Show Me The Money!

Netflix, Meta, Alphabet, Microsoft, Amazon, Apple and Tesla collectively rang the register to the tune of $101.23 billion over the last quarter.

You heard that right, a combined $101.34 billion in net income from the tech giants alone.

Net Income Breakdown:

NFLX 0.00%↑ - $2.36 billion

META 0.00%↑ - $15.7 billion

GOOGL 0.00%↑ - $26.3 billion

MSFT 0.00%↑ - $24.67 billion

AMZN 0.00%↑ - $15.3 billion

AAPL 0.00%↑ - $14.73 billion

TSLA 0.00%↑ - $2.17 billion

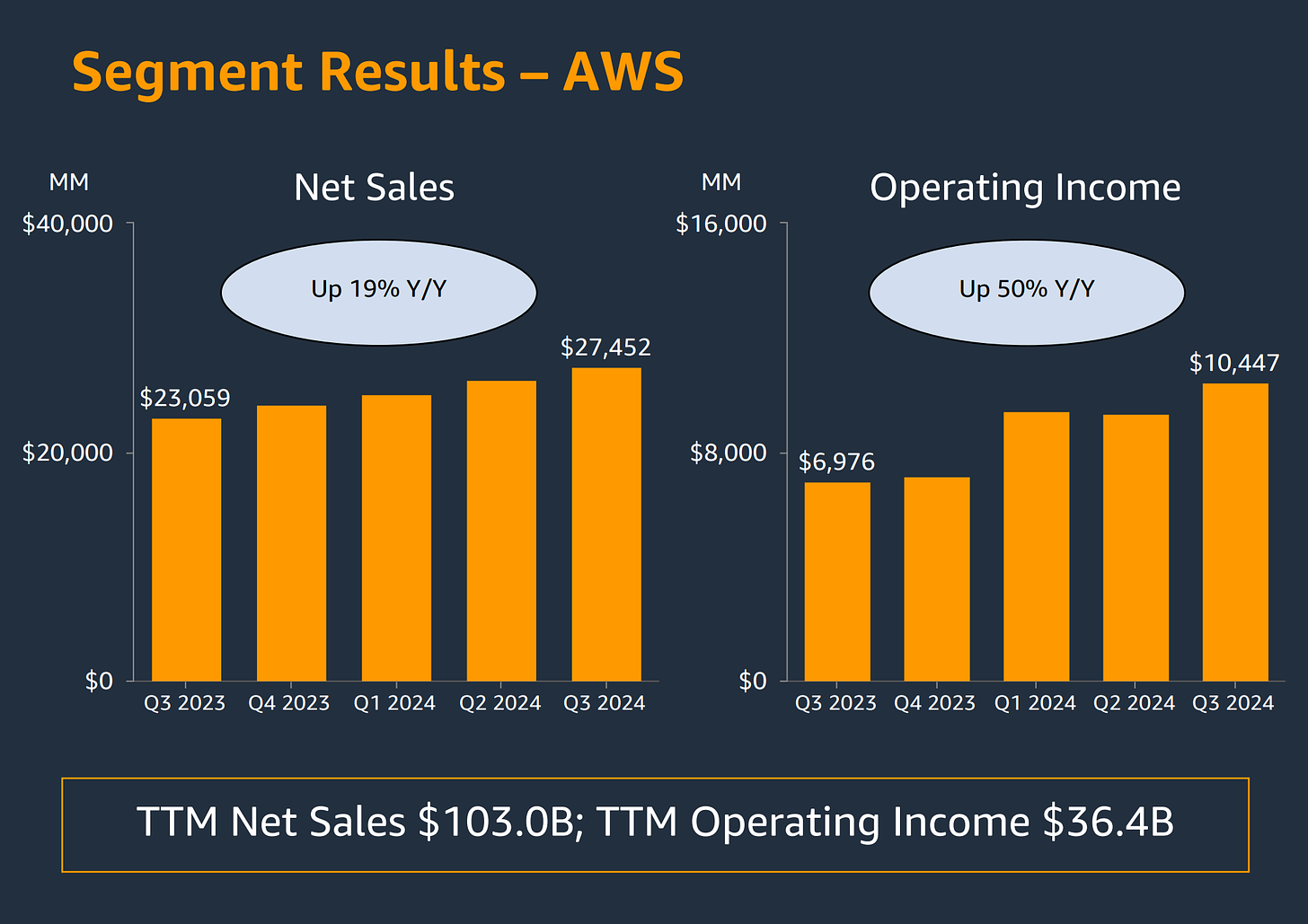

Cloud computing was a major revenue driver at Microsoft, Amazon and Google with Amazon’s AWS bringing in over $100 billon in revenue on an annual basis first time ever.

AWS posted $10.45 billion in operating income - accounting for 60% of company profits all while operating margin expanded to 38%, the highest margins since 2014.

The strength in Amazons AWS segment drove the company to its highest quarterly profit on record - $15.3 billion.

