A Thanksgiving Lesson: How to Crush It In Markets And In Life

"You need to get in the water to catch the wave."

One of the most successful Hedge Fund managers I know, gave me a piece of trading & investing advice I am forever thankful for.

“You need to be in the water to catch the wave”

Surfers are always out in the water and often get crushed and wiped out by monster waves.

Getting crushed by a wave sucks, but you will never catch a monster wave and have the ride of a lifetime if you’re never in the water!

Think about surfing much like trading and investing. After a follow through day, you must always get in the water, when a follow through day fails, you cut your losses at 3%, 5%, 7%.

Taking that loss is painful, losing money is painful, and it is most definitely painful getting crushed and wiped out by a monster wave.

But you must get in the water and take those small losses while managing your risk diligently, because one day after getting stopped out, turned around and wiped out, you are going to stumble into a monster TML (True Market Leader) and you are going to have the ride of a lifetime.

He would also say:

“It only takes one TML to change your life”

So stay the course, look for the best stocks with the best fundamentals and most importantly, get in the water.

You can apply this analogy to all aspects of your life, you need to get out there and take chances and get back in the water after a big wave tosses you to shore.

Be unrelenting in the face of adversity.

Patience Is A Virtue

The famous saying “patience is a virtue” comes from a poem called Piers Plowman, written by William Langland between 1360 – 1387.

As in surfing and investing , patience is important.

From the outside looking in, we think surfers spend the majority of their time riding monster waves and having the time of their lives.

In reality: Surfers only spend eight percent of the entire surf session riding waves.

According to The Sports Performance Research Institute New Zealand, surfers spend 54 percent of their time paddling and 28 percent waiting for waves.

The main activity surfers are most known for (riding waves) amounts to just 8% of the entire experience.

92% of the time is dedicated to paddling, waiting and practicing.

The same rings true on Wall Street.

Professional traders and investors dedicate the majority of their time to working a systematic proven investment framework.

Countless hours spent on equity research, reading, building DCF models and looking through hundreds of charts of companies that fit their investment criteria.

While most think about trading and investing as sitting by a computer pushing buy/sell buttons and making money, the reality is that the action of buying, selling and making money (if you’re lucky) probably equals the time surfers spend riding waves, 8%.

Everyone wants the 8% (riding monster waves and making money) while not doing what it takes 92% of the time.

92% of the time you need to be in the water, doing research, practicing and getting wiped out by waves.

Most people give up due to lack of patience.

If you do the 92%, it’s only a matter of time before you stumble into a monster, and when that happens, sit tight and enjoy the ride.

Patience is a virtue.

Time For a Revised Dow Theory?

A fundamental point in Dow Theory states the market to be in an uptrend if the Dow Jones Transportation Average advances above a previous important high, and is accompanied or followed by a similar advance in another average.

Dow Theory is an investing methodology created by Charles H. Dow along with Charles Bergstresser and Edward Jones - the founders of Dow Jones & Company and the Dow Jones Industrial Average (1896)

The bulk of the theory was published in the Wall Street Journal before the death of Charles Dow in 1902.

121 years later - I am replacing The Dow Jones Transportation Average with the

SOX Philadelphia Semiconductor Index

If petroleum is referred to as Liquid Gold because of its high value in the market, then semiconductors should be referred to as the new Physical Gold.

Below are some of the products we use everyday that require semiconductors.

Smartphones

Computers

Data Storage

Solar Cells

Advanced Medical Devices

Electric Vehicles

Home Appliances

Manufacturing Equipment

The global semiconductor industry is poised for a decade of growth and is projected to become a trillion-dollar industry by 2030, per McKinsey & Company

Knowing this, it’s appropriate to focus on the health of the sector as a whole as it will be the growth driver of the global economy for the next decade.

Without the participation in semiconductor stocks, it will be hard to confirm a durable uptrend in the market.

If semiconductors are leading, trading above major moving averages, and trading near 52 week highs or record highs - we can conclude the market to be in a durable uptrend and that the market is expecting robust demand for chips going forward.

Below are the top components in SOXX 0.00%↑ iShares Semiconductor ETF, add each stock to a watch list in Bloomberg, MarketSmith or TradingView.

Pay close attention to how these stocks are acting.

