News is Always The Worst at The Bottom

When Peter Zeihan made an appearance on Joe Rogan in November 2022, he made a call that Bitcoin, at the time trading for $16,800, would continue its decline to $0 and perhaps even go negative.

2022 was one of the bleakest years for the Bitcoin and crypto space with two notable cataclysmic events happening just months apart.

Three Arrows Capital - ordered to liquidate on June 27, 2022

FTX Bankruptcy - November 2022

Keep in mind that FTX was once valued at over $32 Billion and Three Arrows Capital lost in excess of $3 billion over the course of 2021 - 2022.

A monumental number given that the total market capitalization of the entire space was under $800 billion at the time.

Events such as the FTX collapse and the Three Arrows Capital (3AC) collapse were green light bottom signals to professionals who study the markets and do this for a living.

Those two catalysts were the last crescendos to wash out all of the speculative excess and fraud in the industry.

Looking at the Bitcoin chart above, 3AC and FTX marked the bottom for Bitcoin and most crypto assets.

Markets bottom on a waterfall style sell off accompanied by extremely explosive volume with terrifying news headlines.

2022 checked all of those boxes for Bitcoin:

Major price declines

Explosive volume

Terrible news

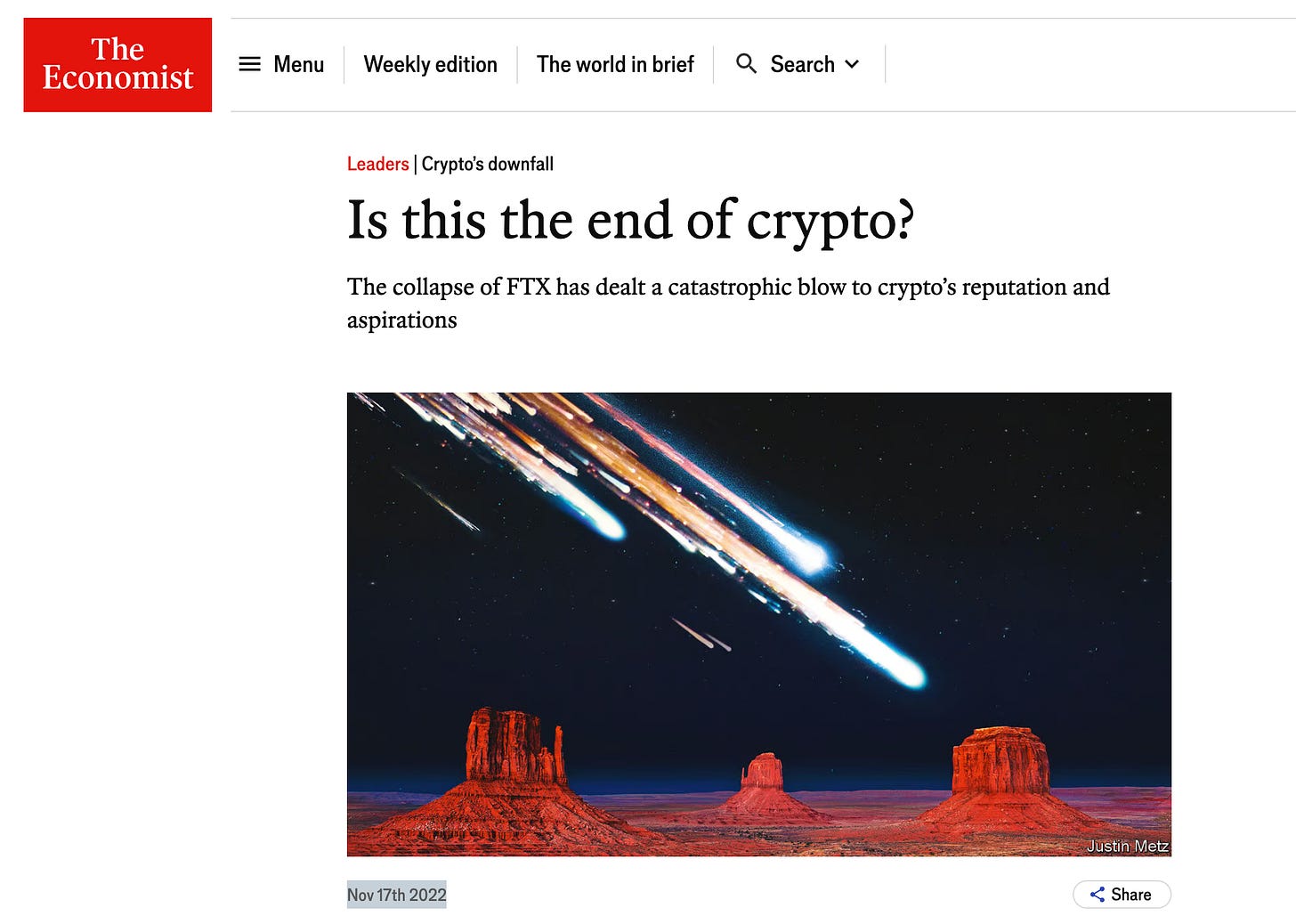

Pictured above is a screen shot of the media headlines covering the Bitcoin and the crypto ecosystem at the dead bottom of the market.

