Feb 28, 2022

Rally Attempt

E-mini S&P 500 futures (ES) sold down to 4,100 on February 24, 2022 as Russia launched their full scale invasion of Ukraine.

There is an old saying on Wall Street to “Buy on the sound of cannons, sell on the sound of trumpets.”

Markets rallied hard at the open, erasing all of its overnight losses and closing at the dead high of the day to finish the trading session at 4,290, a 190 point intraday swing, up 4.21% from the lows.

The S&P continued its gains on Friday, up another 100 points but on lower volume than the previous session. Are the lows in?

Lets take a look Behind The Street.

S&P 500 rally off the lows. Notice Friday on lower volume than Thursday.

Caution: Death Cross

The S&P 500 has been spending much of its time below the 200-day moving average since it broke the long term trendline on higher than average volume on January 24th.

Recent price action is setting up the potential for a Death Cross, where the 50-day moving average crosses below the 200-day moving average.

This is a significant bearish signal that has successfully predicted some of the most severe stock market declines including 1929, 1938, 1974, and 2008.

I will note that the Death Cross is an extreme lagging indicator and once it happens the market tends to be oversold and ready for a rally.

Potential Death Cross- 50MA (BLUE) looking to Break Below 200MA (BLACK)

As shown in the picture above, the 50-day (BLUE) is now rolling over and coming close to breaking below the 200-day (BLACK) on the S&P 500.

2018 saw similar price action in the S&P where price spent many weeks below the 200-day moving average, allowing the 50-day moving average to roll over and break below, leading to significant declines in the index.

December 2018 Death Cross. 50-Day Breaks 200Day

The picture above is a snap shot of the Death Cross that predicted the stock market sell off in December 2018.

Notice the build up to the event. Once the S&P broke the 200 in October, price had a hard time rallying back above the key long term trend line.

This allowed time for the 50-Day to trend lower and eventually break below the 200-day, leading the stock market lower into a waterfall selloff ending Christmas Eve.

Not all Death Crosses pan out, but I think it is wise to pay attention to what could happen in order to be ready if/when the market rolls over.

I always tend to lean bullish and I truly believe we may have had an “Operation Desert Storm” moment on Thursday and Friday of last week.

Click Here to read about the S&P 500 during the Gulf War: Behind The Street - Special Report - Issue #15 | Revue (getrevue.co)

It is possible we bottomed on Thursday. Wait for a Follow-Through-Day to confirm a new uptrend.

Cybersecurity & Idea Generation

Idea generation is one of the most important aspects to investing.

Many of my investment ideas stem from the daily conversations I have with industry leading CTO’s and CFO’s at some some of the largest Hospitals, Home Heath Care Agencies, and Nursing Homes.

When formulating an investment thesis, I look for a growing company in a fast growing industry, with an ever expanding total addressable market (TAM)

Cybersecurity Spending Seen Increasing - $1.75 Trillion

Global Cybersecurity Spending To Exceed $1.75 Trillion From 2021-2025

Cybersecurity Ventures anticipates 15 percent year-over-year growth Press Release

As an Enterprise Salesperson in tech, one of my main goals is to help my clients decide upon and implement critical software and technology to help not only make their operations more efficient, but to protect their corporate infrastructure.

I have never not had a conversation with a CTO where cybersecurity wasn’t brought up into conversation, especially when consulting with industry leaders in Healthcare.

HIPAA compliance and keeping patient and employee information safe is critical as more Hospitals and Home Care Agencies migrate over to the cloud.

Security is a must.

Cybersecurity Stock Watch

Having sold Zscaler, $ZS products in the past, I see this company as a true leader in the cybersecurity ecosystem.

$ZS reported second quarter fiscal year 2022 financial results on February 24, 2022.

Revenue came in at $255.6 million up 63% year over year.

EPS came in at $0.13, up 30%.

$ZS - 251 Customers with ARR of $1MM or more

A key metric to look at in any SaaS company reporting earnings is customer acquisition of Large Enterprise accounts.

Zscaler now has 251 customers with over $1MM ARR, up 85%.

Large Enterprise customers tend to have extremely long and complex sales/buying cycles with an extreme internal vetting process.

Large Enterprise organizations that chose Zscaler over a competitor did so for a reason. Usually large customer acquisitions lead to more notable new logo wins in quarters ahead.

Large Enterprise New Logo Wins = Good Marketing!

Zscaler Reports Second Quarter Fiscal 2022 Financial Results

$ZS - Zscaler Technicals

Just because a company reports stellar earnings doesn’t means its always buyable.

Zscaler carries a hefty valuation with a Market Cap of $33.5 Billion on total estimated revenue of $1.045 billion to $1.05 billion for full year 2022.

Weekly Chart - $ZS

Zscaler is sitting well below its 200-day moving average and 50-day moving average.

I have a rule to never buy a stock below the 50. I’ll hold firm here.

Another cause for concern is the anemic RS Rating of 39, growth stocks have been in a sever bear market for over a year now and this has taken a toll on relative strength.

Should the general market have a follow-through-day, $ZS is buyable over the swing high at $289.84 with a 7% stop loss.

Allow for leading growth stocks to make some repair work to damaged bases and be ready to scale in as the general trend of the market turns up.

The current leader in the cybersecurity sector is $PANW-Palo Alto Networks

READ MORE ABOUT A FOLLOW-THROUGH-DAY HERE: Behind The Street - Issue #16 | Revue (getrevue.co)

Daily Chart of $ZS

Notice how price is trading below the 50-day moving average and 200-day moving average. Allow a base to build and price to rally back above key moving averages.