Jerome Powell Declaring Victory

The consumer price index was flat in October from the previous month but increased 3.2% from a year ago. Both were below Wall Street estimates, sparking a major rally on Wall Street, per CNBC

The night before the October CPI release I posted the above on twitter forecasting a 7th consecutive decline in shelter costs.

We got it.

October 2023 Shelter - 6.7%

Shelter accounts for 40% of CPI, meaning if Fed Chair Jerome Powell wants to see inflation at the mandated 2% target, he must get shelter costs down, and fast.

In a previous issue of Behind The Street, we discussed why asset prices tend to correct “In order of Liquidity”, with equities having an immediate reaction to rising interest rates, repricing for a higher interest rate environment, while shelter has a significant lagged reaction.

The Federal Reserve started hiking interest rates on March 16, 2022 about 1 year and 8 months ago, meaning we are just starting to see the impact of rising rates on the real estate market.

Expect the shelter component of CPI to continue to decline over the coming months.

Please refer to previous Behind The Street publications for our view on Commercial Real Estate.

IPO Market Update

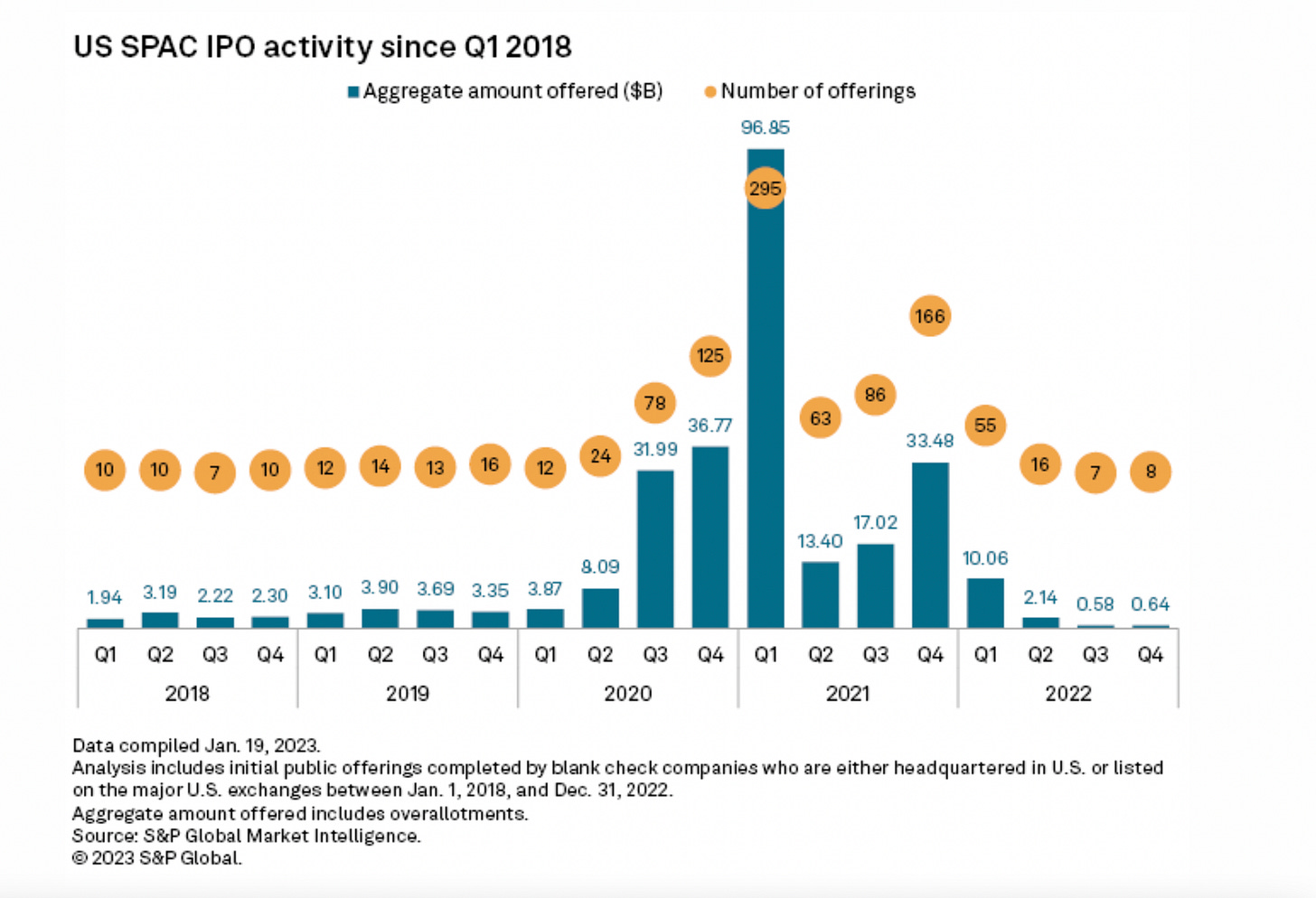

Unprecedented amounts of fiscal and monetary pandemic stimulus blew the doors off the IPO market in 2021 with 1,035 new IPOs.

IPOs by SPACs in 2022 raised a combined $13.42 billion, compared with $160.75 billion in 2021, per S&P Market Intelligence data.

“Pay close attention to companies coming public during bear markets, not bull markets”

Anyone can raise money and go public when money is freely flowing through the economy, it’s nearly impossible to raise money and go public during bear markets.

If a company can manage to raise money from investors and go public during a severe bear, pay attention because you’ve likely found a diamond in the rough.