Notice The Economist headline “Is this the end of crypo” dated November 17, 2022.

Bitcoin was trading at $16,485 on the day this article was publish - Bitcoin also bottomed exactly 4 days later on November 21 at $15,530.

Since then Bitcoin has rallied 484% or $74,960.

Remember: at the bottom of bear markets usually comes a cataclysmic event that most market participants deem impossible to recover from.

This results in capitulation across the board where everyone "throws in the towel".

Rookies puke at the bottom, while smart money made an absolute fortune picking up the pieces from 3AC and FTX - all while Bitcoin whales continued to accumulate aggressively.

Read our Bitcoin bull thesis and Bitcoin Halving article - published December 21, 2023: HERE

The Death of SAB 121

The Trump administration will most certainly pave the way for the destruction of SEC SAB 121 - In our view, this will pave the way for an entire new meaning of institutional adoption.

Staff Accounting Bulletin 121 or SAB 121 - requires publicly traded banks who choose to custody crypto, list the assets on their balance sheet and create a corresponding liability equal to the worth of the crypto / Bitcoin.

Note: Bank custodial assets are always held off-balance sheet.

Read Securities and Exchange Commission [Release No. SAB 121] HERE

The September ruling that Bank of New York Mellon would receive SEC Exemption From SAB 121, marked a major turning point for the crypto ecosystem and for institutional investment into Bitcoin.

Read Full Article HERE

It is our position that once SEC Chair Gary Gensler steps down or is replaced by a Trump appointed candidate - we will see monumental changes in a shift towards pro Bitcoin / Crypto.

Why does it matter?

What happens when banks are allowed to custody Bitcoin just like any other asset?

Our Answer:

The financial system as we know it will expand exponentially and every single bank from JP Morgan, Goldman Sachs, Bank of America, Citi and others will start to offer products and services catered to the Bitcoin ecosystem.

Examples:

Banks will pay Bitcoin holders interest on their Bitcoin - similar to owning a U.S Treasury.

Banks will issue Bitcoin backed loans - think SOFR + 50 etc.

Bitcoin Collateralization - similar to banks accepting stocks as collateral for a loan. (SBLOC)

Remember:

The banks look to the regulator and the regulator looks to the President / Administration.

The rhetoric coming from the administration will influence how regulators make policy and the policy will determine how banks and other institutions act.

We are coming up on the most pro Bitcoin and crypto administration in history.

We advise to plan accordingly.

The Bond Market Mystery

U.S. Inflation is on its way down from a CPI peak of 9.1% to a recent October reading of 2.6%.

President elect Donald Trump announced the creation of the Department of Government Efficiency - D.O.G.E

If inflation is on a gradual and steady decline and if the Department of Government Efficiency will work to reduce wasteful government spending and reduce the deficit - why is the bond market selling off?

The yield on the 10YR U.S. Treasury is 4.43% - up 23% since September 18 and up 4% since the U.S. Presidential Election.