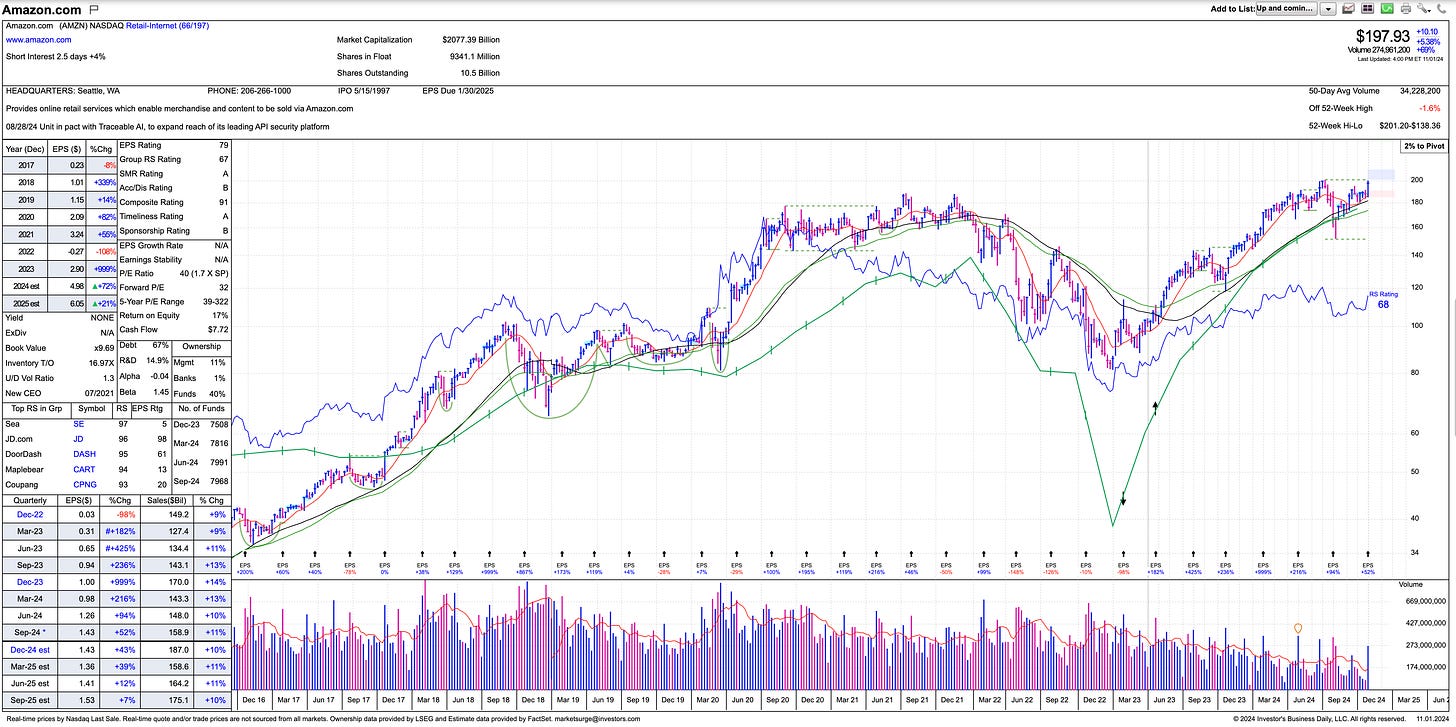

Amazon stock has fought its way back to previous highs set in 2021 - a clean breakout over $200 will warrant a position in size.