Russia & Ukraine Thoughts

Now do you understand why U.S. Equities tend to trade at a premium to Emerging Markets?

I know, I know, this statement is going to get me in trouble, but you cannot ignore the fact that people feel more comfortable investing in U.S. Equities.

Russian Market Crash After Ukraine Invasion

What’s the good and bad news?

Good news is that for S&P 500 companies, Russia only amounts to 0.1% of total sales, according to Bank of America. Limited exposure for many U.S. companies.

However, the U.S. neon supply, key in the advanced lithography chipmaking process, comes almost entirely from Russia and Ukraine. - Read Investor’s Business Daily cover story by Jed Grahm

With the escalating war in Ukraine, President Biden made clear statements about possible Russian Cyber threats.

Biden has been presented with options for massive cyberattacks against Russia

President Biden has been presented with options for major U.S. cyberattacks designed to disrupt Russia’s ability to sustain its military operations in Ukraine.

“If Russia pursues cyberattacks against our companies, our critical infrastructure, we are prepared to respond.” - President Biden

Cybersecurity has gone from a “nice to have” to a “must have” not only for private corporations, but governments at the Federal, State, and local levels.

$ZS, $FTNT, $CRWD, PAWN should all benefit from increased cybersecurity spending.

Pay attention to the leaders!

Oil Trade Over?

When I am formulating an investing thesis I always try to identify an investment with a positive asymmetric risk profile.

I want to set up an opportunity where the risk I take will generate a profit that is bigger than the risk taken.

We have been talking about the energy trade for over 17 weeks, and I believe the asymmetric risk profile is starting to shift from positive to neutral/negative.

In the hedge fund business there is a term called “crowdedness” and I believe the energy trade may be getting a bit crowded, meaning many investors are on the same side of the trade.

It may be wise to use any rally in energy to exit long positions and take some profits. Use the liquidity to start unwinding long energy trades.

Yes, oil can absolutely go higher, but I am not going to go long crude at $95 in hopes to sell it at $100 - $110. I will use this liquidity for profit taking.

Light Crude Oil Futures

The chart above is of Light Crude Oil futures, notice the large rejection candles near $100. I believe large institutions are using all of this liquidity to exit positions and take profits.

Once again, price can go higher. I just don’t think the same risk profile exists now that the trade is getting crowded.

Creativity is important, and long crude is not creative right now.

Future Of Work

Many of my friends in Banking and Tech are now being asked to go back to the office.

When speaking to my friends, many have told me that they are going to start to look for a job that will not require them to go into the office.

Could large Investment Banks and Tech companies soon face another mass exodus?

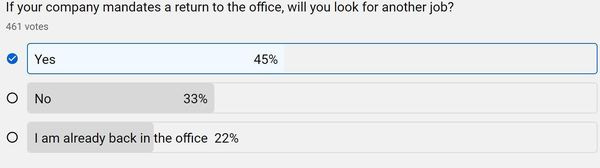

Poll with 461 Respondents

I ran a poll on the YouTube channel and here is how 461 of you responded.

45% of respondents said that they will look for another job if their company mandates a return to the office.

33% of respondents said they would not look for another job.

22% said they are already back to work in the office.

Over 200 people said they will look for a job that will not require a return to the office. That’s a lot!

In order for companies to attract and retain top talent, I would advise they give employees an option to return to the office.

Many employees are more productive from home anyway.

61% of people working from home are doing so because they want to, even though their office is open

Today’s remote workers feel more strongly than ever about making it permanent.

However, if you want to give yourself an edge especially if you are early in your career, you should be going into the office and getting “face time.”

When I first started my career in tech sales, networking with my coworkers and managers was an absolute game changer for the trajectory of my career.

As you get older and advance in your career, your network will determine your success.

For those of you reading in your early 20’s, double down on networking now! Its a big world out there and you never know who you may run into.

Focus on growing your network and building solid relationships with your clients. Start building your book of business.

Trust me, you will have plenty of time to sit at home when you’re 80 years old. Get up, get out, and get to work!

Looking Ahead

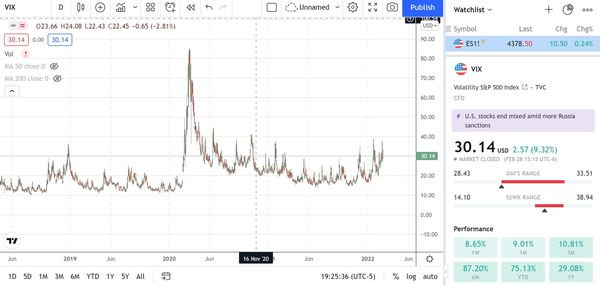

My concern looking ahead is that the major fear indicators are not reflecting the massive fear in the media.

We have the Fed, Inflation, War, Covid, and a million other things to worry about.

But the VIX is not yet at extreme levels.

CNN Fear & Greed Index

Fear & Greed Index - Investor Sentiment - CNNMoney

Fear & Greed is CNNMoney’s investor sentiment tool that comprises of 7 markets indicators.

The CNN Fear & Greed index is just now starting to get into the extreme fear readings. I would like to see this fall further.

$VIX 30.14

The VIX is elevated but not extreme levels as seen back during the COVID lows. VIX Index (cboe.com)

Finally, just wait for the Follow-Through-Day and manage risk.

Remember that 7 out of 10 stocks tend to follow the overall market trend.

Buying breakouts during a correction increases your risk.

Thank You!