The investing world has suffered great losses in the past, but 2023 has brought the loss of three of the world’s most notable investors.

All coming from humble beginnings and building their businesses into the massive empires they are today.

Each showcasing that anything is possible in the United States of America.

William O’Neil - Investors Business Daily

Bill O’Neil was born in 1933 on the Southern Plains of Oklahoma.

He studied business at Southern Methodist University, served in the United States Air Force, became the youngest person to buy a seat on the New York Stock Exchange, founded William O’Neil + Co in 1963, and created one of the most successful investing newspapers - Investors Business Daily - that later sold to News Corp for $275 Million.

Lesson: Relentless American Optimism

Bill taught us that in order to be successful in investing and in life, you must have an unrelenting optimism on America and American businesses.

The United States of America will continue to churn out unlimited investing and business opportunities in perpetuity, forever, for anyone who wants to take advantage.

America is a brain drain on the rest of the world.

The best and brightest people overwhelmingly choose the U.S. as the place to start a business, raise a family and pursue the American Dream.

So long as the Golden Goose of Capitalism isn’t suffocated by socialism, it will continue to lay its golden eggs that produce the most successful, innovative and profitable companies the world has ever seen.

Best of all, you and I will have the opportunity to share in that growth.

The opportunities in America are endless.

Charlie Munger - Vice Chairman of Berkshire Hathaway

Charlie Munger was arguably one of the greatest value investors of all time, serving as the right hand man to Warren Buffet, CEO of Berkshire Hathaway.

Charlie constantly told investors to focus on profitable businesses with a wide moat in a growing total addressable market.

“The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage. The products and services that have wide, sustainable moats around them are the ones that deliver rewards to investors.”

Warren Buffett & Charlie Munger

Lesson: Be a Life Long Learner

Aside from Mr. Munger’s investing principles that we all know and love, what stood out the most was his focus on reading consistently and acquiring new skills.

The world we live in is changing every day and if you are not reading, exploring and trying to understand new trends - you are going to get left behind.

The importance of being a life long learner is more critical now than ever before.

Charlie advises to get into the habit of reading 15 minutes per day, pick a topic that interests you and dive in.

The more you read the more likely it is that you develop a competitive edge, in the investment business, the way you find success is by finding an edge.

The value investing hand book is Security Analysis by Benjamin Graham & David Dodd - recommended reading to fully understand the investing methodology of Warren Buffet and Charlie Munger.

Take Charlie Mungers advice, read more and start here.

Sam Zell - Legendary Real Estate Investor

Sam Zell is a true American success story and embodies what the American Dream is all about. He was born from Jewish parents who fled from Poland four months before his birth to escape the Nazi Invasion of Poland.

By the time Sam graduated from the University of Michigan he was already managing over 4,000 apartments and owned over 150 units outright.

His contrarian bets coined his nickname “The Grave Dancer” as he would acquire mismanaged properties at significant discounts in hopes to improve the operations of the business.

This strategy made Sam Zell a Real Estate Billionaire.

Lesson: Take Risk

Sam Zell famously said that all the opportunity in the world means nothing if you don’t actually pull the trigger. Maximize the opportunity to take risks when you’re young, especially if you live in the United States.

People tend to think the risk they are taking is bigger than it actually is, this prevents individuals from taking action and pursuing what they really want in life.

An example would be having a great business idea but not wanting to pursue it because you are afraid of giving up your salary at work.

You think about the cataclysmic life altering impacts should you take the risk, quit your job and the business fails.

In reality, if the business fails you just go back and get another job.

Humans are programed for survival, we are not programmed to thrive.

Your mind will prevent you from going after what you really want because your brain is programmed to keep you safe.