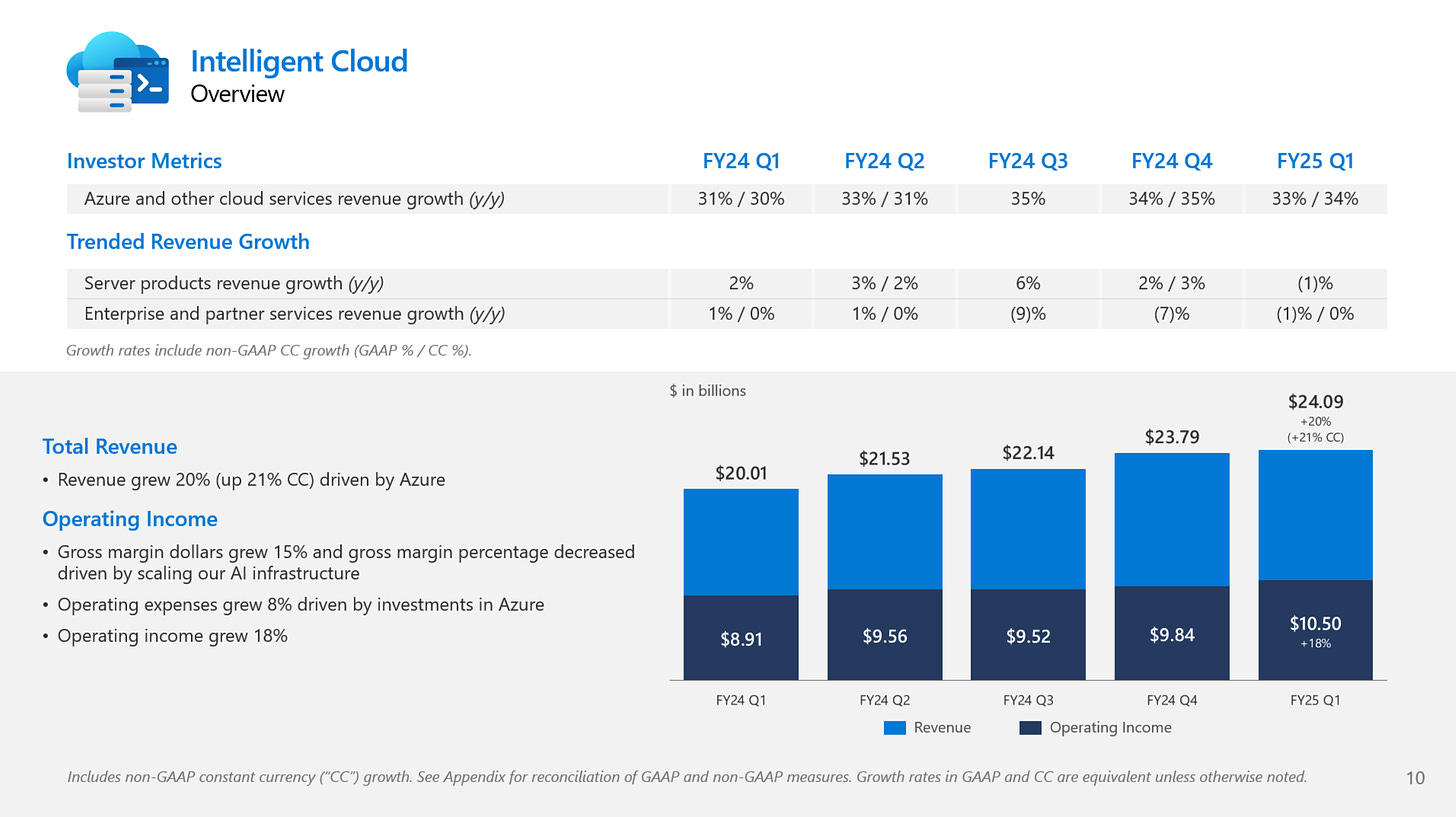

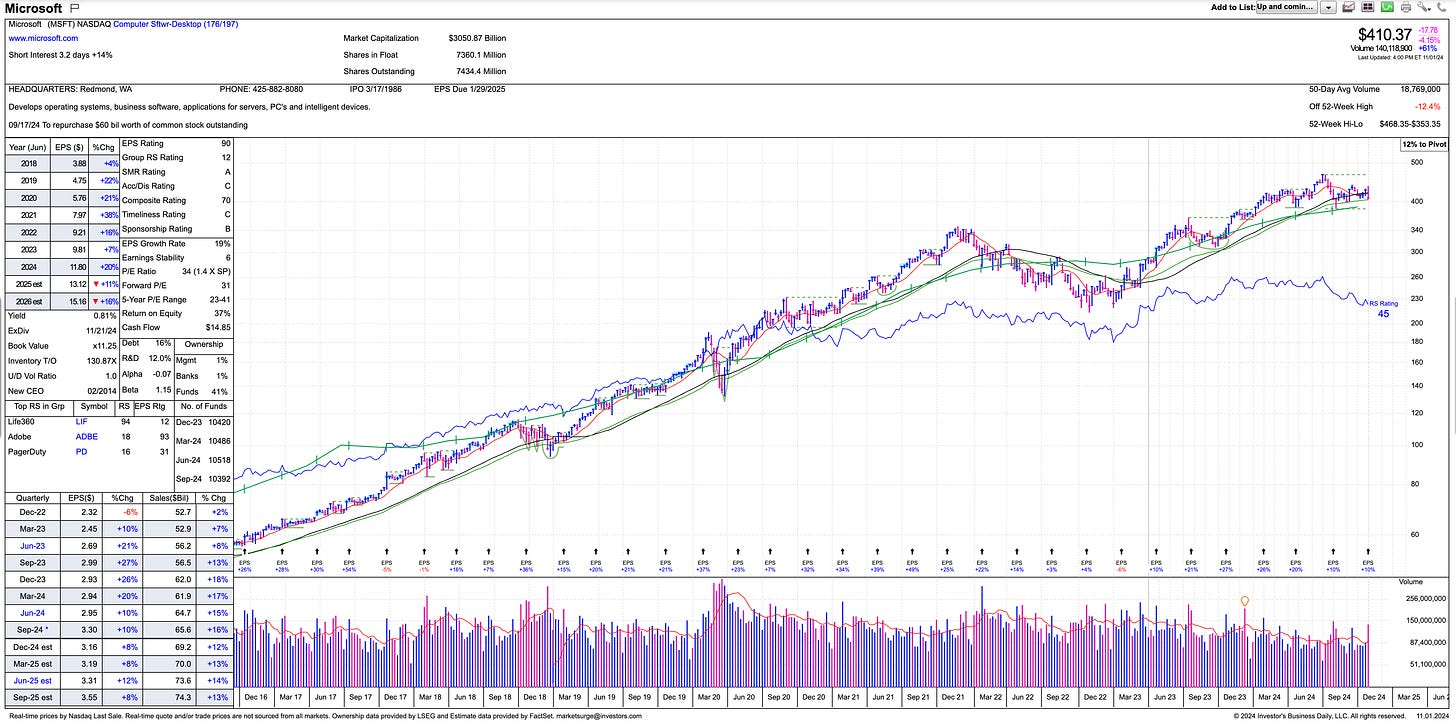

Microsoft Azure

At Microsoft - the intelligent cloud segment including Azure grew by 20% annually and generated $24.09 billion in revenue.

Azure alone grew by 34% with with 12 points coming from artificial intelligence services - a sign that AI demand is real and robust.

Spending continues to ballon, up 50% y/y to $14.92 billion as Microsoft doubles down on infrastructure and data center spending to develop AI technology.

Investors are curious if all this spending will be worth it - in our view, infrastructure spending is absolutely necessary and will pay dividends for years to come.

AI-related products at MSFT 0.00%↑ are now on track to contribute about $10 billion to annual revenue.

According to CEO Satya Nadella AI-related products are the“fastest business in our history to reach this milestone,”.

Microsoft stock is stuck in a flat base consolidation, struggling to break out over the $467 high set in July 2024.

Price has now broken below both the 50 and 200 day moving average.

We would be long the stock on a break back above the 200 day moving average on heavy volume.

Avoid purchasing stocks sitting below the 200 day.