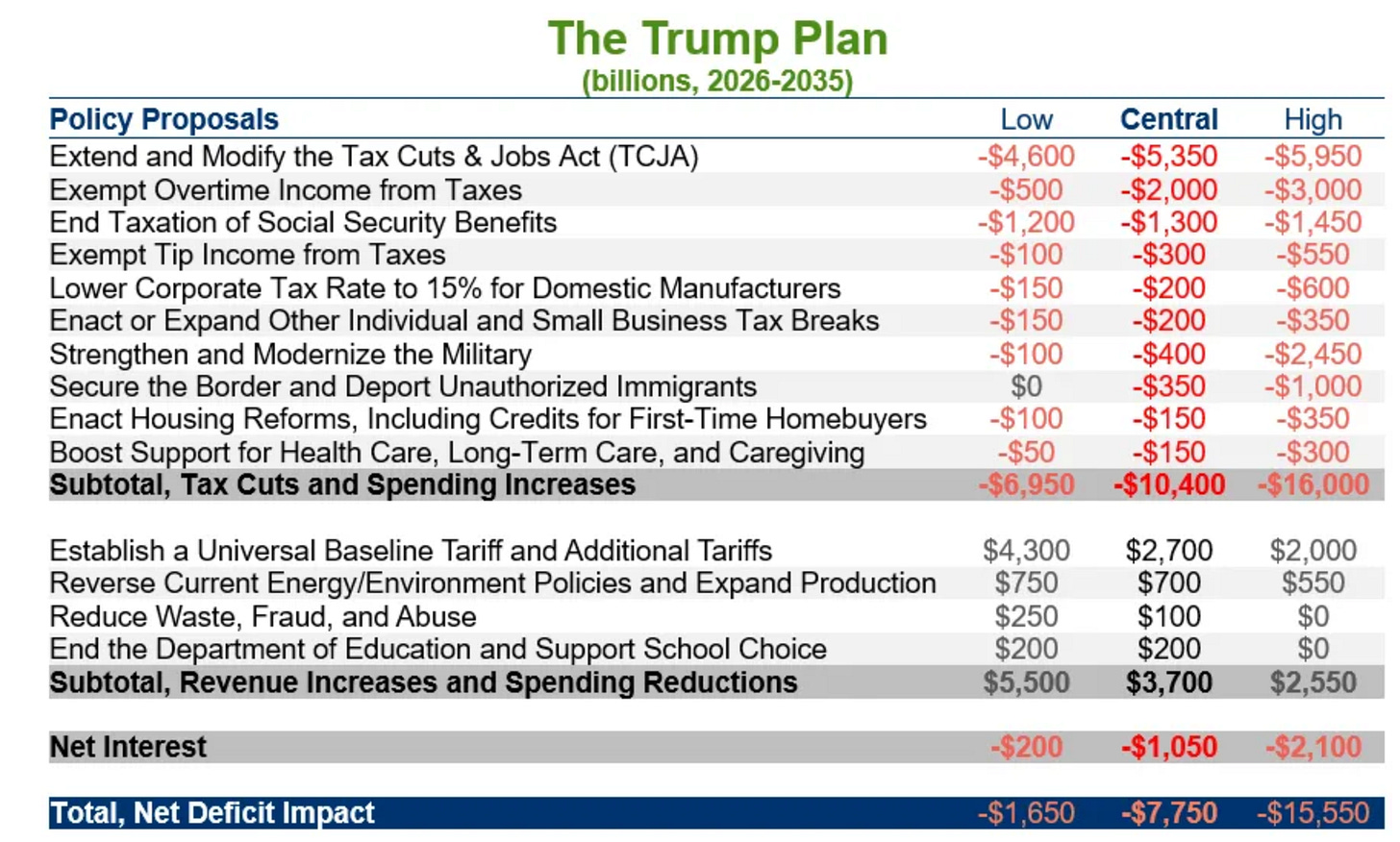

Perhaps the bond market is not yet convinced that D.O.G.E will be able to make a meaningful dent in the deficit and that President Trump will not be able to get congress to cut up the credit card.

According to the Committee for a Responsible Federal Budget they estimate that under Harris’s plan primary spending would rise to 21.8 percent of GDP in FY 2035.

Under Trump’s plan they estimate primary spending would rise to about 21.0 percent of GDP in FY 2035.

In conclusion, regardless of who won the Presidency - the market was expecting more of the same - more spending!

Read More HERE

The Charles Schwab of The New Generation

Charles Schwab SCHW 0.00%↑ once the major disruptor on Wall Street that forced the industry to drive down brokerage commissions and appeal to a larger retail audience.

As we study the history of the company and the founding vision for the brokerage giant, we can’t help notice the similarities with “the new kids on the block”.

Robinhood Markets HOOD 0.00%↑

Coinbase COIN 0.00%↑

Like them or not, Robinhood is doing a fantastic job of growing its customer base and growing net deposits.

Almost everyone we know under the age of 35 has a Robinhood account and raves about the easy to use UI.

The future is with the younger generation and what they use now will likely be what they continue to use going forward.

The rebellious attitude and the “move fast and break things” persona of the CEO Vlad Tenev reminds us of the early days of Schwab.

The same can be said with Coinbase COIN 0.00%↑ as it relates to the forward looking disruptive attitude towards an entirely new investing ecosystem of crypto.

Overwhelmingly, the younger generations are interested and want to invest in crypto.

We advise investors to skate to where the puck is going!