Listen to Sam, take the calculated risk

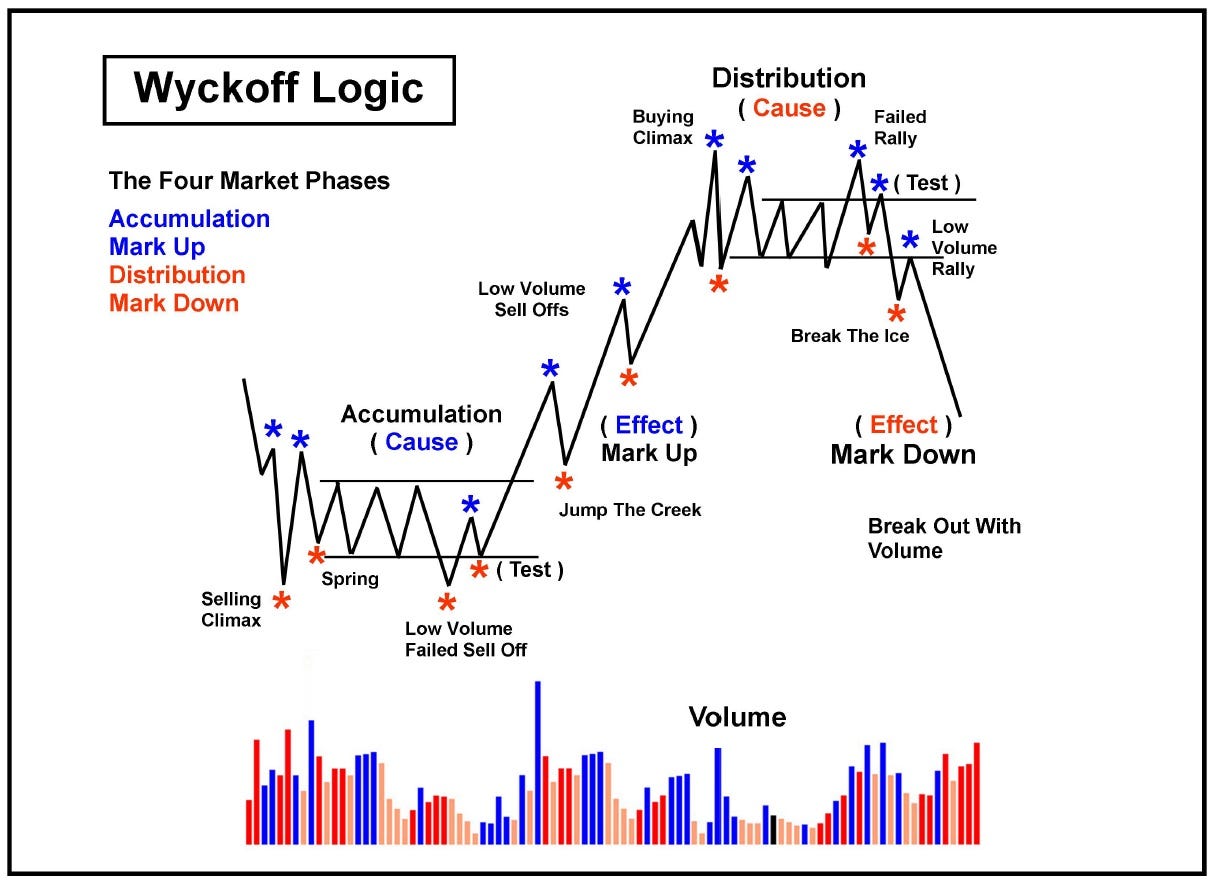

Understanding Market Cycles - Wyckoff

There are four market phases every trader and investor must know.

Accumulation

Mark up

Distribution

Mark Down

Richard Wyckoff was one of the most successful stock market operators of all time and the founder of Wyckoff Theory.

Wyckoff Theory states that there is a “composite operator” that dictates trends and direction in the market.

The composite operators are the large institutional investors on Wall Street - Hedge Funds, Family Offices, Prop Traders, Banks and Mutual Funds.

Institutional traders are managing the big money on the street and can take months, even years to accumulate full position sizes in the market.