The SPAC mania will go down in Wall Street history as the most egregious and in some cases fraudulent cash grab in investment banking history.

Many of the SPACs (special purpose acquisition companies) are now bankrupt. Most SPACs from 2021 were unprofitable and suboptimal companies that sold pipe dreams to retail investors.

Grossly overstating sales and earnings projections to unbeknownst investors new to the market in 2021.

There are at least 23 bankrupt companies born out of SPACs, or special-purpose acquisition companies, and more than a dozen additional firms that were acquired far below their debut values. On top of that, there are roughly 110 post-SPAC firms that are trading for less than $1. per Fortune

Time to lock in and pay attention after rising interest rates ran its carnage through the junk, I can see the vultures circling to pick up the pieces.

To learn how to better deal with and understand IPOs check out the book:

The Lifecycle Trade: How to Win at Trading IPOs and Super Growth Stocks by Eve Boboch (Author), Kathy Donnelly (Author), Eric Krull (Author), Kurt Daill (Author)

Palantir at one point declined 87% from its pandemic mania record high at $44, most new issues will trade below their initial list price within the first year of going public.

Currently the stock is working on building out the right side of its IPO base while earnings are ramping +600% the last two quarters.

Revenue growth is a bit lackluster as we look for 25%+ q/q growth. PLTR 0.00%↑ is posting high teens top line acceleration.

If PLTR 0.00%↑ can work its way through the significant overhead supply, while earnings and sales continue to increase, a position might be justified over $29.09 swing high.

It is best to avoid stocks with significant overhead.

Earnings matter above all.

“Pay close attention to companies coming public during bear markets, not bull markets”

