the subprime crisis at fire sale prices.

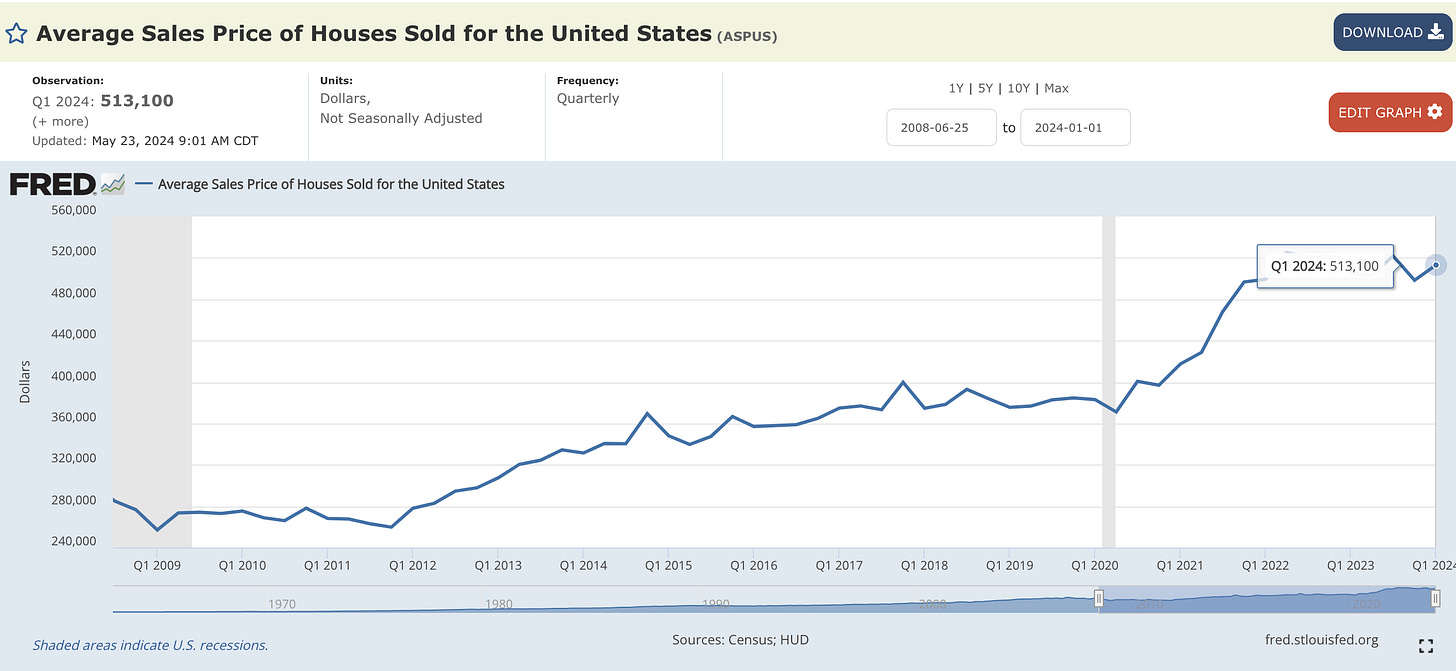

The average sales price of a house sold in the United States in Q1 2009 was $257,000.

In Q1 2024 that number ballooned to $513,100.

This is a perfect visual representation of asset price inflation.

As reviewed above, by and large the top 10% of Americans benefited.

Consequences of ZIRP

With so much long duration debt outstanding at low interest rates - the most recent Federal Reserve hiking cycle has caused problems at many banks.

There is an inverse correlation in the debt market - as interest rates go up, the value of bonds decline and vice versa.

Above is a chart of the iShares MBS ETF: Exposure to broad range of U.S. mortgage-backed bonds, including those issued by government sponsored enterprises such as Ginnie Mae, Fannie Mae, and Freddie Mac

As the Fed took rates from 0% to 5.50% the value of mortgage backed bonds declined significantly.

The steep declines in MBS is arguably what caused the collapse of Silicon Valley Bank as they were long duration at extremely low rates.

When depositors started to withdrawal funds from Silicon Valley Bank, they were forced to sell assets in order to cover deposits - problem is the value of those MBS assets were cut in half.

Unrealized losses on available-for-sale and held-to-maturity securities increased by $39 billion to $517 billion in the first quarter. Higher unrealized losses on residential mortgage-backed securities, resulting from higher mortgage rates in the first quarter, drove the overall increase. This is the ninth straight quarter of unusually high unrealized losses since the Federal Reserve began to raise interest rates in first quarter 2022. - FDIC

Read: FDIC Quarterly Banking Profile First Quarter 2024

As you’ll read in the FDIC quarterly banking profile - the banking sector is actually quite healthy in the U.S. with net income of $64.2 billion in the first quarter, up 79.5% from the prior quarter.

The problem lies in unrealized losses on available-for-sale and held-to maturity securities.

This, in our view is a result of ZIRP.

Second Newsletter

As you can tell, this weeks Behind The Street was structured different than most.

We thought this topic was important enough to allocate a stand alone letter, we will be publishing a complete market update letter Thursday June 16.

Big Ideas: Watch Bitcoin & Gold as these look just about ready to go!

See you next week.

Video Coming Soon

Coming soon! Behind The Street will be publishing market update videos every other day and a market outlook video on Sundays.

Stay tuned for an official launch date, we will upload on YouTube.

Thank You

A big THANK YOU to all of our clients! Without your support we wouldn’t have been able to secure #1 Medium Team - Transactions.

Updates

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.

Great job!

Your newsletters are always very interesting. Reminds me of Jared Dillian, how he started..