By analyzing the tape and looking at volume profiles, we can identify whether the market is under accumulation or being distributed.

We are currently watching ARKK 0.00%↑ after an aggressive bear market sent the ETF tumbling -82% from the previous record high in February 2021, right before the Federal Reserve launch quantitative tightening, raising interest rates.

ARKK is an ETF comprised of high beta growth stocks that generally perform poorly when interest rates rise.

When rates are low, the present value of a company’s future cash flows are worth more and when interest rates start moving higher, the present value of the company’s future cashflows decline.

It is our view that the bear market in growth concluded in May 2022 and that we are now entering a re-accumulation phase.

Much of the trading activity in ARKK has taken place between $31 - $52, showing this is where institutions, “composite operators” see fair value and are comfortable accumulating shares.

In our view it is likely ARKK trades in this range for some time, but risk is to the upside once previous share holders are shaken out.

Fed’s Last Opportunity In 2023

The last Federal Open Market Committee meeting will take place December 12 -13.

Currently, the Fed Funds Rate sits at 5.25% - 5.50% with the market showing a less than 30% chance of a rate hike at next weeks meeting.

October’s better than expected CPI report sparked a major rally in the bond market putting downward pressure on rates across the curve.

October’s Headline CPI print came in at 3.2%, down from 3.7% in September and 7.7% October 2022.

The US 10-YR Yield has now declined from 5% in late October to 4.1% as of December 7th, as bonds have been rallying aggressively after one of the worst performing years on record.

Bond yields decline as prices go up - Bond yields increase as prices decline.

TLT 0.00%↑ - ishares 20+ Year Treasury Bond ETF has been rallying back to its declining 200 day moving average in a mean reversion trade.

When prices get overly extended to the downside from major moving averages, prices generally revert back to the mean in time.

Notice the substantial uptick in volume as the ETF capitulated into the lows.

On October 10, 2023 we posted the following tweet pointing out the likely capitulation in bond prices, just two weeks from the bottom.

Reviewing Wyckoff Theory above, a substantial pick up in volume on major price declines can be a signal for the conclusion of the mark down phase.

Conclusion: The bond market may be pricing in rate cuts in 2024.

Narrative Breaker - Home Builders

In spite of having the highest interest rates on a 30 Year Fixed Mortgage since 2001, home builder stocks are trading at 52 week highs and some, breaking into record high territory.

Our Two part Thesis:

The Market is Always Right

Over a decade of artificially suppressed interest rates have resulted in roughly four in five homeowners with a mortgage interest rate below 5% and nearly one-quarter have a rate below 3%. Reducing resale supply and decreasing motivation to move.

The supply is going to come from new development, plus builders are able to get creative to get deals done including rate buydowns and other incentives.

The above chart depicts XHB 0.00%↑ SPDR Series Trust Homebuilders ETF breaking out to an all time record high, leading the general market.

The S&P 500 has yet to make a new high since 2021, homebuilders are a market leading sector, at least for now.

Other leading sectors include cybersecurity and semiconductors.

PulteGroup PHM 0.00%↑ broke out from a cup base into new highs, now extended from its 50 & 200 day moving average.

The 3 Largest Bases

There are 3 distinct bases forming in the market that every trader and investor should pay attention to.

Japan Nikkei 225

Gold

Bitcoin

Japan Nikkei 225

The Nikkei has been building out the right side of a cup base since the lows of the great financial crisis, approaching the previous record high set in 1989.

With the shake up in global supply chains away from mainland China - Japan, South Korea and India should be the largest beneficiaries.

It is possible that the move in the Nikkei 225 is just getting started.

Gold

Gold recently broke out to an all time record high, trading at $2,144 but quickly failed and was rejected back into its base at $2,028.

Gold tends to have explosive rallies accompanied by decade long consolidations to digest the move.

A sustained breakout above $2,100 should justify a position in size with risk managed at 3% - 5% - 7%.