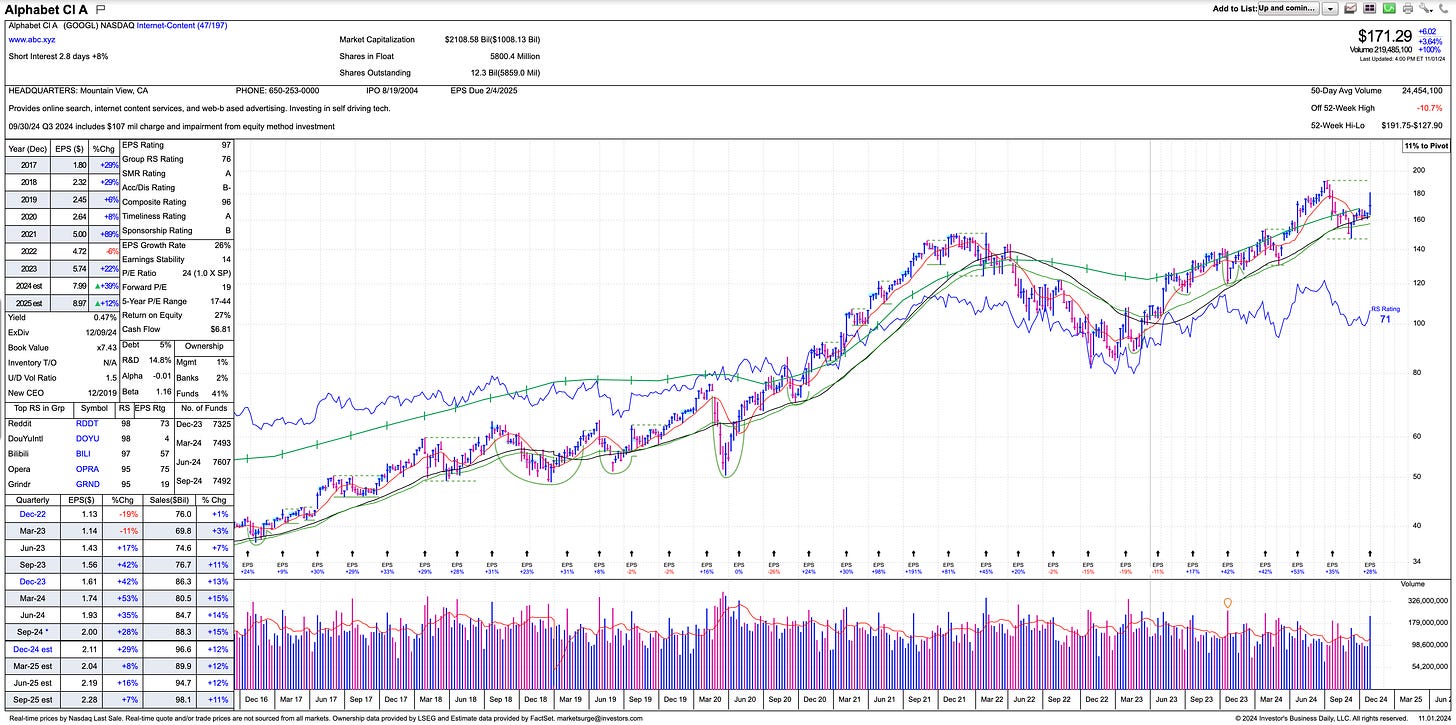

Google Cloud

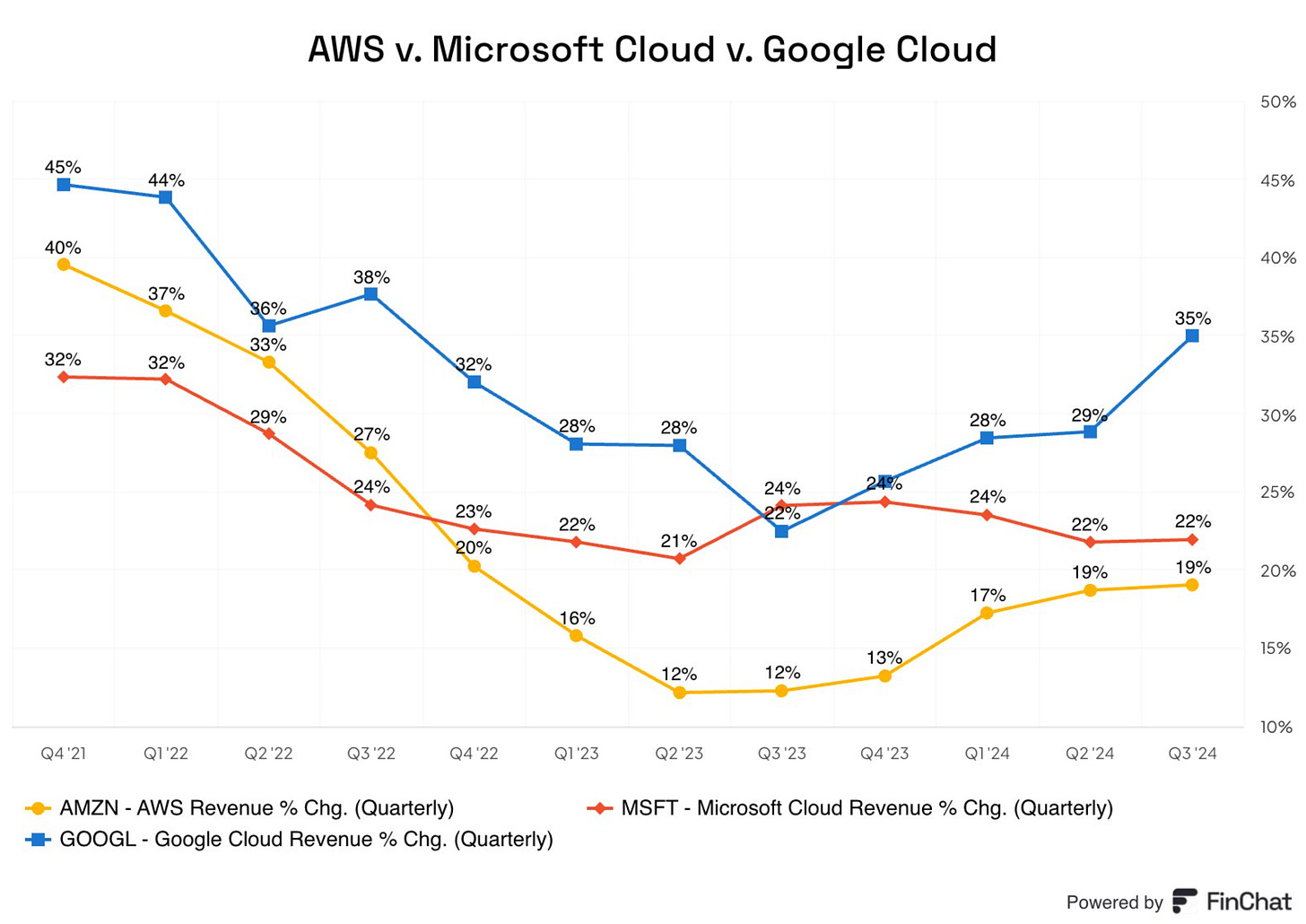

Perhaps the most impressive numbers between all three cloud giants came from GOOGL 0.00%↑.

Google Cloud revenue skyrocketed 35% to $11.35 billion vs. $8.41 billion a year ago driven by its artificial intelligence offerings according to CEO Sundar Pichai.

Follow FinChat on X: HERE

According to FinChat, Google Cloud is now consistently growing faster than Microsoft cloud and AWS.