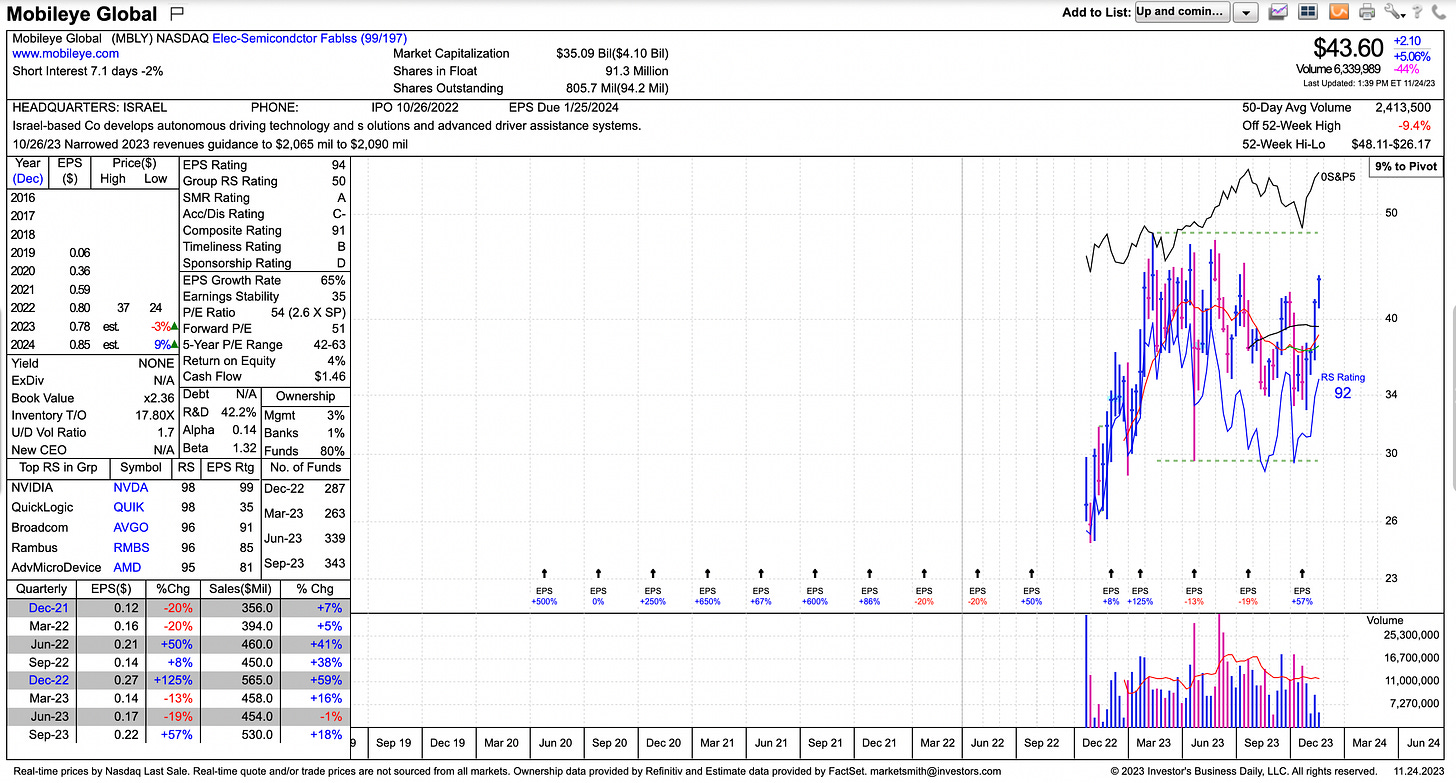

Mobileye Global is an Israel based company that develops autonomous driving technology and advanced driver assistance systems.

MBLY 0.00%↑ went public during a harsh IPO bear market, the quality stand out in times of distress.

Keep this on your watch list, paying close attention for the following characteristics

EPS Growth

Revenue Growth

Return on Equity

Pre Tax, After Tax Margin

Institutional Sponsorship

Group Strength

Typically we want to see consistent 25%+ EPS and Revenue growth.

All Eyes On Gold

Gold is back above $2,000/oz trading near record highs after building out the right side of a handle on a decade long cup with handle base.

Gold tends to have decade long consolidations before breaking out and running into new high territory.

The measured move on this base will bring significantly higher prices, put it on the watch list and monitor volume on a break out.

A position in size is warranted on a break into new highs.

Manage risk with traditional 3%, 5%, 7%.

Beach Ball Underwater

A sign of a healthy market is when stocks initially sell off after earnings but rally right back within a day or two.

We saw this action on many occasions this earnings season, for example withPANW 0.00%↑

Cybersecurity company Palo Alto Networks initially sold off on earnings, at one point down 7%.

The next two days the stock rallied back to its pre earnings gap and closed at the high of its range.

When a stock quickly regains its losses, this show institutions are getting in the market and supporting the stock.

During bear markets, gap downs are met with additional selling pressure on heavy volume.

Read the tape to make sure volume declines on down days and accelerates on up days.

New York City Real Estate - Featured Listing

75 First Avenue is one of the most luxurious residential boutiques in the East Village designed by star Italian architect Stefano Pasqualetti.

Penthouse 8A is on the market for $5,250,000 and sports 3 Bedrooms 3 Bathrooms and over 1,100 SF of exterior space with unobstructed views of Midtown Manhattan.

Listing Highlights:

3 Bed 3Bath

1,757 INT SF

1,100 EXT SF

White Calacatta Oro Marble Countertops & Backsplash

High-end Appliances from Miele

Nublado Raw Textured Marble Walls

Click Play Below To Tour Penthouse 8A at 75 First Avenue

Updates

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.

Lastly, If You Enjoyed The Newsletter, Support My Work By Sharing It.

Tom,This is brilliant!! So well written and structured!! You certainly are "riding a monster wave" with this edition!

Luv it