Bitcoin

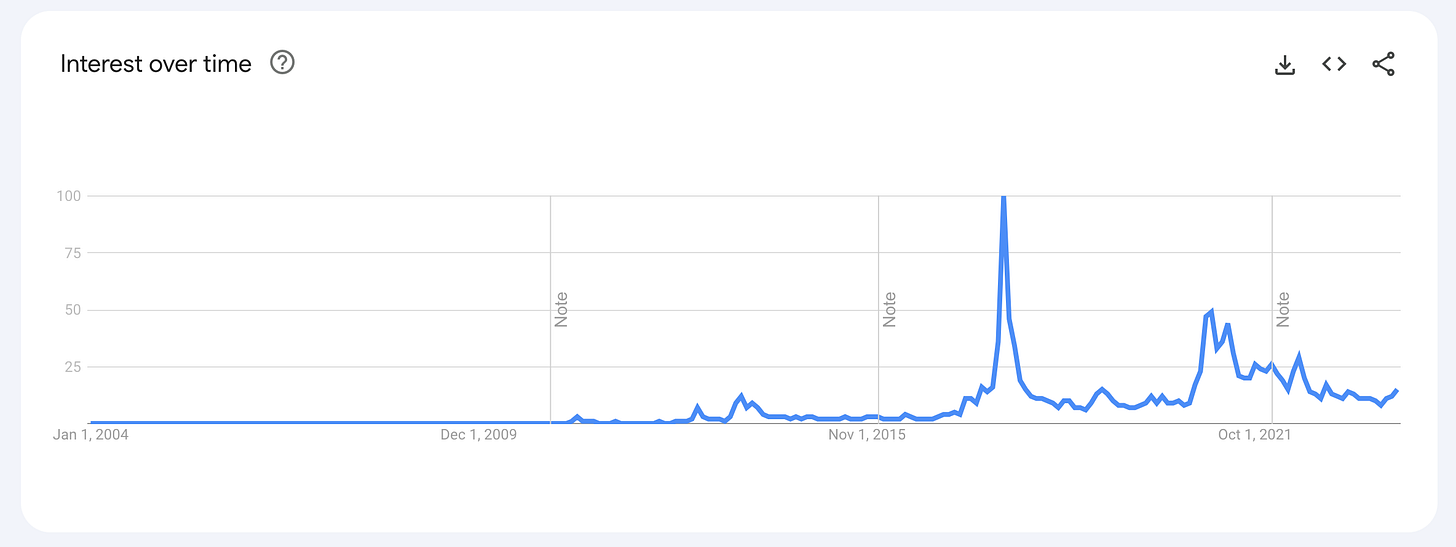

Digital gold is starting to break out over $40,000 while investor interest has been generally muted, another bullish sign.

The interest in Bitcoin is currently near record lows while price has rallied 185% from the November 2022 low, a very positive sign and an indicator that the move may just be getting started.

Our approach with Bitcoin has been to accumulate when overall investor interest is low, while trimming and using heightened investor interest as exit liquidity to reduce position size.

Remember, Bitcoin is the worlds only unconfiscatable asset and with geopolitical tensions rising across the globe - Bitcoin will serve as a hedge to tyrannical governments.

New York City Real Estate - Featured Listing

The next issue of Behind The Street will feature our newest project at 435 W 19th Street and include a video tour of the penthouse.

75 First Avenue is one of the most luxurious residential boutiques in the East Village designed by star Italian architect Stefano Pasqualetti.

Penthouse 8A is on the market for $5,250,000 and sports 3 Bedrooms 3 Bathrooms and over 1,100 SF of exterior space with unobstructed views of Midtown Manhattan.

Listing Highlights:

3 Bed 3Bath

1,757 INT SF

1,100 EXT SF

White Calacatta Oro Marble Countertops & Backsplash

High-end Appliances from Miele

Nublado Raw Textured Marble Wall

Updates:

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.

Lastly, If You Enjoyed The Newsletter, Support My Work By Sharing It.

Great tribute to the greats.