Google Cloud now has three consecutive quarters with 25%+ revenue growth and is proving that they can execute at scale.

At 17.5% operating margins, Google Cloud will most certainly turn out to be a cash generating machine going forward - we are bullish the stock.

Google stock is trying to rebuild a flat base after a 22% sell off from the July 2024 $190 high - price action is holding up above the 200 day moving average after giving up most of its earnings gains.

A 5% stop under the 50 day moving average should act as your guard rail.

In conclusion:

Cloud businesses as Microsoft, Amazon and Google will continue to be cash generating machines for the foreseeable future - especially with the tailwinds of AI.

Investors should have exposure to these highly profitable and scalable businesses.

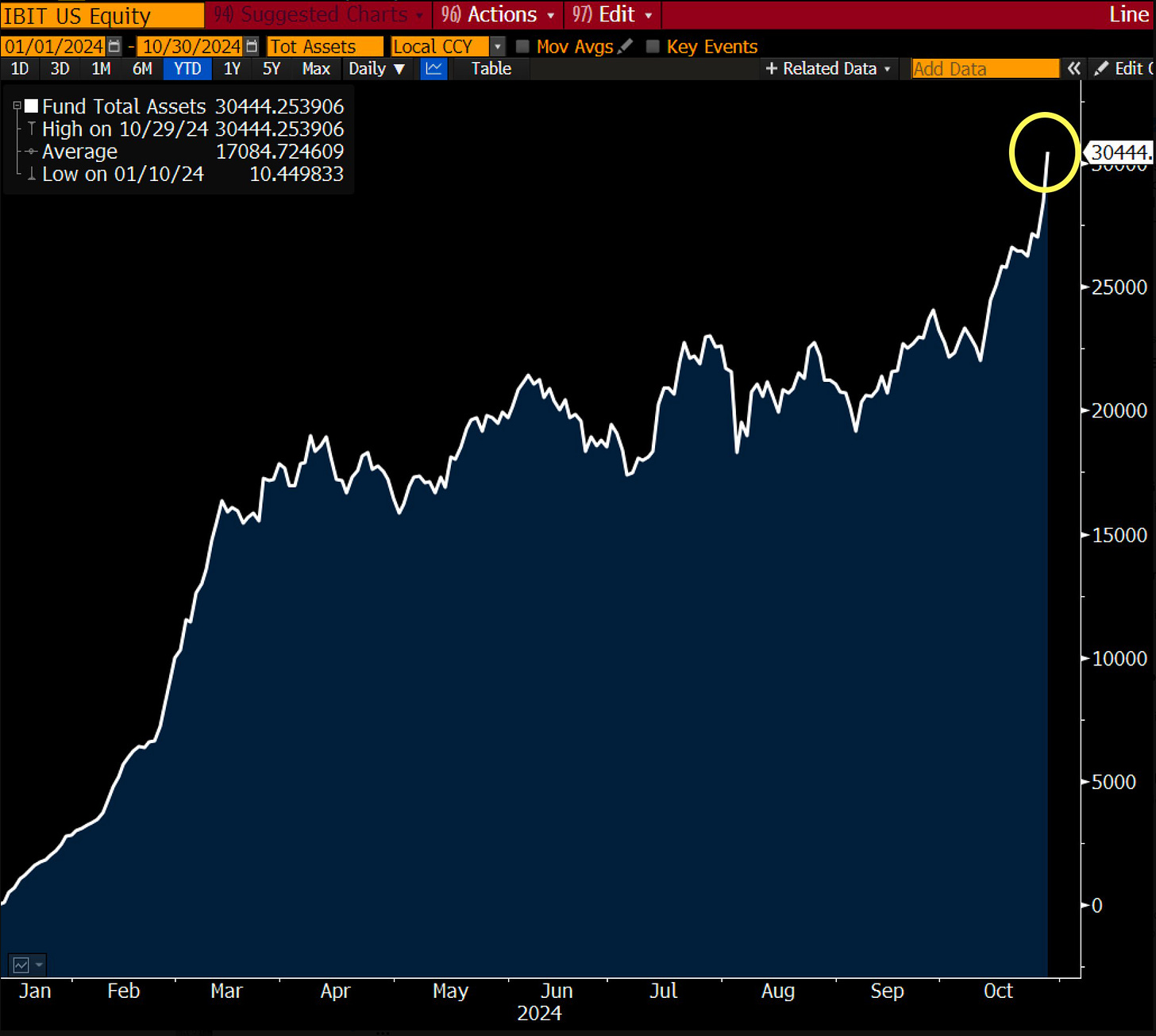

Record Flows - IBIT 0.00%↑

As discussed in prior issues of Behind The Street, we are watching the multi year cup and handle pattern on Bitcoin.

The BlackRock iShares Bitcoin Trust ETF IBIT 0.00%↑ shattered records by crossing $30 billion in assets on October 30, 2024.

