Down Trend

THE TREND IS YOUR FRIEND

7 out of 10 stocks follow the overall market trend and the trend is down.

Be careful with new buys when the market is in a downtrend as your odds of success are limited.

EARNINGS POSITIVE - PRICE ACTION NEGATIVE

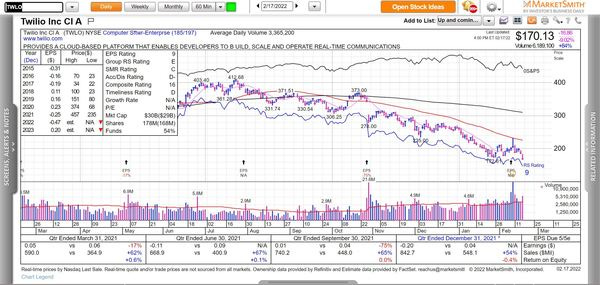

We have seen positive earnings reports from $TWLO, $NVDA, and $ZI but the stocks have sold off on good news.

$TWLO was up 20% after reporting and has since given back all gains, rallies are being sold. Fund managers are selling into strength.

This is a clear sign that growth stocks are not yet in gear. As we covered in previous newsletters, watch the leaders!

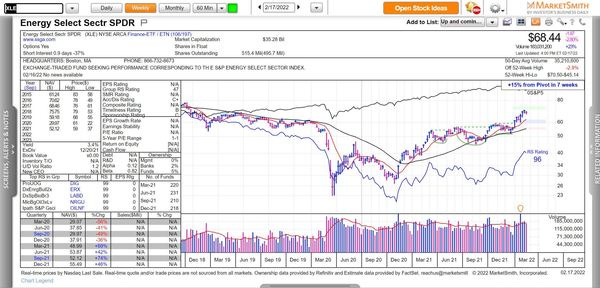

Oil & Gas, Tobacco, Financials, and Energy are leading this market. RED FLAG

$XLE - Energy leading the market, 96 RS. Clear rotation

$TWLO up 20% after ER, gave back all gains. Terrible RS of 9, bad.

Operation Desert Storm Jan. 16, 1991

On January 16, 1991 the U.S. Military started to attack Iraqi antiaircraft equipment destroying Iraqi radar sites.

The U.S. Military and coalition forces continued to attack Iraqi positions and supply lines for the next 42 days.

Feb. 24, 1991, the ground war began with U.S. and allied forces attacking with such force that masses of Iraqi troops began surrendering within hours.

Feb. 28, 1991, U.S. and allied troops in Iraq and Kuwait defeated the fourth largest army in the world and liberated Kuwait.

FEAR FEAR FEAR

During this time fear was at its peak with articles surfacing that the U.S. government was rushing to buy body bags, expecting massive casualties as a result from the war.

New York Times Article Jan. 16, 1991

Read New York Times Article Here: CONFRONTATION IN THE GULF: War Supplies; Somber Workers Press to Fill A Rush Order for Body Bags - The New York Times (nytimes.com)

Market Reaction To Operation Desert Storm

The S&P 500 surly sold off and crashed. Right?

Quite the opposite, on Jan. 17, 1991 the market had a massive follow through day, up almost 4% on thunder volume and kicking off the start of one of the strongest bull markets in history.

S&P 500 01/16/1991 Follow Through Day

This was the bottom for the stock market on the day of the attack.

The S&P 500 went on to rally 18%, just a reminder to listen to the market and ignore the news.

Usually the market will turn when the fear is so great you won’t want to buy, you will want to sell everything and hide in a corner.

Pay attention to price action, monitor follow though days, manage risk, and be ready when the market trend turns up.

Russia, Ukraine, U.S.

The likelihood that Russia invades Ukraine is up in the air.

However in the event of an invasion, be ready for anything, even a situation similar to what happened during the gulf war.

When thinking about the markets, turn off the news and watch price and volume because the market tells all.

Moving Averages Roll Over

The major indexes are all running into resistance from major moving averages such as the 50 - day and 200 - day moving average.

Once trending higher, the 50 day is now rolling over and pointed down turning away price and leading to further declines.

Price sitting trading below the 50 with averages trending down.

Thank You!