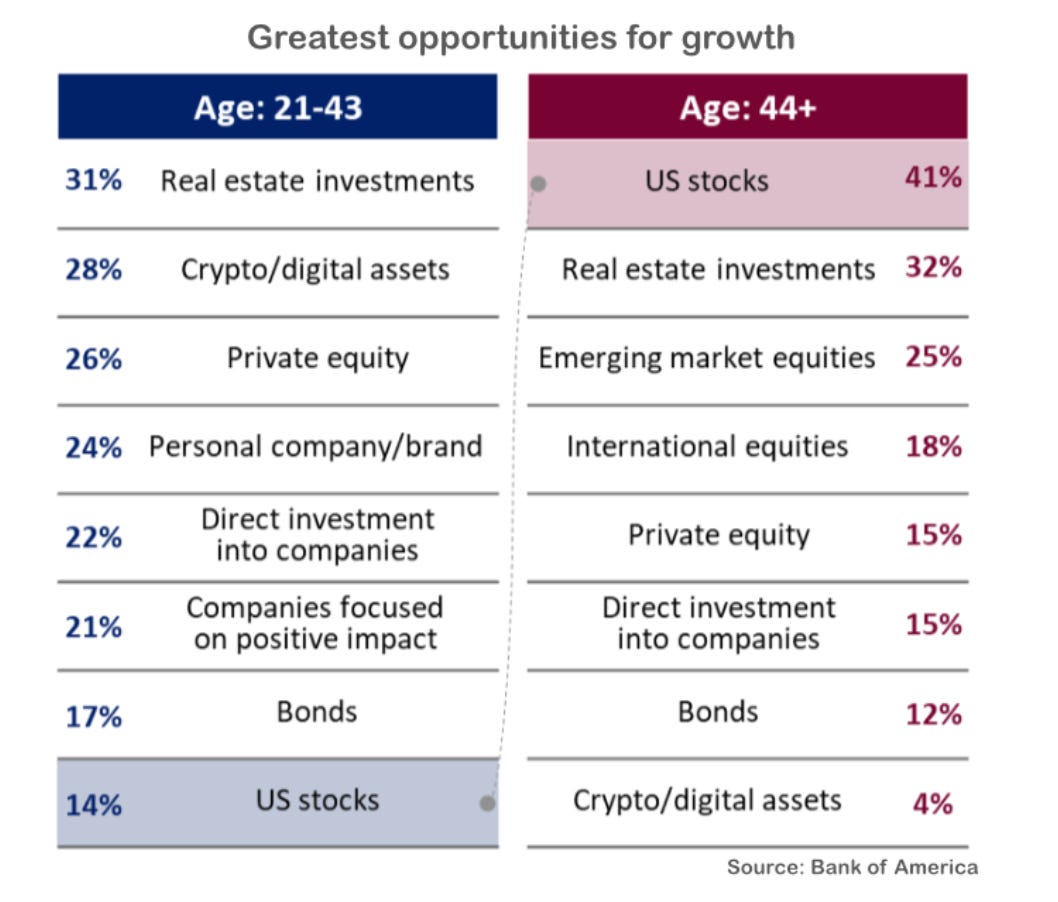

According to Bank of America, 28% of people age 18-43 see Crypto / digital assets as the greatest opportunity for growth.

Not only do we see similarities in the fundamentals, the technicals are aligning almost perfectly!

Let’s take a trip back to Charles Schwabs IPO - 1987!

Pictured above is the Charles Schwab Stage 1 IPO base before the stock broke out into new record highs in 1991.

You will notice the classic IPO sell off followed by sideways price action on low volume before the creation of a handle.

Similar action can be seen in the current stage 1 IPO base on Robinhood as the stock rallies up the right side of the base - likely to form a handle before breaking out into new high territory sometime in 2025.

Again we see the same action with Coinbase as the stock tries to emerge out of its Stage 1 IPO base and break above the handle into new record highs.

It is an important fundamental and technical story to pay attention to and as the famous American writer and humorist Mark Twain once said:

“History Doesn't Repeat Itself, but It Often Rhymes”. - Mark Twain

The early growth story of Coinbase and Robinhood seem to be rather similar to that of Charles Schwab but possibly more explosive and exponential.

Perhaps it would be wise to study the original vision for Charles Schwab by reading the book shown above, then make the decision if you want to own a piece of what we like to call “the infrastructure of the future.”

Good Luck!

Paul Tudor Jones Documentary Trader

As a bonus to this weeks Behind The Street, below you will find a link to the Paul Tudor Jones Documentary - often removed from the internet.

Take some time out of your week to watch this film, this documentary is more relevant than ever as we have many macro trade set ups in the market.

If you enjoy our newsletter - please share it with your co-workers, friends and family.

5 Beekman Street Penthouse

Take a look at our newest listing at 5 Beekman Street PH 51.

Listing Information: 5 Beekman Street #PH51 3 Bed 3.5 Bath 3,554SF

Updates

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.

Thanks for reading Behind The Street ! Subscribe for free to receive new posts and support my work.

Thanks for sharing. Great analysis. I fully agree with you on Bitcoin in the current scenario. Best of luck with the listed property; it looks fantastic.

How do I make money Sara got better Kirby I