According to Senior ETF Analyst at Bloomberg Eric Balchunas, IBIT 0.00%↑ hit this milestone in just 293 days, an all time record.

The old record was JEPI 0.00%↑ which hit $30 billion in 1,272 days.

GLD 0.00%↑ took 1,790 days.

Follow Eric Balchunas on X: Here

Demand for Bitcoin seems to be ramping just as price action attempts to break out over the $73,000 handle.

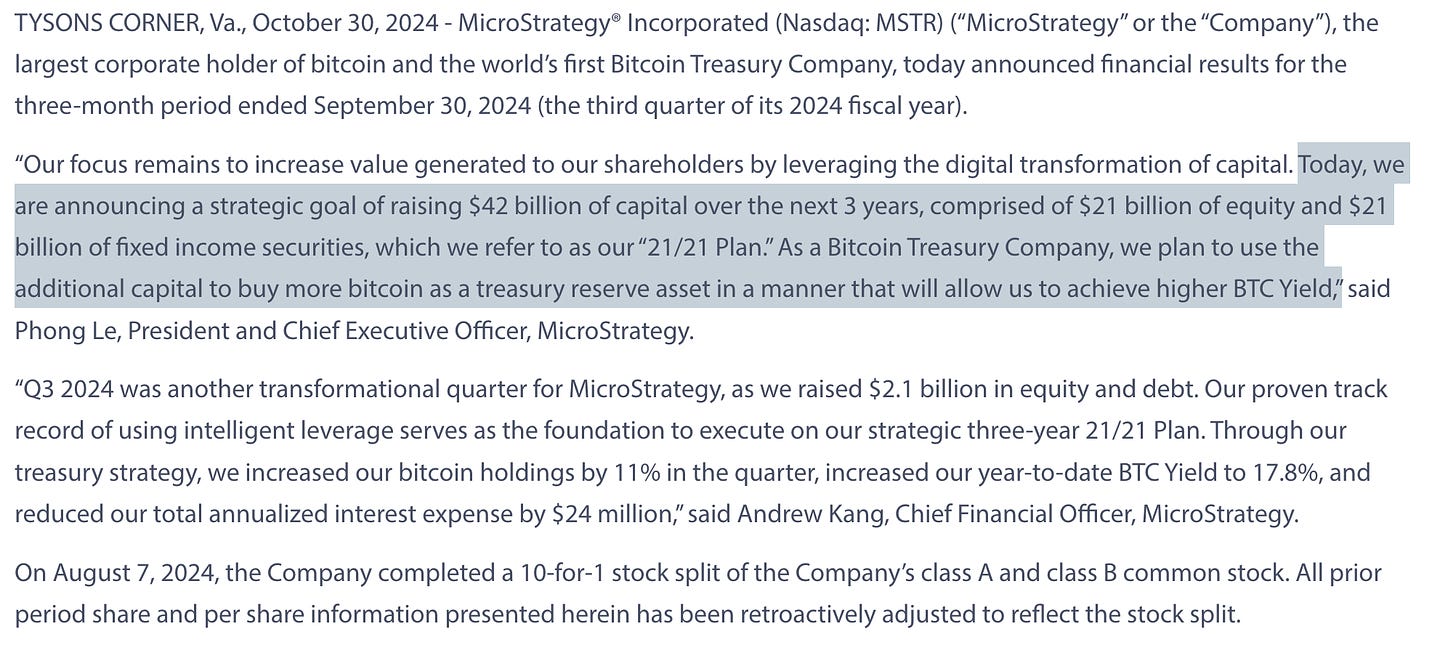

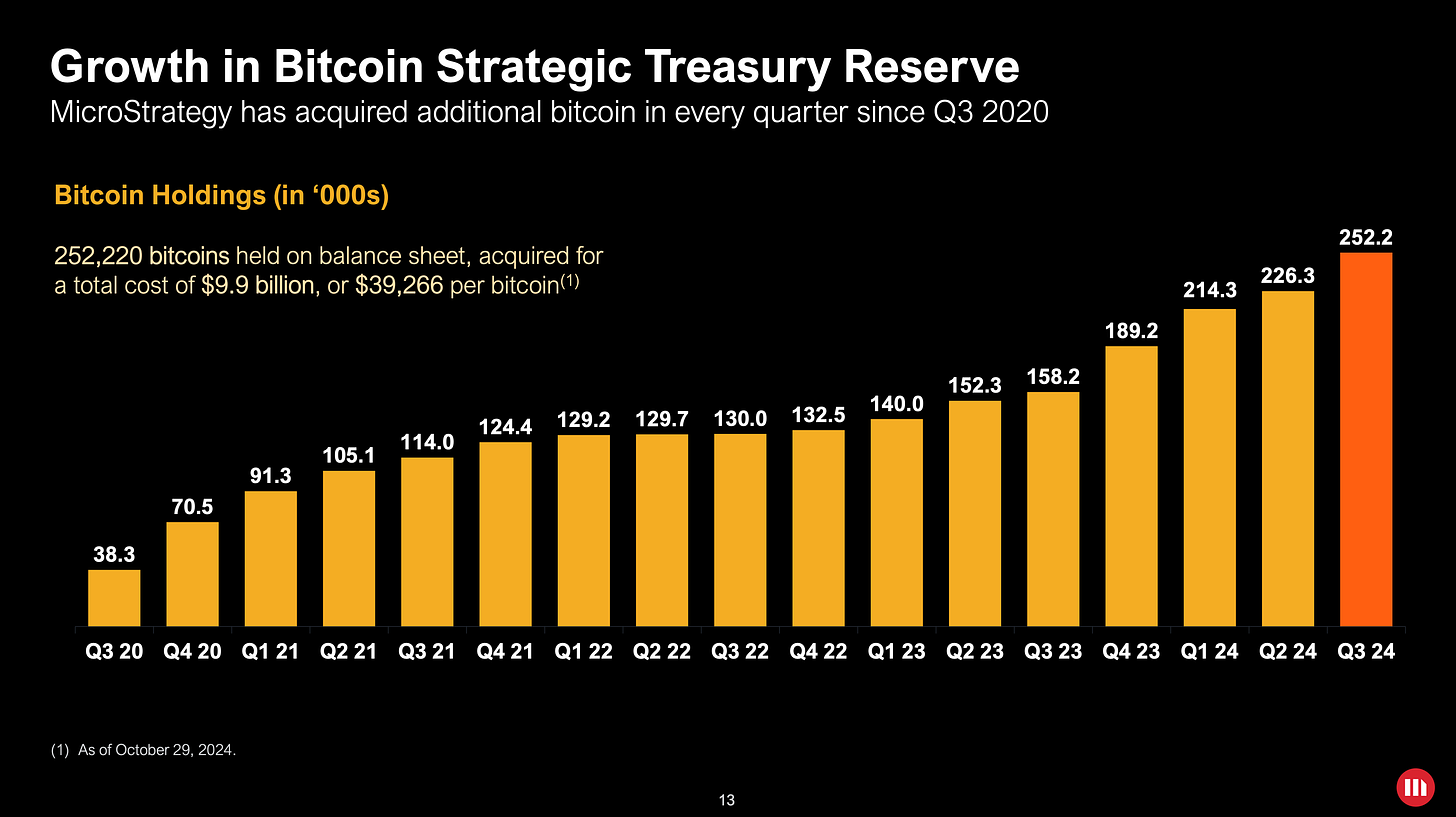

Speaking of demand for Bitcoin, MicroStrategy MSTR 0.00%↑ announced that it will be raising $42 billion of equity and fixed income over the next 3 years to purchase additional Bitcoin.

To put things into perspective, at current Bitcoin prices of roughly $70,000 - MicroStrategy will need purchase 800 Bitcoin every day for 2 years to meet its goal.

Only 492,750 new Bitcoin will be mined in the next three years, meaning MicroStrategy’s goal of buying $42 billion in bitcoin would account for over 50% of all new supply.

Plan accordingly.

The Focus

This week is election week, meaning distractions by the machine and increased propaganda.

Should the market experience volatility in and around election day, we’d like to remind you to stay focused and to not mix political opinions with your investments.

We know many investors who missed out on life changing investing opportunities because they chose to make an emotional decision regarding politics.

At the end of the day, the only two things that matters are GDP growth and Earnings growth.

It is our view that we are currently living through one of the most transformative times in modern history - don’t fumble the bag because the machine has you fighting over Donald Trump and Kamala.

It’s all about the earnings, earnings, earnings - nothing else matters.

We will be posting out 2025 investing outlook with our top thematic ideas a week before Christmas.

Paul Tudor Jones Documentary Trader

As a bonus to this weeks Behind The Street, below you will find a link to the Paul Tudor Jones Documentary - often removed from the internet.

Take some time out of your week to watch this film, this documentary is more relevant than ever as we have many macro trade set ups in the market.

If you enjoy our newsletter - please share it with your co-workers, friends and family.

5 Beekman Street Penthouse

Take a look at our newest listing at 5 Beekman Street PH 51.

Listing Information: 5 Beekman Street #PH51 3 Bed 3.5 Bath 3,554SF

Updates

The Behind The Street Newsletter will be published every other Thursday.

The Behind The Street Newsletter is for educational use only, not financial advice.

The newsletter will have a focus on financial markets, equities, fixed income, real estate and a market update section focusing on New York City & Miami real estate.

I have joined the Kirsten Jordan Team at Douglas Elliman About Me Click Here

If yourself, a family member or friend is looking to buy, sell or rent anywhere in New York or Miami please contact me: Thomas.Malloy@elliman.com

We also work with institutional clients looking for exposure to NYC and Miami.

Thanks for reading Behind The Street ! Subscribe for free to receive new posts and support my work.